SunTrust 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227

|

|

1

to our shareholders

While 2011 continued to pose challenges for SunTrust and the industry, we are

pleased to report that we generated momentum in key business fundamentals

and continued to capitalize on the opportunities that presented themselves over

the course of the year.

Like the rest of the banking industry, we strived to adapt to a rapidly changing

marketplace — one best characterized by persistently slow growth in the

economy, ongoing issues in the housing and mortgage markets, and the

emerging effects of regulatory reform. We made notable progress in several

performance areas and reached key milestones in our efforts to improve

shareholder return.

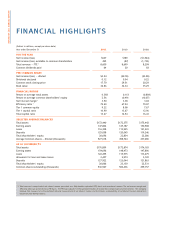

2011 highlights

• Our nancial performance

steadily improved, with full-

year earnings per share up

meaningfully from 2010.

• Balance sheet trends closed the

year favorably as low-cost deposits

continued to increase (balances

up $8 billion or 8 percent over

the prior year), and loan growth

exhibited a notable pick-up during

the third and fourth quarters,

particularly in those areas targeted

for growth. Overall, loans were up

$7 billion or 6 percent compared

with the prior year.

• Many of our core businesses

demonstrated positive trends

throughout the year, which helped

offset some of the regulatory and

environmental headwinds we faced

on the fee side of the business.

• Credit quality improved steadily

throughout 2011, with delinquencies,

nonperforming assets, and net

charge-offs all improving

consistently throughout the year.

We further reduced our exposure

to higher-risk loans and produced

a much more diversied and

lower-risk balance sheet.

• Our capital ratios remained strong

and well in excess of current and

proposed regulatory requirements.

• We repaid the government’s TARP

investment, following a patient

approach that proved benecial

to our shareholders; and we

increased our common dividend.

• We launched a new mortgage

origination model and an array of

deposit products, and enhanced

ATM, online, and mobile channels.

• We received numerous industry

accolades, including several that

recognized us for our industry-

leading service quality.

• We demonstrated a strengthened

commitment to our communities

and nancial education.

• We made signicant headway

with our strategic priorities and

announced an expense savings

program to remove $300 million

from our expense base.