PNC Bank 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

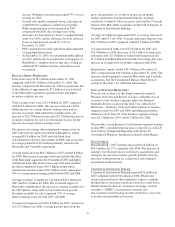

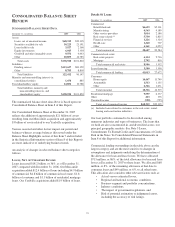

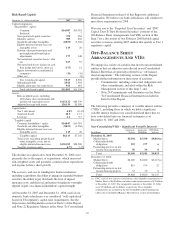

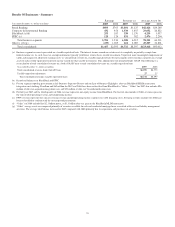

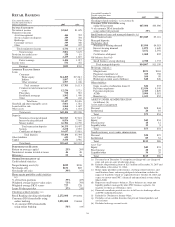

Risk-Based Capital

December 31 - dollars in millions 2007 2006

Capital components

Shareholders’ equity

Common $14,847 $10,781

Preferred 77

Trust preferred capital securities 572 965

Minority interest 985 494

Goodwill and other intangibles (8,853) (3,566)

Eligible deferred income taxes on

intangible assets 119 26

Pension, other postretirement and

postemployment benefit plan

adjustments 177 148

Net unrealized securities losses, after

tax 167 91

Net unrealized losses (gains) on cash

flow hedge derivatives, after tax (175) 13

Equity investments in nonfinancial

companies (31) (30)

Other, net (5)

Tier 1 risk-based capital 7,815 8,924

Subordinated debt 3,024 1,954

Eligible allowance for credit losses 964 681

Total risk-based capital $11,803 $11,559

Assets

Risk-weighted assets, including

off-balance sheet instruments and

market risk equivalent assets $115,132 $85,539

Adjusted average total assets 126,139 95,590

Capital ratios

Tier 1 risk-based 6.8% 10.4%

Total risk-based 10.3 13.5

Leverage 6.2 9.3

Tangible capital

Common shareholders’ equity $14,847 $10,781

Goodwill and other intangibles (8,853) (3,566)

Eligible deferred income taxes on

intangible assets 119 26

Tangible capital $6,113 $7,241

Total assets excluding goodwill and

other intangible assets, net of

eligible deferred income taxes $130,185 $98,280

Tangible common equity 4.7% 7.4%

The declines in capital ratios from December 31, 2006 were

primarily due to the impact of acquisitions, which increased

risk-weighted assets and goodwill, common share repurchases

and organic balance sheet growth.

The access to, and cost of, funding new business initiatives

including acquisitions, the ability to engage in expanded business

activities, the ability to pay dividends, the level of deposit

insurance costs, and the level and nature of regulatory oversight

depend, in part, on a financial institution's capital strength.

At December 31, 2007 and December 31, 2006, each of our

domestic bank subsidiaries was considered “well capitalized”

based on US regulatory capital ratio requirements. See the

Supervision And Regulation section of Item 1 of this Report

and Note 22 Regulatory Matters in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information. We believe our bank subsidiaries will continue to

meet these requirements in 2008.

We refer you to the “Perpetual Trust Securities” and “PNC

Capital Trust E Trust Preferred Securities” portions of the

Off-Balance Sheet Arrangements And VIEs section of this

Item 7 for a discussion of two February 2008 hybrid capital

securities issuances totaling $825 million that qualify as Tier 1

regulatory capital.

O

FF

-B

ALANCE

S

HEET

A

RRANGEMENTS

A

ND

VIE

S

We engage in a variety of activities that involve unconsolidated

entities or that are otherwise not reflected in our Consolidated

Balance Sheet that are generally referred to as “off-balance

sheet arrangements.” The following sections of this Report

provide further information on these types of activities:

• Commitments, including contractual obligations and

other commitments, included within the Risk

Management section of this Item 7, and

• Note 24 Commitments and Guarantees in the Notes

To Consolidated Financial Statements included in

Item 8 of this Report.

The following provides a summary of variable interest entities

(“VIEs”), including those in which we hold a significant

variable interest but have not consolidated and those that we

have consolidated into our financial statements as of

December 31, 2007 and 2006.

