SunTrust 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

suntrust banks, inc.

ANNUAL

REPORT

2 011

Table of contents

-

Page 1

suntrust banks, inc. ANNUAL REPORT 2011 -

Page 2

... provide mortgage banking, insurance, brokerage, investment management, equipment leasing, and investment banking services. SunTrust enjoys leading market positions in some of the most attractive markets in the United States and also serves customers in selected markets nationally. The Company... -

Page 3

... return. 2011 highlights • Our financial performance steadily improved, with fullyear earnings per share up meaningfully from 2010. • Balance sheet trends closed the year favorably as low-cost deposits continued to increase (balances up $8 billion or 8 percent over the prior year), and loan... -

Page 4

... revenue, reduce risk, improve profitability, and ultimately, enhance shareholder return. our foundation SunTrust's Southeast and Mid-Atlantic banking footprint is widely regarded as one of the best in the industry. The markets in which we operate have attractive long-term demographic and economic... -

Page 5

...diversifying our exposure to real estate-related loans. We made noteworthy progress during 2011. Commercial and industrial loans were up 11 percent. Direct and indirect consumer loans were up 9 percent, including portfolio acquisitions. At the same time, we continued the multi-year trend of reducing... -

Page 6

... end, last fall we announced a program under which we expect to eliminate $300 million in core expenses from our cost base by the end of 2013. Efforts are already under way to identify and execute on savings opportunities, specifically in strategic supply management, consumer banking and operations... -

Page 7

... word of thanks to Jim Wells who retired from the Company and the Board of Directors as Executive Chairman at the end of the year. The financial industry landscape changed significantly during Jim's 43-year career - from some of the best of times to some of the most challenging. But Jim's unwavering... -

Page 8

...legg 2, 4 Former President and Chief Executive Officer Legg Mason Capital Management Baltimore, Maryland dr. phail wynn, jr. 3, 5 Vice President Durham and Regional Affairs Duke University Durham, North Carolina a. d. correll 1, 3, 5 Chairman Atlanta Equity Investors, LLC Atlanta, Georgia william... -

Page 9

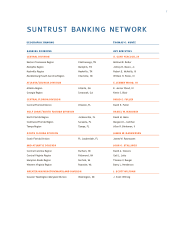

.../South Carolina Region Chattanooga, TN Memphis, TN Nashville, TN Charlotte, NC thomas g. kuntz key executive s. gary peacock, jr Michael R. Butler Johnny B. Moore, Jr. Robert E. McNeilly, III William H. Peele, III atlanta/georgia division Atlanta Region Georgia Region Atlanta, GA Savannah, GA... -

Page 10

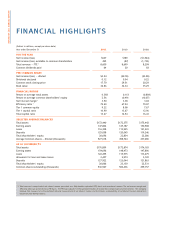

... stock closing price Book value ï¬nancial ratios Return on average total assets Return on average common shareholders' equity Net interest margin 1 Efficiency ratio 1 Tier 1 common equity Tier 1 capital ratio Total capital ratio selected average balances Total assets Earning assets Loans Deposits... -

Page 11

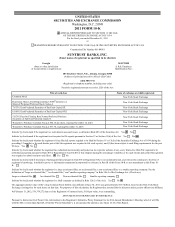

... company No Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes The aggregate market value of the voting Common Stock held by non-affiliates at June 30, 2011 was approximately $13.9 billion, based on the New York Stock Exchange closing price... -

Page 12

... on Accounting and Financial Disclosure. Item 9A: Controls and Procedures. Item 9B: Other Information. PART III Item 10: Directors, Executive Officers and Corporate Governance. Item 11: Executive Compensation. Item 12: Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 13

... Class B common stock. CLO - Collateralized loan obligation. CMBS - Commercial mortgage-backed securities. Coke - The Coca-Cola Company. Company - SunTrust Banks, Inc. CORO - Corporate Operational Risk Office. CP - Commercial paper. CPP - Capital Purchase Program. CRA - Community Reinvestment Act of... -

Page 14

...- Federal Reserve Board. FTE - Fully taxable-equivalent. FVO - Fair value option. GenSpring - GenSpring Family Offices, LLC. GLB Act - Gramm-Leach-Bliley Act. GSE - Government-sponsored enterprise. HARP - Home Affordable Refinance Program. HUD - U.S. Department of Housing and Urban Development. IFRS... -

Page 15

...of cost or market. LTI - Long-term incentive. LTV- Loan to value. MBS - Mortgage-backed securities. MD&A - Management's Discussion and Analysis of Financial Condition and Results of Operations. MIP - Management Incentive Plan. MMMF - Money market mutual fund. Moody's - Moody's Investors Service. MSA... -

Page 16

..., Inc. SunTrust - SunTrust Banks, Inc. SunTrust Community Capital - SunTrust Community Capital, LLC. TARP - Troubled Asset Relief Program. TDR - Troubled debt restructuring. The Agreements - Equity forward agreements. Three Pillars -Three Pillars Funding, LLC. TRS - Total return swaps. U.S. - United... -

Page 17

...including deposit, credit, and trust and investment services. Additional subsidiaries provide mortgage banking, asset management, securities brokerage, capital market services, and credit-related insurance. SunTrust operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina... -

Page 18

..., trust preferred securities will no longer be included in Tier 1 after a three-year phase-out. Tier 2 capital consists of preferred stock not qualifying as Tier 1 capital, mandatorily convertible debt, limited amounts of subordinated debt, other qualifying term debt, the allowance for credit losses... -

Page 19

... in order to evaluate the safety and soundness of financial institutions. The Federal Reserve recently announced that its approval of certain capital actions, such as dividend increases and stock repurchase, will be tied to the level of Tier 1 common equity, and that bank holding companies must... -

Page 20

... and activities of banking entities over a one-year time horizon. To comply with these requirements, banks will take a number of actions which may include increasing their asset holdings of U.S. Treasury securities and other sovereign debt, increasing the use of long-term debt as a funding source... -

Page 21

... the banking subsidiary. In order to become and maintain its status as a financial holding company, the Company and all of its affiliated depository institutions must be "well-capitalized," "well-managed," and have at least a satisfactory CRA rating. Furthermore, if the Federal Reserve determines... -

Page 22

... programs. During the fourth quarter of 2011, the Federal Reserve's final rules related to debit card interchange fees became effective. These rules significantly limit the amount of interchange fee income that we may charge for electronic debit transactions. Similarly, in 2009, the Federal Reserve... -

Page 23

... to price products and services on less advantageous terms to retain or attract clients. Employees As of December 31, 2011, there were 29,182 full-time equivalent employees within SunTrust. None of the domestic employees within the Company are subject to a collective bargaining agreement. Management... -

Page 24

... Ethics; (ii) Corporate Governance Guidelines; and (iii) the charters of SunTrust Board committees. The Company's Annual Report on Form 10-K is being distributed to shareholders in lieu of a separate annual report containing financial statements of the Company and its consolidated subsidiaries. Item... -

Page 25

...behalf of customers or conduct related market making activities would adversely affect our business and results of operations. As of December 31, 2011, we held less than $200 million in interests in private equity and hedge funds likely to be affected by the Volcker Rule. We expect that over time we... -

Page 26

... housing finance market in the U.S. The report, among other things, outlined various potential proposals to wind down the GSEs and reduce or eliminate over time the role of the GSEs in guaranteeing mortgages and providing funding for mortgage loans, as well as proposals to implement reforms relating... -

Page 27

... capital, such as dividend increases and acquisitions. Loss of customer deposits and market illiquidity could increase our funding costs. We rely heavily on bank deposits to be a low cost and stable source of funding for the loans we make. We compete with banks and other financial services companies... -

