PNC Bank 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

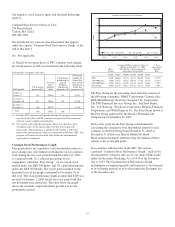

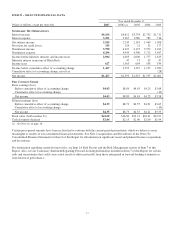

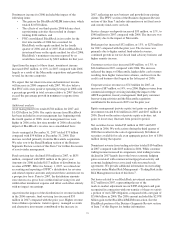

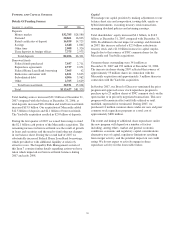

At or for the year ended December 31

Dollars in millions, except as noted 2007 2006 (a) 2005 2004 2003

B

ALANCE

S

HEET

H

IGHLIGHTS

Assets $138,920 $101,820 $91,954 $79,723 $68,168

Loans, net of unearned income 68,319 50,105 49,101 43,495 36,303

Allowance for loan and lease losses 830 560 596 607 632

Securities 30,225 23,191 20,710 16,761 15,690

Loans held for sale 3,927 2,366 2,449 1,670 1,400

Equity investments (b) 6,045 5,330 1,323 1,058 997

Deposits 82,696 66,301 60,275 53,269 45,241

Borrowed funds (c) 30,931 15,028 16,897 11,964 11,453

Shareholders’ equity 14,854 10,788 8,563 7,473 6,645

Common shareholders’ equity 14,847 10,781 8,555 7,465 6,636

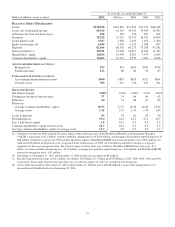

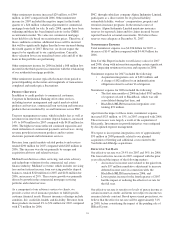

A

SSETS

A

DMINISTERED

(in billions)

Managed (d) $73 $54 $494 $383 $354

Nondiscretionary 113 86 84 93 87

F

UND ASSETS SERVICED

(in billions)

Accounting/administration net assets $990 $837 $835 $721 $654

Custody assets 500 427 476 451 401

S

ELECTED

R

ATIOS

Net interest margin 3.00% 2.92% 3.00% 3.22% 3.64%

Noninterest income to total revenue 57 74 66 64 62

Efficiency 64 52 68 67 66

Return on

Average common shareholders’ equity 10.53 27.97 16.58 16.82 15.06

Average assets 1.19 2.73 1.50 1.59 1.49

Loans to deposits 83 76 81 82 80

Dividend payout 55.0 24.4 43.4 47.2 54.5

Tier 1 risk-based capital 6.8 10.4 8.3 9.0 9.5

Common shareholders’ equity to total assets 10.7 10.6 9.3 9.4 9.7

Average common shareholders’ equity to average assets 11.3 9.8 9.0 9.4 9.9

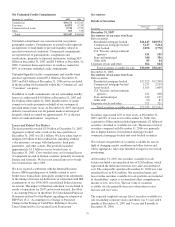

(a) Noninterest income for 2006 included the pretax impact of the following: gain on the BlackRock/Merrill Lynch Investment Managers

(“MLIM”) transaction of $2.1 billion; securities portfolio rebalancing loss of $196 million; and mortgage loan portfolio repositioning loss of

$48 million. Noninterest expense for 2006 included the pretax impact of BlackRock/MLIM transaction integration costs of $91 million. An

additional $10 million of integration costs, recognized in the fourth quarter of 2006, were included in noninterest income as a negative

component of the asset management line. The after-tax impact of these items was as follows: BlackRock/MLIM transaction gain - $1.3

billion; securities portfolio rebalancing loss - $127 million; mortgage loan portfolio repositioning loss - $31 million; and BlackRock/MLIM

transaction integration costs - $47 million.

(b) The balances at December 31, 2007 and December 31, 2006 include our investment in BlackRock.

(c) Includes long-term borrowings of $12.6 billion, $6.6 billion, $6.8 billion, $5.7 billion and $5.8 billion for 2007, 2006, 2005, 2004 and 2003,

respectively. Borrowings which mature more than one year after December 31, 2007 are considered to be long-term.

(d) Assets under management at December 31, 2007 and December 31, 2006 do not include BlackRock’s assets under management as we

deconsolidated BlackRock effective September 29, 2006.

18