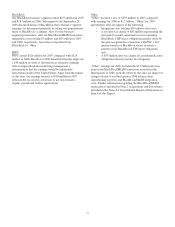

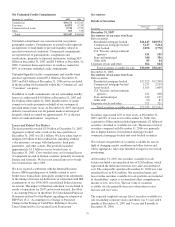

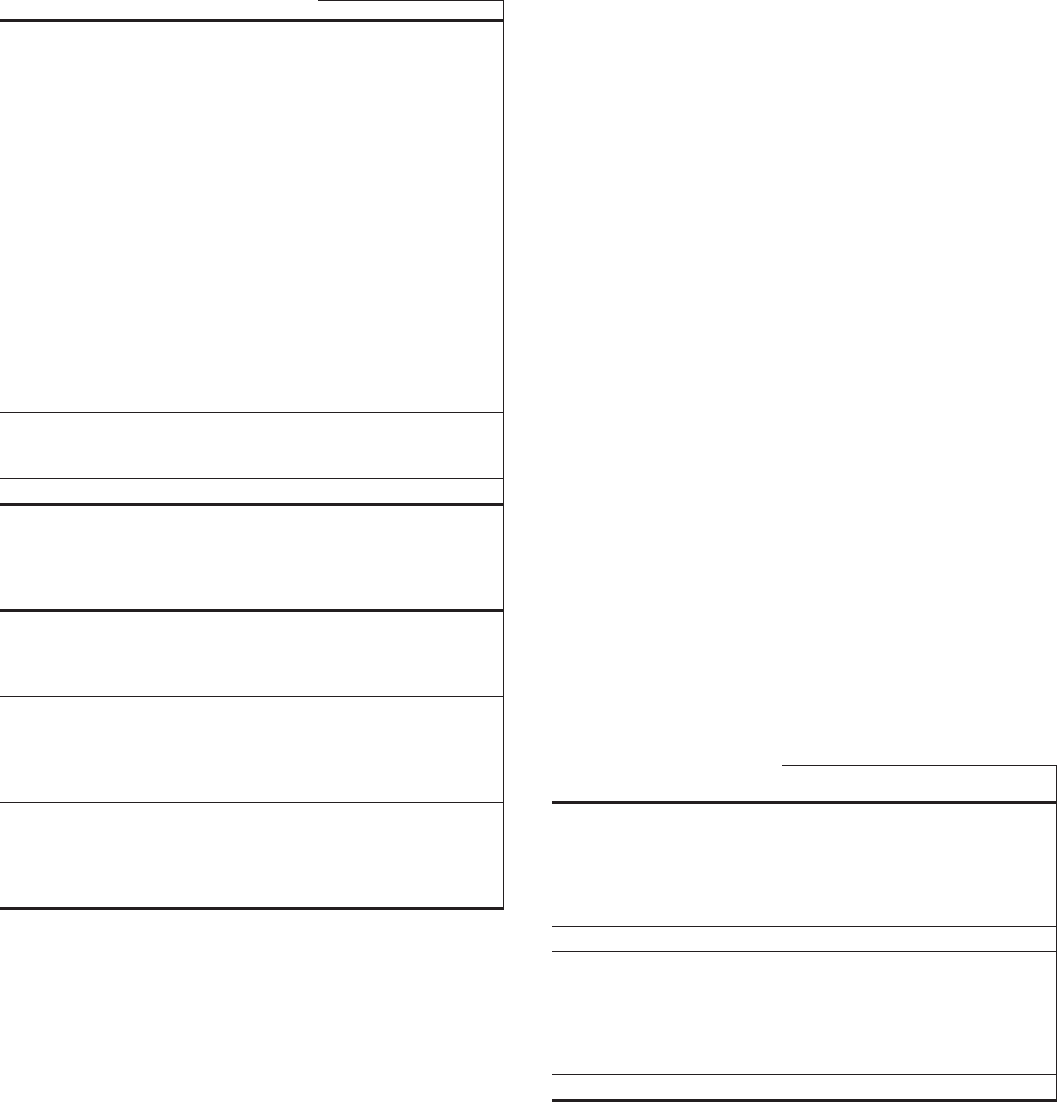

Non-Consolidated VIEs – Significant Variable Interests

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC Risk

of Loss

December 31, 2007

Market Street $5,304 $5,330 $9,019(a)

Collateralized debt

obligations 255 177 6

Partnership interests in low

income housing projects 50 34 8

Total $5,609 $5,541 $9,033

December 31, 2006

Market Street $4,020 $4,020 $6,117(a)

Collateralized debt

obligations 815 570 22

Partnership interests in low

income housing projects 33 30 8

Total $4,868 $4,620 $6,147

(a) PNC’s risk of loss consists of off-balance sheet liquidity commitments to

Market Street of $8.8 billion and other credit enhancements of $.2 billion

at December 31, 2007. The comparable amounts at December 31, 2006

were $5.6 billion and $.6 billion, respectively. These liquidity

commitments are included in the Net Unfunded Credit Commitments

table in the Consolidated Balance Sheet Review section of this Report.

29