Page 28

...instruments issued, insured or guaranteed by related institutions, agencies or instrumentalities, could result in risks to us and general economic conditions that we are not able to predict. On August 5, 2011, S&P cut the U.S. government's sovereign credit rating of long-term U.S. federal debt to AA... -

Page 29

...-A mortgages, home equity lines of credit, and mortgage loans sourced from brokers that are outside our branch banking network. These conditions have resulted in losses, write downs and impairment charges in our mortgage and other lines of business. Continued declines in real estate values, low home... -

Page 30

... fee on us for departures from GSE service levels. In most cases, this is related to delays in the foreclosure process. Additionally, we have received indemnification requests where an investor or insurer has suffered a loss due to a breach of the servicing agreement. While the number of such claims... -

Page 31

... the fair value of our MSRs. The Consent Order did not provide for a civil money penalty but the FRB reserved the ability to seek such penalty. Other government agencies, including state attorneys general and the U.S. Department of Justice, continue to investigate various mortgage related practices... -

Page 32

...value of equity investments that we hold could decline; The value of assets for which we provide processing services could decline; The value of our pension plan assets could decline, thereby potentially requiring us to further fund the plan; or To the extent we access capital markets to raise funds... -

Page 33

... quarter we evaluate the fair value of our MSRs and any related hedges, and any decrease in fair value reduces earnings in the period in which the decrease occurs. We measure at fair value prime mortgages held for sale for which an active secondary market and readily available market prices exist... -

Page 34

... in any number of activities, including lending practices, the failure of any product or service sold by us to meet our clients' expectations or applicable regulatory requirements, corporate governance and acquisitions, or from actions taken by government regulators and community organizations in... -

Page 35

... these threats, the prominent size and scale of SunTrust and our role in the financial services industry, our plans to continue to implement our internet banking and mobile banking channel strategies and develop additional remote connectivity solutions to serve our clients when and how they want to... -

Page 36

... services previously limited to commercial banks has intensified competition. Because non-banking financial institutions are not subject to the same regulatory restrictions as banks and bank holding companies, they can often operate with greater flexibility and lower cost structures. Securities... -

Page 37

... and cash management needs of our clients. Other sources of contingent funding available to us includes inter-bank borrowings, repurchase agreements, FHLB capacity, and borrowings from the Federal Reserve discount window. Any occurrence that may limit our access to the capital markets, such as... -

Page 38

... banking organizations by encouraging employees to take imprudent risks. This regulation significantly restricts the amount, form, and context in which we pay incentive compensation. Our accounting policies and processes are critical to how we report our financial condition and results of operations... -

Page 39

... a determination of their fair value in order to prepare our financial statements. Where quoted market prices are not available, we may make fair value determinations based on internally developed models or other means which ultimately rely to some degree on management judgment. Some of these and... -

Page 40

... COMMENTS The Company's headquarters is located in Atlanta, Georgia. As of December 31, 2011, the Bank owned 615 of its 1,659 fullservice banking offices and leased the remaining banking offices. (See Note 8, "Premises and Equipment," to the Consolidated Financial Statements in this Form 10-K for... -

Page 41

... share during the year ended December 31, 2010. Our common stock is held of record by approximately 33,821 holders as of December 31, 2011. See "Unregistered Sales of Equity Securities and Use of Proceeds" below for information on share repurchase activity, announced programs, and the remaining... -

Page 42

... Sales Of Equity Securities And Use Of Proceeds SunTrust did not repurchase any shares of its common stock, Series A Preferred Stock Depositary Shares, Series B Preferred Stock Depositary Shares, or warrants to purchase common stock during the quarter ended December 31, 2011. On September 12, 2006... -

Page 43

... common share Book value per common share Tangible book value per common share2 Market capitalization Market price: High Low Close Selected Average Balances Total assets Earning assets Loans Consumer and commercial deposits Brokered time and foreign deposits Total shareholders' equity Average common... -

Page 44

... to tangible assets2 Effective tax rate (benefit) 5 Allowance to year-end total loans Total nonperforming assets to total loans plus OREO, other repossessed assets, and nonperforming LHFS Common dividend payout ratio6 Capital Adequacy Tier 1 common equity Tier 1 capital Total capital Tier 1 leverage... -

Page 45

... improves, and the impact of U.S. government programs on our student loan portfolio; (ii) future levels of credit-related expenses, mortgage repurchase provision, net charge-offs, NPLs, net interest margin, repurchase demands, other real estate expenses, compensatory fees related to foreclosure... -

Page 46

... commercial banking organizations and our headquarters are located in Atlanta, Georgia. Our principal banking subsidiary, SunTrust Bank, offers a full line of financial services for consumers and businesses through its branches located primarily in Florida, Georgia, Maryland, North Carolina, South... -

Page 47

... paid on these products was nominal, and we expect that to continue while the low rate environment exists. Conversely, during the fourth quarter of 2011, the Federal Reserve's final rules related to debit card interchange fees became effective. The debit card interchange rules limit the amount of... -

Page 48

... the expected normalization in credit-related expense and mortgage repurchase provision as the economic environment improves. The three main components of the PPG expense program are focused in the areas of strategic supply management, consumer bank efficiencies, and operations staff and support. We... -

Page 49

...gains on our fair value debt and index-linked CDs. Compared to 2009, noninterest income declined 8%, with increases in trading income, card fees, investment banking income, and trust income, offset by declines in mortgage-related income, service charge income, and the 2009 gain on sale of Visa share... -

Page 50

..." and Note 25, "Subsequent Event," to the Consolidated Financial Statements in this Form 10-K related to the potential mortgage servicing settlement and claims expense. Line of Business Highlights Many of our core businesses demonstrated positive trends during 2011, helping to offset some of the... -

Page 51

... Real estate home equity lines Real estate commercial Commercial - FTE2 Credit card Consumer - direct Consumer - indirect Nonaccrual3 Total loans Securities available for sale: Taxable Tax-exempt - FTE2 Total securities available for sale - FTE Funds sold and securities purchased under agreements... -

Page 52

... time Other time Brokered time deposits Foreign deposits Funds purchased Securities sold under agreements to repurchase Interest-bearing trading liabilities Other short-term borrowings Long-term debt Total interest expense Net change in net interest income 1 Table 2 2010 Compared to 2009 Increase... -

Page 53

...reduction in closed mortgage loan volume. Our loan portfolio yielded 4.58% for the year, down 16 basis points from 2010. The yield decline was predominantly related to higher balances in the consumer-indirect loan portfolio that included high-quality loans acquired at lower rates and the real estate... -

Page 54

... in millions) 2011 Service charges on deposit accounts Trust and investment management income Other charges and fees Card fees Investment banking income Trading income/(loss) Retail investment services Mortgage production related (loss)/income Mortgage servicing related income Net securities gains... -

Page 55

...-issued interchange fee rules and Regulation E. Inherent in this expectation is our ability to charge certain deposit-related fees for value-added services we provide. Investment banking income increased by $4 million, or 1%, compared with the year ended December 31, 2010. The increase over 2010 was... -

Page 56

... assessments Credit and collection services Other real estate expense Operating losses Marketing and customer development Equipment expense Consulting and legal Potential mortgage servicing settlement and claims expense Other staff expense Postage and delivery Communications Operating supplies... -

Page 57

... common risk characteristics. The commercial and industrial loan type includes loans secured by owner-occupied properties, corporate credit cards and other wholesale lending activities. Commercial real estate and commercial construction loan types are based on investor exposures where repayment is... -

