PNC Bank 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.B

LACK

R

OCK

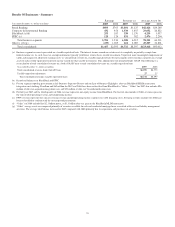

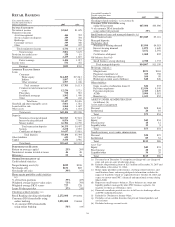

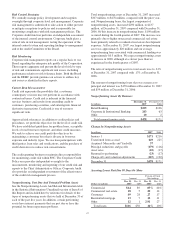

Our BlackRock business segment earned $253 million in 2007

and $187 million in 2006. Subsequent to the September 29,

2006 deconsolidation of BlackRock, these business segment

earnings are determined by taking our proportionate share of

BlackRock’s earnings and subtracting our additional income

taxes recorded on our share of BlackRock’s earnings. Also,

for this business segment presentation, after-tax BlackRock/

MLIM transaction integration costs totaling $3 million and

$65 million in 2007 and 2006, respectively, have been

reclassified from BlackRock to “Other.” In addition, the 2006

business segment earnings have been reduced by minority

interest in income of BlackRock, excluding MLIM transaction

integration costs, totaling $65 million and additional income

taxes recorded on our share of BlackRock’s earnings totaling

$7 million.

PNC’s investment in BlackRock was $4.1 billion at

December 31, 2007 and $3.9 billion at December 31, 2006.

Based upon BlackRock’s closing market price of $216.80 per

common share at December 31, 2007, the market value of our

investment in BlackRock was $9.4 billion at that date. As

such, an additional $5.3 billion of pretax value was not

recognized in our equity investment account at that date.

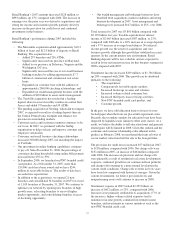

On October 1, 2007, BlackRock acquired the fund of funds

business of Quellos Group, LLC (“Quellos”). The combined

fund of funds platform operates under the name BlackRock

Alternative Advisors and is comprised one of the largest fund

of funds platforms in the world, with over $25 billion in assets

under management. In connection with the acquisition,

BlackRock paid $562 million in cash to Quellos and placed

1.2 million shares of BlackRock common stock into an escrow

account. The shares of BlackRock common stock will be held

in the escrow account for up to three years and will be

available to satisfy certain indemnification obligations of

Quellos under the acquisition agreement.

Therefore, any gain to be recognized by PNC resulting from

the issuance of these shares and corresponding increase in

PNC’s investment in BlackRock will be deferred pending the

release of shares from the escrow account. In addition,

Quellos may receive up to an additional $969 million in cash

and BlackRock common stock through December 31, 2010

contingent on certain measures.

B

LACK

R

OCK

/MLIM T

RANSACTION

On September 29, 2006 Merrill Lynch contributed its

investment management business (“MLIM”) to BlackRock in

exchange for 65 million shares of newly issued BlackRock

common and preferred stock. BlackRock accounted for the

MLIM transaction under the purchase method of accounting.

Further information regarding this transaction is included in

Note 2 Acquisitions and Divestitures included in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

B

LACK

R

OCK

LTIP P

ROGRAMS

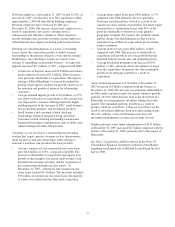

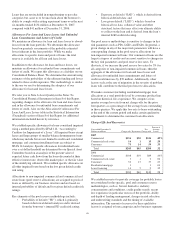

BlackRock adopted the 2002 LTIP program to help attract and

retain qualified professionals. At that time, PNC agreed to

transfer up to four million of the shares of BlackRock

common stock then held by us to help fund the 2002 LTIP and

future programs approved by BlackRock’s board of directors,

subject to certain conditions and limitations. Prior to 2006,

BlackRock granted awards of approximately $233 million

under the 2002 LTIP program, of which approximately $208

million were paid on January 30, 2007. The award payments

were funded by 17% in cash from BlackRock and one million

shares of BlackRock common stock transferred by PNC and

distributed to LTIP participants. We recognized a pretax gain

of $82 million in the first quarter of 2007 from the transfer of

BlackRock shares. The gain was included in noninterest

income and reflected the excess of market value over book

value of the one million shares transferred in January 2007.

PNC’s noninterest income in 2007 also included a $209

million pretax charge related to our commitment to fund

additional BlackRock LTIP programs. This charge represents

the mark-to-market adjustment related to our remaining

BlackRock LTIP shares obligation as of December 31, 2007

and resulted from the increase in the market value of

BlackRock common shares during 2007. We recognized a

similar charge for $12 million in 2006.

BlackRock granted additional restricted stock unit awards in

January 2007, all of which are subject to achieving earnings

performance goals prior to the vesting date of September 29,

2011. Of the shares of BlackRock common stock that we have

agreed to transfer to fund their LTIP programs, approximately

1.6 million shares have been committed to fund the restricted

stock unit awards vesting in 2011 and the amount remaining

would then be available for future awards.

We may continue to see volatility in earnings as we mark to

market our LTIP shares obligation each quarter-end. However,

additional gains based on the difference between the market

value and the book value of the committed BlackRock

common shares will generally not be recognized until the

shares are distributed to LTIP participants.

41