ADT 2002 Annual Report Download - page 160

Download and view the complete annual report

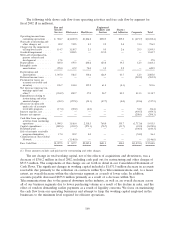

Please find page 160 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.arise if amounts were distributed by their subsidiaries or if their subsidiaries were disposed. It is not

practicable to estimate the additional taxes related to the permanently reinvested earnings or the basis

differences related to investments in subsidiaries.

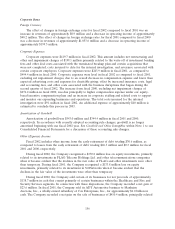

Cumulative Effect of Accounting Changes

In December 1999, the SEC issued SAB 101, in which the SEC expressed its views regarding the

appropriate recognition of revenue in a variety of circumstances, some of which are relevant to us. As

required under SAB 101, we modified our revenue recognition policies with respect to the installation

of electronic security systems (see ‘‘Revenue Recognition’’ within Note 1 to our Consolidated Financial

Statements). In addition, in response to SAB 101, we undertook a review of our revenue recognition

practices and identified certain provisions included in a limited number of sales arrangements that

delayed the recognition of revenue under SAB 101. During the fourth quarter of fiscal 2001, we

changed our method of accounting for these items retroactive to the beginning of the fiscal year to

conform to the requirements of SAB 101. This was reported as a $653.7 million after-tax

($1,005.6 million pre-tax) charge for the cumulative effect of change in accounting principle in the fiscal

2001 Consolidated Statement of Operations.

The impact of SAB 101 on net revenues in fiscal 2001 was a net decrease of $241.1 million,

reflecting the deferral of $520.5 million of fiscal 2001 revenues, partially offset by the recognition of

$279.4 million of revenue that is included in the cumulative effect adjustment as of the beginning of the

fiscal year.

We recorded a cumulative effect adjustment, a $29.7 million loss, net of tax, in fiscal 2001 in

accordance with the transition provisions of SFAS No. 133.

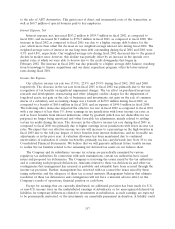

Critical Accounting Policies

The preparation of consolidated financial statements in conformity with GAAP requires

management to use judgment in making estimates and assumptions that affect the reported amounts of

assets and liabilities, disclosure of contingent assets and liabilities and the reported amounts of

revenues and expenses. The following accounting policies are based on, among other things, judgments

and assumptions made by management that include inherent risks and uncertainties. Management’s

estimates are based on the relevant information available at the end of each period.

Long-Lived Assets—Management periodically evaluates the net realizable value of long-lived assets,

including property, plant and equipment, the TGN and intangible assets, relying on a number of factors

including operating results, business plans, economic projections and anticipated future cash flows. We

carry long-lived assets at the lower of cost or fair value. Since judgment is involved in determining the

fair value of long-lived assets, there is risk that the carrying value of our long-lived assets may be

overstated or understated.

We wrote-off a significant portion of the TGN during fiscal 2002, and management continues to

monitor developments in the fiberoptic capacity markets. It is possible that the assumptions underlying

the impairment analysis will change in such a manner that a further impairment in value may occur in

the future. In addition, we may experience additional TGN impairments if the downturn in the

telecommunications industry continues.

The Company generally divides its electronic security assets into various asset pools: internally

generated residental systems, internally generated commercial systems and accounts acquired through

the ADT dealer program (discussed below in Amortization Method for Customer Contracts).

With respect to the Company’s depreciation policy for security monitoring systems installed in

residential and commercial customer premises, the costs of these systems are combined in separate

pools for internally generated residential and commercial account customers, and generally depreciated

158