Page 58

... real estate Commercial construction Total commercial loans Residential loans: Residential mortgages - guaranteed Residential mortgages - nonguaranteed1 Home equity products Residential construction Total residential loans Consumer loans: Guaranteed student loans Other direct Indirect Credit cards... -

Page 59

...,164 1,023 $122,495 $2,353 Commercial Real estate: Home equity lines Construction Residential mortgages1 Commercial real estate: Owner occupied Investor owned Consumer: Direct Indirect Credit card LHFI LHFS 1 For the years ended December 31, 2011, 2010, 2009, 2008, and 2007, includes $431 million... -

Page 60

... rates, although the true loss exposure is very low due to the government guarantee. Early stage delinquencies excluding government-guaranteed loans continued to trend lower, down 22 basis points during the year, driven by improvements in nonguaranteed mortgages and home equity loans. Commercial... -

Page 61

... Real Estate Consumer Products and Services Health Care and Pharmaceuticals Diversified Financials and Insurance Government Retailing Automotive Diversified Commercial Services and Supplies Capital Goods Energy and Utilities Media and Telecommunication Services Religious Organizations/Non-Profits... -

Page 62

... to period-end loans 3,4 ALLL to NPLs 5 ALLL to net charge-offs Net charge-offs to average loans 1 Beginning in the fourth quarter of 2009, SunTrust began recording the provision for unfunded commitments within the provision for credit losses in the Consolidated Statements of Income/(Loss). Given... -

Page 63

... insurance claim losses were recorded as operating losses in the Consolidated Statements of Income/(Loss). These creditrelated operating losses totaled $160 million and $78 million during the years ended December 31, 2008 and 2007, respectively. During 2009, credit-related operating losses charged... -

Page 64

... real estate property values, and the variability and relative strength of the housing market. At this point in the cycle, we expect the ALLL to trend at a pace consistent with improvements in credit quality and overall economic conditions. As of December 31, 2011, the allowance to period-end loans... -

Page 65

... 14 2011 2010 2009 Nonaccrual/NPLs: Commercial loans Commercial & industrial Commercial real estate Commercial construction Total commercial NPLs Residential loans Residential mortgages - nonguaranteed Home equity products Residential construction Total residential NPLs Consumer loans Other direct... -

Page 66

..., following the Federal Reserve's horizontal review of the nation's largest mortgage loan servicers, SunTrust and other servicers entered into Consent Orders with the FRB. We describe the Consent Order in Note 20, "Contingencies," to the Consolidated Financial Statements in this Form 10-K and... -

Page 67

... Ginnie Mae and classified as held for sale at December 31, 2009, 2008, and 2007, respectively. 3 Nonaccruing restructured loans are included in total nonaccrual/NPLs. Restructured Loans To maximize the collection of loan balances, we evaluate troubled loans on a case-by-case basis to determine if... -

Page 68

...December 31, 2011 and 2010, specific reserves included in the ALLL for residential TDRs were $401 million and $422 million, respectively. See Note 6, "Loans," to the Consolidated Financial Statements in this Form 10-K for more information. The following tables display our residential real estate TDR... -

Page 69

... the year ended December 31, 2011, primarily reflecting net charge-offs during the year, as well as returns of commercial TDRs to accrual status and repayments. See additional discussion in Note 1, "Significant Accounting Policies," and Note 6, "Loans," to the Consolidated Financial Statements in... -

Page 70

...) U.S. Treasury securities Federal agency securities U.S. states and political subdivisions MBS - agency MBS - private CDO/CLO securities ABS Corporate and other debt securities Coke common stock Other equity securities1 Total securities AFS 1 At December 31, 2011, other equity securities included... -

Page 71

... Bank stock, and $197 million in mutual fund investments. (Dollars in millions) U.S. Treasury securities Federal agency securities U.S. states and political subdivisions MBS - agency MBS - private ABS Corporate and other debt securities Coke common stock Other equity securities1 Total securities... -

Page 72

... Securities Available for Sale December 31, 2011 (Dollars in millions) Distribution of Maturities: Amortized Cost U.S. Treasury securities Federal agency securities U.S. states and political subdivisions MBS - agency MBS - private CDO/CLO securities ABS Corporate and other debt securities Total debt... -

Page 73

...we obtained from our long-term holding of this asset, including the capital treatment by bank regulators. We entered into The Agreements, which were comprised of two variable forward agreements and share forward agreements effective July 15, 2008 with a major, unaffiliated financial institution (the... -

Page 74

... "Live Solid. Bank Solid." brand to improve our visibility in the marketplace. It is designed to speak to what is important to clients in the current environment and to inspire customer loyalty and capitalize on some of the opportunities presented by the new banking landscape. We continue to manage... -

Page 75

...21 0.39 Balance $839 1,644 7,000 1,983 Rate 0.09% 0.13 0.14 0.50 Maximum Outstanding at any Month-End $1,169 2,411 7,000 3,218 2011 Funds purchased 1 Securities sold under agreements to repurchase 1 FHLB advances Other short-term borrowings 2010 Funds purchased 1 Securities sold under agreements to... -

Page 76

... unrealized gain on equity securities. Additionally, for purposes of computing regulatory capital, mark to market adjustments related to our own creditworthiness for debt and index linked CDs accounted for at fair value are excluded from regulatory capital. Both the Company and the Bank are subject... -

Page 77

...trust preferred securities Preferred stock Allowable minority interest Tier 1 common equity Risk-based ratios: Tier 1 common equity Tier 1 capital Total capital Tier 1 leverage ratio Total shareholders' equity to assets In March 2011, the Federal Reserve completed its CCAR to evaluate capital plans... -

Page 78

...as the Collins Amendment) directs the Federal Reserve to adopt new capital requirements for certain bank holding companies, including us, which are at least as stringent as those applicable to insured depositary institutions, such as SunTrust Bank. We expect that the Federal Reserve will apply these... -

Page 79

... pension asset (net of DTL) Total calculation adjustments Basel III Tier 1 Common Capital Basel I RWA Calculation Adjustments: Unrealized losses on pension and post-retirement plan held in AOCI - additional RWA no longer required Tier 2 capital credit from unrealized gains on AFS equity securities... -

Page 80

... assessment of internal and external influences on credit quality that are not fully reflected in the historical loss or risk-rating data. Large commercial nonaccrual loans and certain commercial, consumer, and residential loans whose terms have been modified in a TDR, are individually evaluated to... -

Page 81

... "Allowance for Credit Losses," to the Consolidated Financial Statements in this Form 10-K. Mortgage Repurchase Reserve We sell residential mortgage loans to investors through whole loan sales in the normal course of our business. Prior to 2008 we also sold loans to investors through securitizations... -

Page 82

...the GSEs are working through the backlog of defaulted loans from prior years and that the repurchase requests in the latter half of 2011 were due to an acceleration of timing of repurchase requests as opposed to an increase in the total population of requests. Our liability for losses resulting from... -

Page 83

... changes in housing prices over the past several years, we believe the loss severity over the past 12 months will be more indicative of our future loss severity rate. Our current estimated liability for contingent losses related to loans sold was $320 million as of December 31, 2011. The liability... -

Page 84

...value. The objective of fair value is to use market-based inputs or assumptions, when available, to estimate the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where observable market prices... -

Page 85

... particularly when pricing service information or observable market trades are not available. In most cases, the current market conditions caused the broker quotes to be indicative and the price indications and broker quotes to be supported by very limited to no recent market activity. In those... -

Page 86

... to assumption changes and market volatility. Improvements may be made to our pricing methodologies on an ongoing basis as observable and relevant information becomes available to us. See Note 19, "Fair Value Election and Measurement," to the Consolidated Financial Statements in this Form 10-K for... -

