PNC Bank 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

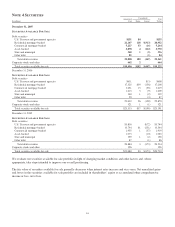

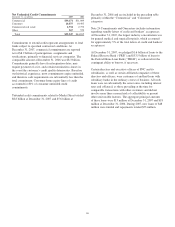

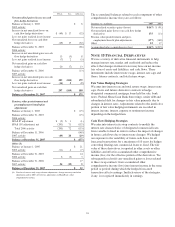

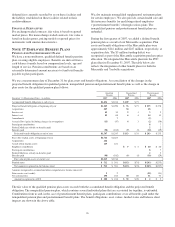

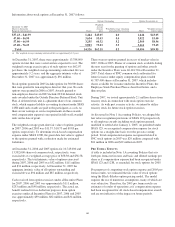

Pretax Tax After-tax

Net unrealized gains (losses) on cash

flow hedge derivatives

Balance at January 1, 2005 $ 6

2005 activity

Increase in net unrealized losses on

cash flow hedge derivatives $ (49) $ 17 (32)

Less: net gains realized in net income

Net unrealized losses on cash flow

hedge derivatives (49) 17 (32)

Balance at December 31, 2005 (26)

2006 activity

Increase in net unrealized gains on cash

flow hedge derivatives 13 (5) 8

Less: net gains realized in net income (7) 2 (5)

Net unrealized gains on cash flow

hedge derivatives 20 (7) 13

Balance at December 31, 2006 (13)

2007 activity

Increase in net unrealized gains on cash

flow hedge derivatives 283 (104) 179

Less: net gains realized in net income (14) 5 (9)

Net unrealized gains on cash flow

hedge derivatives 297 (109) 188

Balance at December 31, 2007 $ 175

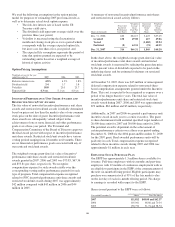

Pension, other postretirement and

postemployment benefit plan

adjustments

Balance at January 1, 2005 $ (15)

Balance at December 31, 2005 (15)

2006 activity

SFAS 87 adjustment $ (2) $ 1 (1)

SFAS 158 adjustment, net (203) 71 (132)

Total 2006 activity (205) 72 (133)

Balance at December 31, 2006 (148)

2007 activity (49) 20 (29)

Balance at December 31, 2007 $ (177)

Other (b)

Balance at January 1, 2005 $ 21

2005 activity (11) 4 (7)

Balance at December 31, 2005 14

2006 activity 6 (3) 3

Balance at December 31, 2006 17

2007 activity 24 (19) 5

Balance at December 31, 2007 $ 22

(b) Consists of interest-only strip valuation adjustments, foreign currency translation

adjustments and in 2007, deferred tax adjustments on BlackRock’s other

comprehensive income.

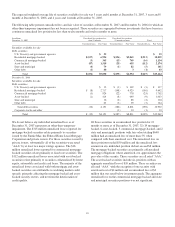

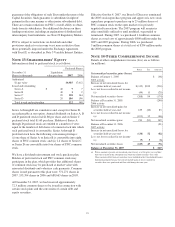

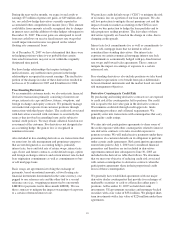

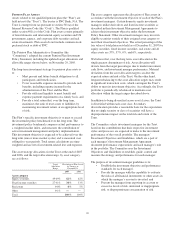

The accumulated balances related to each component of other

comprehensive income (loss) are as follows:

December 31 – in millions 2007 2006

Net unrealized securities gains (losses) $(167) $ (91)

Net unrealized gains (losses) on cash flow hedge

derivatives 175 (13)

Pension, other postretirement and post-

employment benefit plan adjustments (177) (148)

Other 22 17

Accumulated other comprehensive (loss) $(147) $(235)

N

OTE

15 F

INANCIAL

D

ERIVATIVES

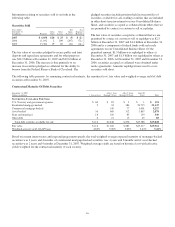

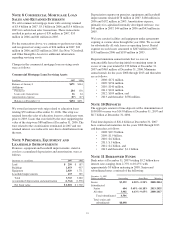

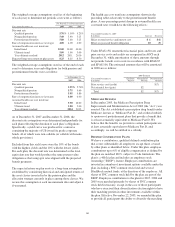

We use a variety of derivative financial instruments to help

manage interest rate, market and credit risk and reduce the

effects that changes in interest rates may have on net income,

fair value of assets and liabilities, and cash flows. These

instruments include interest rate swaps, interest rate caps and

floors, futures contracts, and total return swaps.

Fair Value Hedging Strategies

We enter into interest rate and total return swaps, interest rate

caps, floors and futures derivative contracts to hedge

designated commercial mortgage loans held for sale, bank

notes, Federal Home Loan Bank borrowings, senior debt and

subordinated debt for changes in fair value primarily due to

changes in interest rates. Adjustments related to the ineffective

portion of fair value hedging instruments are recorded in

interest income, interest expense or noninterest income

depending on the hedged item.

Cash Flow Hedging Strategies

We enter into interest rate swap contracts to modify the

interest rate characteristics of designated commercial loans

from variable to fixed in order to reduce the impact of changes

in future cash flows due to interest rate changes. We hedged

our exposure to the variability of future cash flows for all

forecasted transactions for a maximum of 10 years for hedges

converting floating-rate commercial loans to fixed. The fair

value of these derivatives is reported in other assets or other

liabilities and offset in accumulated other comprehensive

income (loss) for the effective portion of the derivatives. We

subsequently reclassify any unrealized gains or losses related

to these swap contracts from accumulated other

comprehensive income (loss) into interest income in the same

period or periods during which the hedged forecasted

transaction affects earnings. Ineffectiveness of the strategies,

if any, is recognized immediately in earnings.

94