Page 87

... assumptions related to our IRLCs is described in Note 19, "Fair Value Election and Measurement," to the Consolidated Financial Statements in this Form 10-K. Goodwill As of December 31, 2011 and 2010, our reporting units with goodwill balances are Branch Banking, Diversified Commercial Banking, CIB... -

Page 88

... loan and deposit growth, forward interest rates, historical performance, and industry and economic trends, among other considerations. The long-term growth rate used in determining the terminal value of each reporting unit was estimated at 4% as of September 30, 2011 and 2010 based on management... -

Page 89

... the Consolidated Financial Statements in this Form 10-K. Pension Accounting Several variables affect the annual cost for our retirement programs. The main variables are: (1) size and characteristics of the employee population, (2) discount rate, (3) expected long-term rate of return on plan assets... -

Page 90

... 8 years. See Note 16, "Employee Benefit Plans," to the Consolidated Financial Statements in this Form 10-K for details on changes in the pension benefit obligation and the fair value of plan assets. If we were to assume a 0.25% increase/decrease in the expected long-term rate of return for... -

Page 91

... governance and management limits, policies, processes, and procedures to reflect changes in external conditions and/or corporate goals and strategies. In terms of underwriting, we seek to mitigate risk through analysis of such things as a borrower's credit history, financial statements, tax returns... -

Page 92

..., control, monitor, and report on operational risks Company-wide. These processes support our goals in seeking to minimize future operational losses and strengthen our performance by optimizing operational capital allocation. Operational Risk Management is overseen by our CORO, who reports directly... -

Page 93

... monitor and limit exposure to market risk. The policies established by ALCO are reviewed and approved by our Board. Market Risk from Non-Trading Activities The primary goal of interest rate risk management is to control exposure to interest rate risk, both within policy limits approved by the Board... -

Page 94

... rates. Market Risk from Trading Activities Under established policies and procedures, we manage market risk associated with trading, capital markets, and foreign exchange activities using a VAR approach that determines total exposure arising from interest rate risk, equity risk, foreign exchange... -

Page 95

... sheet so that we fund less liquid assets, such as loans, with stable funding sources, such as retail and wholesale deposits, long-term debt, and capital. We primarily monitor and manage liquidity risk at the Parent Company and Bank levels as the non-bank subsidiaries are relatively small and these... -

Page 96

... Total 1 Average based upon month-end data, except excess reserves, which is based upon a daily average. Uses of Funds. Our primary uses of funds include the extension of loans and credit, the purchase of investment securities, working capital, and debt and capital service. The Bank and the Parent... -

Page 97

... and long-term senior and subordinated notes. The primary uses of Parent Company liquidity include debt service, dividends on capital instruments, the periodic purchase of investment securities, and loans to our subsidiaries. We fund corporate dividends primarily with dividends from our banking... -

Page 98

...310 $6,263 108 68 $6,439 Unused lines of credit: Commercial Mortgage commitments 1 Home equity lines Commercial real estate CP conduit Credit card Total unused lines of credit Letters of credit: Financial standby Performance standby Commercial Total letters of credit 1 Includes IRLC contracts with... -

Page 99

... in the Federal Reserve Bank. In order to be an FHLB member, we are required to purchase capital stock in the FHLB. In exchange, members take advantage of competitively priced advances as a wholesale funding source and access grants and low-cost loans for affordable housing and community-development... -

Page 100

...Time deposit maturities Brokered time deposit 1 Short-term borrowings 1 Long-term debt 1,2 1 Operating lease obligations Capital lease obligations 1 Purchase obligations 3 Total 1 2 1 year or less $9,851 226 11,466 2,360 214 1 81 $24,199 As of December 31, 2011 1-3 years 3-5 years After 5 years... -

Page 101

... Treasury Basic Dividends paid per average common share Book value per common share Tangible book value per common share2 Market capitalization Market price: High Low Close Selected Average Balances Total assets Earning assets Loans Consumer and commercial deposits Brokered time and foreign deposits... -

Page 102

.... Compared with the fourth quarter of 2010, mortgage-production related (loss)/income decreased by $103 million, predominantly due to a $130 million increase in mortgage repurchase provision partially offset by higher income from loan production activities. Mortgage servicing income decreased by $46... -

Page 103

...years ended December 31: Average Loans and Deposits by Segment Average Loans (Dollars in millions) Retail Banking Diversified Commercial Banking CRE CIB Mortgage W&IM Corporate Other and Treasury 2011 $35,648 23,097 7,045 13,717 29,128 7,503 170 2010 $33,511 22,571 9,704 10,876 29,043 8,015 205 2009... -

Page 104

... in home equity lines, commercial loans, residential mortgage loans, and credit cards as well as slight declines in personal credit lines and other customer loans. Total noninterest income was $1.1 billion, a decrease of $65 million, or 6%, compared with the same period in 2010. Service charges on... -

Page 105

..., as well as compensation accruals tied to our Merchant Banking business along with increased operating costs tied to growth in loans and deposits, contributed to higher overall expense. Mortgage Mortgage reported a net loss of $693 million for the year ended December 31, 2011, an improvement of $94... -

Page 106

..., operating losses related to mortgage servicing, and collection costs that were partially offset by certain lower volume-related expenses, and lower other real estate. Wealth and Investment Management W&IM's net income for the twelve months ended December 31, 2011 was $160 million, an increase of... -

Page 107

... 2009. Service charges on deposits decreased $4 million driven by lower commercial deposit analysis fees while letters of credit fees decreased $5 million. Additional decreases in deposit sweep fees and leasing revenue were partially offset by an increase in loan fees and sales and referral credits... -

Page 108

... quarter of 2009 on the affordable housing properties. Corporate and Investment Banking CIB's net income for the twelve months ended December 31, 2010 was $320 million, an increase of $203 million, compared with the same period in 2009. Net income increased due to lower provision for loan losses... -

Page 109

..., and participant-directed retirement accounts. The December 31, 2009 assets under management included approximately $18.0 billion of MMMF assets. SunTrust completed the sale of the money market fund business to Federated Investors, Inc. in the fourth quarter 2010. SunTrust's total assets under... -

Page 110

... decreased operating losses and other real estate expense. Corporate Other and Treasury Corporate Other and Treasury's net income for the twelve months ended December 31, 2010 was $489 million, an increase of $108 million, or 28%, compared with the same period in 2009. The increase was predominantly... -

Page 111

... accretion associated with the repurchase of preferred stock issued to the U.S. Treasury. We believe these measures are useful to investors, because removing the non-cash impairment charge and non-cash accelerated accretion provides a more representative view of normalized operations and the measure... -

Page 112

... 2011, 2010, 2009, and 2008, respectively. 6 We present a tangible equity to tangible assets ratio that excludes the after-tax impact of purchase accounting intangible assets. We believe this measure is useful to investors because, by removing the effect of intangible assets that result from merger... -

Page 113

... $1,899 We present net income/(loss) available to common shareholders that excludes the accelerated accretion associated with the repurchase of preferred stock issued to the U.S. Treasury. We believe this measure is useful to investors, because removing the non-cash accelerated accretion provides... -

Page 114

... Public Accounting Firm The Board of Directors and Shareholders of SunTrust Banks, Inc. We have audited the accompanying consolidated balance sheets of SunTrust Banks, Inc. (the Company) as of December 31, 2011 and 2010, and the related consolidated statements of income/(loss), shareholders' equity... -

Page 115

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of SunTrust Banks, Inc. as of December 31, 2011 and 2010 and the related consolidated statements of income/(loss), shareholders' equity and cash flows for each of the... -

Page 116

... and fees on loans Interest and fees on loans held for sale Interest and dividends on securities available for sale: Taxable interest Tax-exempt interest Dividends1 Trading account interest and other Total interest income Interest Expense Interest on deposits Interest on long-term debt Interest... -

Page 117

...and commercial deposits Brokered time deposits (CDs at fair value: $1,018 and $1,213 as of December 31, 2011 and 2010, respectively) Foreign deposits Total deposits Funds purchased Securities sold under agreements to repurchase Other short-term borrowings Long-term debt 3 (debt at fair value: $1,997... -

Page 118

... stock activity Amortization of restricted stock compensation Issuance of stock for employee benefit plans and other Fair value election of MSRs Adoption of VIE consolidation guidance Balance, December 31, 2010 Net income Other comprehensive income: Change in unrealized gains (losses) on securities... -

Page 119

... credit losses and foreclosed property Mortgage repurchase provision Potential mortgage servicing settlement and claims expense Deferred income tax expense/(benefit) Stock option compensation and amortization of restricted stock compensation Net (gain)/loss on extinguishment of debt Net securities... -

Page 120

...including deposit, credit, and trust and investment services. Additional subsidiaries provide mortgage banking, asset management, securities brokerage, capital market services, and credit-related insurance. SunTrust operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina... -

Page 121

... of noninterest income in the Consolidated Statements of Income/(Loss). On a quarterly basis, the Company reviews nonmarketable equity securities, which include venture capital equity and certain mezzanine securities that are not publicly traded as well as equity investments acquired for various... -

Page 122

... to Consolidated Financial Statements (Continued) The Company may transfer certain residential mortgage loans, commercial loans, and student loans to a held-for-sale classification at LOCOM. At the time of transfer, any credit losses are recorded as a reduction in the ALLL. Subsequent credit losses... -

Page 123

... or recent sales information. Appraisals generally represent the "as is" value of the property but may be adjusted based on the intended disposition strategy of the property. For commercial real estate loans secured by property, an acceptable third-party appraisal or other form of evaluation, as... -

Page 124

... shorter of the improvements' estimated useful lives or the lease term, depending on whether the lease meets the transfer of ownership or bargain-purchase option criterion. Certain leases are capitalized as assets for financial reporting purposes and are amortized using the straight-line method of... -

Page 125

...also reported in mortgage servicing related income in the Consolidated Statements of Income/(Loss). For additional information on the Company's servicing fees, see Note 9, "Goodwill and Other Intangible Assets." Other Real Estate Owned Assets acquired through, or in lieu of loan foreclosure are held... -

Page 126

... tool to economically hedge certain identified market risks, along with certain IRLCs on residential mortgage loans that are a normal part of the Company's operations. The Company also evaluates contracts, such as brokered deposits and short-term debt, to determine whether any embedded derivatives... -

Page 127

..."Derivative Financial Instruments," and Note 19, "Fair Value Election and Measurement." Stock-Based Compensation The Company sponsors stock plans under which incentive and nonqualified stock options and restricted stock may be granted periodically to certain employees. The Company accounts for stock... -

Page 128

Notes to Consolidated Financial Statements (Continued) not available. For additional information on the Company's valuation of its assets and liabilities held at fair value, see Note 19, "Fair Value Election and Measurement." Accounting Policies Recently Adopted and Pending Accounting Pronouncements... -

Page 129

... margin evaluation on the acquisition date based on market volatility, as necessary. It is the Company's policy to obtain possession of collateral with a fair value between 95% to 110% of the principal amount loaned under resale agreements. The total market value of the collateral held was... -

Page 130

... loans related to TRS. See Note 20, "Contingencies," to the Consolidated Financial Statements for information concerning ARS added to trading assets in 2008 as well as the current position in those assets at December 31, 2011. Trading instruments are used as part of the Company's overall balance... -

Page 131

... of Atlanta stock, $391 million in Federal Reserve Bank stock, and $197 million in mutual fund investments. Securities AFS that were pledged to secure public deposits, repurchase agreements, trusts, and other funds had a fair value of $9.1 billion and $6.9 billion as of December 31, 2011 and 2010... -

Page 132

...agency MBS - private CDO/CLO securities ABS Corporate and other debt securities Total debt securities Fair Value: U.S. Treasury securities Federal agency securities U.S. states and political subdivisions MBS - agency MBS - private CDO/CLO securities ABS Corporate and other debt securities Total debt... -

Page 133

...to Consolidated Financial Statements (Continued) Securities in an Unrealized Loss Position The Company held certain investment securities having unrealized loss positions. Market changes in interest rates and credit spreads will result in temporary unrealized losses as the market price of securities... -

Page 134

...of the securities that the Company has reviewed for credit-related OTTI, credit information is available and modeled at the loan level underlying each security, and the Company also considers information such as loan to collateral values, FICO scores, and geographic considerations such as home price... -

Page 135

... time during the period. OTTI related to these securities are excluded from this amount. The following table presents a summary of the significant inputs used in determining the measurement of credit losses recognized in earnings for private MBS for the years ended December 31, 2011, 2010, and 2009... -

Page 136

... consumer credit risk scores, rating agency information, borrower/guarantor financial capacity, LTV ratios, collateral type, debt service coverage ratios, collection experience, other internal metrics/analysis and qualitative assessments. For the commercial portfolio, the Company believes that... -

Page 137

...obtained by the Company at least quarterly. However, for government guaranteed student loans, the Company monitors the credit quality based primarily on delinquency status, as it is a more relevant indicator of credit quality due to the government guarantee. As of December 31, 2011 and 2010, 79% and... -

Page 138

... real estate Commercial construction Total commercial loans Residential loans: Residential mortgages - guaranteed Residential mortgages - nonguaranteed1 Home equity products Residential construction Total residential loans Consumer loans: Guaranteed student loans Other direct Indirect Credit cards... -

Page 139

... loans: Commercial & industrial Commercial real estate Commercial construction Total commercial loans Residential loans: Residential mortgages - nonguaranteed Home equity products Residential construction Total residential loans Consumer loans: Other direct Credit cards Total consumer loans Total... -

Page 140

...Consolidated Financial Statements (Continued) As of December 31, 2010 (Dollars in millions) Unpaid Principal Balance Amortized Cost1 Related Allowance Impaired loans with no related allowance recorded: Commercial loans: Commercial & industrial Commercial real estate Commercial construction Total... -

Page 141

... real estate Commercial construction Residential loans: Residential mortgages - nonguaranteed Home equity products Residential construction Consumer loans: Other direct Credit cards Total TDRs 1 Restructured loans which had forgiveness of amounts contractually due under the terms of the loan... -

Page 142

... extend credit on home equity lines and $7.8 billion in mortgage loan commitments. Of the residential loans owned at December 31, 2011, 14% were guaranteed by a federal agency or a GSE. At December 31, 2010, the Company owned $46.5 billion in residential real estate loans, representing 40% of total... -

Page 143

... in the Consolidated Statements of Income/(Loss). 2 The unfunded commitments reserve is separately recognized in other liabilities in the Consolidated Balance Sheets. Activity in the ALLL by segment at December 31 is presented in the tables below: 2011 (Dollars in millions) Commercial $1,303 324... -

Page 144

...Total premises and equipment Useful Life Indefinite 2 - 40 years 1 - 30 years 1 - 20 years 2011 $358 1,033 580 1,322 105 3,398 1,834 $1,564 2010 $353 1,008 577 1,385 168 3,491 1,871 $1,620 The carrying amounts of premises and equipment subject to mortgage indebtedness (included in long-term debt... -

Page 145

... to Consolidated Financial Statements (Continued) Various Company facilities are leased under both capital and noncancelable operating leases with initial remaining terms in excess of one year. Minimum payments, by year and in aggregate, as of December 31, 2011 were as follows: Operating Leases $214... -

Page 146

... fees and late fees, net of curtailment costs. Such income earned for the year ended December 31, 2011, 2010, and 2009 was $364 million, $399 million, and $354 million, respectively. These amounts are reported in mortgage servicing related income in the Consolidated Statements of Income/(Loss... -

Page 147

... of loans serviced for third parties. During the year ended December 31, 2011, the Company sold MSRs on residential loans with an unpaid principal balance of $2.3 billion. Because MSRs are reported at fair value, the sale did not have a material impact on mortgage servicing related income. A summary... -

Page 148

...$707 million, including servicing rights for the years ended December 31, 2011, 2010, and 2009, respectively. These gains are included within mortgage production related (loss)/income in the Consolidated Statements of Income/(Loss). These gains include the change in value of the loans as a result of... -

Page 149

... for estimating the fair values of these financial instruments). At December 31, 2011 and 2010, the Company's Consolidated Balance Sheets reflected $315 million and $316 million, respectively, of loans held by the CLO and $289 million and $290 million, respectively, of debt issued by the CLO... -

Page 150

...consolidating the Student Loan entity were increases in LHFI, the related ALLL, and long-term debt. Additionally, the Company's ownership of the residual interest in the SPE, previously classified in trading assets, was eliminated upon consolidation and the assets and liabilities of the Student Loan... -

Page 151

... 1 - Year Ended December 31, 2009 Commercial and Corporate Student CDO Loans Loans Securities $2 $7 $3 11 1 - Total $80 17 (Dollars in millions) Cash flows on interests held Servicing or management fees Residential Mortgage Loans $94 5 Total $106 17 Portfolio balances and delinquency balances... -

Page 152

... the Company, net of direct salary and administrative costs, of $65 million, $68 million, and $59 million for the years ended December 31, 2011, 2010, and 2009, respectively. At December 31, 2011, the Company's Consolidated Balance Sheets included approximately $2.9 billion of secured loans held by... -

Page 153

... complete by the second quarter of 2012, and upon completion, the Bank will terminate the liquidity arrangements and standby letter of credit. The liquidation is not expected to have a material impact to the Company's financial condition, results of operations, or cash flows. Total Return Swaps The... -

Page 154

... affordable housing developments and other community development entities as a limited and/or general partner and/or a debt provider. The Company receives tax credits for various investments. The Company has determined that the related partnerships are VIEs. During the years ended December 31, 2011... -

Page 155

... on mergers, consolidations, certain leases, sales or transfers of assets, minimum shareholders' equity, and maximum borrowings by the Company. As of December 31, 2011, the Company was in compliance with all covenants and provisions of long-term debt agreements. As currently defined by federal bank... -

Page 156

... service contracts. As of December 31, 2011, the Company had the following in unconditional obligations: (Dollars in millions) Operating lease obligations Capital lease obligations 1 Purchase obligations 2 Total 1 2 1 year or less $214 1 81 $296 As of December 31, 2011 1-3 years 3-5 years After... -

Page 157

... Rate Cumulative Preferred Stock, Series D, that was issued to the U.S. Treasury under the TARP's CPP in 2008. As a result of the repurchase of Series C and D Preferred Stock, the Company incurred a one-time non-cash charge to net income/(loss) available to common shareholders of $74 million related... -

Page 158

...to which the Company raises its dividend. The formulas are contained in the warrant agreements which were filed as exhibits to Form 8As filed on September 23, 2011. During the years ended December 31, 2011, 2010 and 2009, SunTrust paid cash dividends on perpetual preferred stock totaling $67 million... -

Page 159

... in the Consolidated Statements of Income/(Loss) were as follows: (Dollars in millions) Year ended December 31 2011 ($4) - ($4) $81 2 83 $79 2010 $- (14) ($14) ($177) 6 (171) ($185) 2009 ($7) 3 ($4) ($798) (96) (894) ($898) Current income tax expense/(benefit): Federal State Total Deferred income... -

Page 160

... examination by the IRS for taxable years prior to 2006. The IRS audit of the 2006 federal income tax return is closed, but the return is still subject to examination to the extent of carryback claims. The Company's 2007 through 2009 federal income tax returns are currently under examination by the... -

Page 161

... in UTBs related to lapse of the applicable statutes of limitations Balance at December 31 NOTE 16 - EMPLOYEE BENEFIT PLANS The Company sponsors various short-term incentive and LTI plans for eligible employees. The Company delivers LTIs through various incentive programs, including stock options... -

Page 162

...on the date of grant using the Black-Scholes option pricing model with the following assumptions: Year Ended December 31 2011 2010 2009 0.75% 0.17% 4.16% 34.87 56.09 83.17 2.48 2.80 1.94 6 years 6 years 6 years Dividend yield Expected stock price volatility Risk-free interest rate (weighted average... -

Page 163

Notes to Consolidated Financial Statements (Continued) The following table presents a summary of stock option and restricted stock activity: Stock Options (Dollars in millions, except per share data) Balance, January 1, 2009 Granted Exercised/vested Cancelled/expired/ forfeited Amortization of ... -

Page 164

...Consolidated Financial Statements (Continued) The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the Company's closing stock price on the last trading day of 2011 and the exercise price, multiplied by the number of in-the-money stock... -

Page 165

... of both. Participants are 100% vested after 3 years of service. The interest crediting rate applied to each Personal Pension Account was an annual effective rate of 4.42% for 2011. SunTrust monitors the funded status of the plan closely and due to the current funded status, SunTrust did not make... -

Page 166

... to Consolidated Financial Statements (Continued) Assumptions The SunTrust Benefits Finance Committee reviews and approves the assumptions for year-end measurement calculations. A discount rate is used to determine the present value of future benefit obligations. The discount rate for each plan is... -

Page 167

... on third party data received as of the balance sheet date. Level 1 assets such as equity securities, mutual funds, and REITs are instruments that are traded in active markets and are valued based on identical instruments. Fixed income securities and common and collective trust funds are classified... -

Page 168

... forth a summary of changes in the fair value of level 3 plan assets for the year ended December 31, 2010: (Dollars in millions) Balance as of January 1, 2010 Purchases/(sales) Realized gain Unrealized loss Transfers out of level 3 Balance as of December 31, 2010 Fixed Income Securities - Corporate... -

Page 169

... grade tax-exempt bond International fund Common and collective funds: SunTrust Reserve Fund SunTrust Equity Fund SunTrust Georgia Tax-Free Fund SunTrust National Tax-Free Fund SunTrust Aggregate Fixed Income Fund SunTrust Short-Term Bond Fund 1 Assets Measured at Fair Value as of December 31, 2010... -

Page 170

...and expenses. Capital market simulations from internal and external sources, survey data, economic forecasts and actuarial judgment are all used in this process. The expected long-term rate of return on plan assets for the SunTrust Retirement Plan for Inactive Participants was 7.75% in 2011 and 8.00... -

Page 171

...108 $665 Other Postretirement Benefits 2011 2010 $17 $34 - - $17 $34 (Dollars in millions) Net actuarial loss Prior service credit Total AOCI, pre-tax Expected Cash Flows Information about the expected cash flows for the Pension Benefit and Other Postretirement Benefit plans is as follows: Other... -

Page 172

...assets Amortization of prior service credit Recognized net actuarial loss Curtailment gain Other Net periodic (benefit)/cost Weighted average assumptions used to determine net cost Discount rate1 Expected return on plan assets Rate of compensation increase 1 Year Ended December 31 2009 $64 120 (149... -

Page 173

...The Company's Corporate Treasury function is responsible for employing the various hedge accounting strategies to manage these objectives and all derivative activities are monitored by ALCO. The Company may also enter into derivatives, on a limited basis, in consideration of trading opportunities in... -

Page 174

...Consolidated Financial Statements (Continued) The majority of the Company's derivatives contain contingencies that relate to the creditworthiness of the Bank. These contingencies, which are contained in industry standard master trading agreements, may be considered events of default. Should the Bank... -

Page 175

... Foreign exchange rate contracts covering: Foreign-denominated debt and commercial loans Trading activity Credit contracts covering: Loans Trading activity Equity contracts - Trading activity Other contracts: IRLCs and other Trading activity Total Total derivatives 1 Trading assets Trading assets... -

Page 176

... Foreign exchange rate contracts covering: Foreign-denominated debt and commercial loans Trading activity Credit contracts covering: Loans Trading activity Equity contracts - Trading activity Other contracts: IRLCs and other Trading activity Total Total derivatives 1 Trading assets Trading assets... -

Page 177

...FV Trading activity Foreign exchange rate contracts covering: Foreign-denominated debt and commercial loans Trading activity Credit contracts covering: Loans Other Equity contracts - trading activity Other contracts: IRLCs Total Mortgage production related (loss)/income 355 $779 Trading income/(loss... -

Page 178

.../(loss) Mortgage servicing related income Mortgage production related (loss)/income Trading income/(loss) ($64) (1) 444 (176) 304 The impacts of derivatives on the Consolidated Statements of Income/(Loss) and the Consolidated Statements of Shareholders' Equity for the year ended December 31, 2009... -

Page 179

... Trading activity Foreign exchange rate contracts covering: Foreign-denominated debt and commercial loans Trading activity Credit contracts covering: Loans Equity contracts - trading activity Other contracts: IRLCs Trading activity Total Mortgage production related (loss)/income Trading income/(loss... -

Page 180

Notes to Consolidated Financial Statements (Continued) any time due to unforeseen circumstances. To date, no material losses have been incurred related to the Company's written risk participations. At December 31, 2011 and 2010, the remaining terms on these risk participations generally ranged from ... -

Page 181

... income/(loss). The Company enters into CDS to hedge credit risk associated with certain loans held within its CIB line of business. Trading activity, as illustrated in the tables within this footnote, primarily includes interest rate swaps, equity derivatives, CDS, futures, options and foreign... -

Page 182

... control of other individual trusts to the mortgage insurance companies. Premium income, which totaled $26 million, $38 million, and $48 million for each of the years ended December 31, 2011, 2010, and 2009, respectively, is reported as part of noninterest income. The related provision for losses... -

Page 183

... $29 million from non-agency investors. The Company uses the best information available when estimating its mortgage repurchase liability. As of December 31, 2011 and 2010, the Company's estimate of the liability for incurred losses related to all vintages of mortgage loans sold totaled $320 million... -

Page 184

... loss for loans sold to non-agency investors or for loans sold subsequent to 2008. The following table summarizes the changes in the Company's reserve for mortgage loan repurchases: Year Ended December 31 (Dollars in millions) Balance at beginning of period Repurchase provision Charge-offs Balance... -

Page 185

... cash or securities held in the defaulting customers' account. For the years ended December 31, 2011, 2010, and 2009, STIS and STRH experienced minimal net losses as a result of the indemnity. The clearing agreements expire in May 2015 for both STIS and STRH. SunTrust Community Capital, a SunTrust... -

Page 186

Notes to Consolidated Financial Statements (Continued) investors. As of December 31, 2011, SunTrust Community Capital has completed six sales containing guarantee provisions stating that SunTrust Community Capital will make payment to the outside investors if the tax credits become ineligible. ... -

Page 187

...the Consolidated Balance Sheets as of December 31, 2011. 2 Includes at cost, $342 million of FHLB of Atlanta stock, $398 million of Federal Reserve Bank stock, and $187 million in mutual fund investments. 3 These amounts include IRLCs and derivative financial instruments entered into by the Mortgage... -

Page 188

... of Federal Reserve Bank stock, and $197 million in mutual fund investments. 2 These amounts include IRLCs and derivative financial instruments entered into by the Mortgage line of business to hedge its interest rate risk. 3 These amounts include the derivative associated with the Company's sale of... -

Page 189

Notes to Consolidated Financial Statements (Continued) The following tables present the difference between the aggregate fair value and the aggregate unpaid principal balance of trading loans, LHFI, LHFS, brokered time deposits, and long-term debt instruments for which the FVO has been elected. For ... -

Page 190

...) Trading income/(loss) $21 (10) 3 - Mortgage Production Related (Loss)/Income 1 $- 450 11 7 Mortgage Servicing Related Income $- - - (733) Assets Trading loans LHFS LHFI MSRs Liabilities Brokered time deposits Long-term debt 1 32 (12) - - - - 32 (12) For the year ended December 31, 2011... -

Page 191

... Consolidated Financial Statements (Continued) Fair Value Gain/(Loss) for the Year Ended December 31, 2009, for Items Measured at Fair Value Pursuant to Election of the FVO Total Changes in Mortgage Fair Values Production Mortgage Included in Related Servicing Current Trading (Loss)/ Related Period... -

Page 192

... the private CMBS held at December 31, 2010, the Company was able to obtain pricing information as part of the foreclosure sale at liquidation and was also able to obtain at least two different pricing sources that were within narrow price range. As such, the Company classified these securities as... -

Page 193

...by credit ratings or total leverage of the trust. These adjustments may be significant; therefore, the subordinate student loan ARS held as trading assets continue to be classified as level 3. Other level 3 AFS ABS includes interests in third party securitizations of auto loans and home equity lines... -

Page 194

... are predominantly standard OTC swaps, options, and forwards, with underlying market variables of interest rates, foreign exchange, equity, and credit. Because fair values for OTC contracts are not readily available, the Company estimates fair values using internal, but standard, valuation models... -

Page 195

... captured in mortgage production related (loss)/income. Level 2 LHFS are primarily agency loans which trade in active secondary markets and are priced using current market pricing for similar securities adjusted for servicing and risk. Level 3 loans are primarily non-agency residential mortgages for... -

Page 196

... years ended December 31, 2011 and 2010, the Company transferred $271 million and $398 million, respectively, of IRLCs out of level 3 as the associated loans were closed. The Company is exposed to interest rate risk associated with MSRs, IRLCs, mortgage LHFS, and mortgage LHFI reported at fair value... -

Page 197

... losses of $2 million for the years ended December 31, 2011, 2010, and 2009, respectively, due to changes in its own credit spread on its brokered time deposits carried at fair value. Long-term debt The Company has elected to carry at fair value certain fixed rate debt issuances of public debt which... -

Page 198

... balance sheet line items Transfers into Level 3 Transfers out of Level 3 Fair value December 31, 2011 Included in earnings (held at December 31, 2011) 1 (Dollars in millions) OCI Purchases Sales Settlements Assets: Trading assets: MBS - private CDO/CLO securities ABS Equity securities Total... -

Page 199

... to Consolidated Financial Statements (Continued) Fair Value Measurements Using Significant Unobservable Inputs Purchases, sales, issuances, settlements, maturities, paydowns, net Transfers from/(to) other balance sheet line items (Dollars in millions) Beginning balance January 1, 2010 Included... -

Page 200

... of conforming, residential mortgage loans and corporate loans that are accounted for at LOCOM. Level 3 LHFS consist of non-agency residential mortgage LHFS for which there is little or no secondary market activity and leases held for sale. These loans are valued consistent with the methodology... -

Page 201

... the years ended December 31, 2011 and 2010, the Company recognized impairment charges of $10 million and $15 million, respectively, on its consolidated affordable housing partnership investments. Other Assets Other assets consist of private equity investments, structured leasing products, other... -

Page 202

... on LHFI LHFI, as adjusted for interest/credit risk Market risk/liquidity adjustment on LHFI LHFI, fully adjusted Financial liabilities Consumer and commercial deposits Brokered time deposits Foreign deposits Short-term borrowings Long-term debt Trading liabilities $4,509 6,279 28,117 2,353 122... -

Page 203

... participants would use in valuing deposits. The value of long-term relationships with depositors is not taken into account in estimating fair values. (f) Fair values for foreign deposits, certain brokered deposits, short-term borrowings, and certain long-term debt are based on quoted market prices... -

Page 204

... to Consolidated Financial Statements (Continued) at December 31, 2011, 2010, and 2009, respectively. The losses related to the FINRA agreement were accrued in 2008; however, during the years ended December 31, 2011 and 2010, the Company recognized gains of $33 million and $18 million relating to... -

Page 205

Notes to Consolidated Financial Statements (Continued) Overdraft Fee Cases The Company has been named as a defendant in two putative class actions relating to the imposition of overdraft fees on customer accounts. The first such case, Buffington et al. v. SunTrust Banks, Inc. et al. was filed in ... -

Page 206

... to Consolidated Financial Statements (Continued) Krinsk v. SunTrust Bank This is a lender liability action in which the borrower claims that the Company has taken actions in violation of her home equity line of credit agreement and in violation of the Truth in Lending Act ("TILA"). Plaintiff filed... -

Page 207

... the Federal Reserve in which SunTrust Banks, Inc., SunTrust Bank, and STM agreed to strengthen oversight of and improve risk management, internal audit, and compliance programs concerning the residential mortgage loan servicing, loss mitigation, and foreclosure activities of STM. Under the terms of... -

Page 208

... Mutual Funds as investment options in the Plan. The plaintiff purports to represent all current and former Plan participants who held the STI Classic Mutual Funds in their Plan accounts from April 2002 through December 2010 and seeks to recover alleged losses these Plan participants supposedly... -

Page 209

... internet (www.suntrust.com), and the telephone (1-800-SUNTRUST). Financial products and services offered to consumers include consumer deposits, home equity lines, consumer lines, indirect auto, student lending, bank card, and other consumer loan and fee-based products. Retail Banking also serves... -

Page 210

... and funding activities, balance sheet risk management, and most real estate assets. Other components include Enterprise Information Services, which is the primary data processing and operations group; the Corporate Real Estate group, Marketing, SunTrust Online, Human Resources, Finance, CRM... -

Page 211

... not directly attributable to a specific segment are allocated based on various drivers (e.g., number of full-time equivalent employees and volume of loans and deposits). The recoveries for these allocations are in Corporate Other and Treasury. Sales and Referral Credits - Segments may compensate... -

Page 212

Notes to Consolidated Financial Statements (Continued) Year ended December 31, 2010 Retail Banking $39,204 75,574 - $2,500 - 2,500 992 1,508 1,129 2,526 111 38 73 - $73 Diversified Commercial Banking $24,862 20,815 - $552 105 657 127 530 235 448 317 114 203 - $203 CRE $10,743 1,662 - $162 - 162 442 ... -

Page 213

...The components of AOCI at December 31 were as follows: (Dollars in millions) Unrealized net gain on AFS securities Unrealized net gain on derivative financial instruments Employee benefit plans Total AOCI 2011 $1,863 569 (683) $1,749 2010 $1,526 532 (442) $1,616 2009 $1,160 412 (502) $1,070 197 -

Page 214

.../(Loss) - Parent Company Only Year Ended December 31 (Dollars in millions) 2011 2010 2009 Income Dividends1 Interest on loans Trading income/(loss) Other income Total income Expense Interest on short-term borrowings Interest on long-term debt Employee compensation and benefits2 Service fees... -

Page 215

...deposits held at other banks Interest-bearing deposits held at SunTrust Bank Cash and cash equivalents Trading assets Securities available for sale Loans to subsidiaries Investment in capital stock of subsidiaries stated on the basis of the Company's equity in subsidiaries' capital accounts: Banking... -

Page 216

... from sales of trading securities Purchases of trading securities Net change in loans to subsidiaries Capital contributions to subsidiaries Sale of other assets Other, net Net cash provided by/(used in) investing activities Cash Flows from Financing Activities: Net increase in other short-term... -

Page 217

... million, pre-tax, or $81 million, after-tax, and has reflected this estimate in Potential Mortgage Servicing Settlement and Claims Expense within the financial results in these Consolidated Financial Statements and Notes to Consolidated Financial Statements as of, and for the year ended December 31... -

Page 218

... the Securities Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the rules and forms of the SEC, and that such information is accumulated and communicated to the Company's management, including its Chief Executive Officer and Chief Financial Officer... -

Page 219

... of SunTrust Banks, Inc. included in this report: Consolidated Statements of Income/(Loss) for the year ended December 31, 2011, 2010, and 2009; Consolidated Balance Sheets as of December 31, 2011, and 2010; Consolidated Statements of Shareholders' Equity as of December 31, 2011, 2010, and 2009; and... -

Page 220

... September 23, 2011. Form of Series A Preferred Stock Certificate, incorporated by reference to Exhibit 4.2 to Registrant's Current Report on Form 8-K filed September 12, 2006. SunTrust Banks, Inc. Annual Incentive Plan (formerly Management Incentive Plan), amended and restated as of January 1, 2012... -

Page 221

... 1 Capital Performance-Vested Restricted Stock Unit Award Agreement; (xi) Form of (2010) Salary Share Stock Unit Award Agreement; (xii) Form of (2011) SunTrust Banks, Inc. Salary Share Stock Unit Agreement; (xiii) Form of Non-Employee Director Restricted Stock Award Agreement; and (xiv) Form of Non... -

Page 222

...'s Annual Report on Form 10-K filed February 23, 2010. Form of Change in Control Agreement. SunTrust Banks, Inc. Deferred Compensation Plan, amended and restated effective as of May 31, 2011, incorporated by reference to Exhibit 10.10 to the Registrant's Quarterly Report on Form 10Q filed August... -

Page 223

... the Board of Governors of the Federal Reserve System, SunTrust Banks, Inc.; SunTrust Bank; and SunTrust Mortgage, Inc., incorporated by reference to Exhibit 10.11 to the Registrant's Quarterly Report on Form 10-Q filed August 9, 2011. Form of Co-investment Restricted Stock Unit Award Agreement with... -

Page 224

... has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. SUNTRUST BANKS, INC. Dated: February 24, 2012 By: /s/ William H. Rogers, Jr. William H. Rogers, Jr., Chairman and Chief Executive Officer POWER OF ATTORNEY KNOW ALL PERSONS BY THESE PRESENTS, that... -

Page 225

.../2012 Date Title Chairman of the Board (Director) and Chief Executive Officer Corporate Executive Vice President and Chief Financial Officer Senior Vice President and Director of Corporate Finance & Controller Director Director Director Director Director Director Director Director Director Director... -

Page 226

... GA-ATL-634 Atlanta, GA 30302-4418 800.324.8093 [email protected] credit ratings Ratings as of December 31, 2011. Moody's Standard Investors & Poor's corporate ratings Long Term Ratings Senior Debt Subordinated Debt Series A Preferred Stock Short Term Commercial Paper bank ratings Long... -

Page 227

suntrust.com SUNTRUST BANKS, INC. 303 PEACHTREE STREET ATLANTA, GEORGIA 30308