PNC Bank 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

R

ECENT

A

CCOUNTING

P

RONOUNCEMENTS

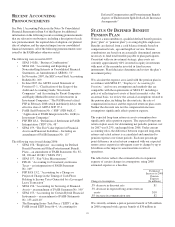

See Note 1 Accounting Policies in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information on the following recent accounting pronouncements

that are relevant to our business, including a description of each

new pronouncement, the required date of adoption, our planned

date of adoption, and the expected impact on our consolidated

financial statements. All of the following pronouncements were

issued by the FASB unless otherwise noted.

The following were issued in 2007:

• SFAS 141(R), “Business Combinations”

• SFAS 160, “Accounting and Reporting of

Noncontrolling Interests in Consolidated Financial

Statements, an Amendment of ARB No. 51”

• In November 2007, the SEC issued Staff Accounting

Bulletin No. 109,

• In June 2007, the AICPA issued Statement of

Position 07-1, “Clarification of the Scope of the

Audit and Accounting Guide “Investment

Companies” and Accounting by Parent Companies

and Equity Method Investors for Investments in

Investment Companies.” The FASB issued a final

FSP in February 2008 which indefinitely delays the

effective date of AICPA SOP 07-1.

• FASB Staff Position No. (“FSP”) FIN 46(R) 7,

“Application of FASB Interpretation No. 46(R) to

Investment Companies”

• FSP FIN 48-1, “Definition of Settlement in FASB

Interpretation (“FIN”) No. 48”

• SFAS 159, “The Fair Value Option for Financial

Assets and Financial Liabilities – Including an

amendment of FASB Statement No. 115”

The following were issued during 2006:

• SFAS 158, “Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Benefit

Plans – an amendment of FASB Statements No. 87,

88, 106 and 132(R)”(“SFAS 158”)

• SFAS 157, “Fair Value Measurements”

• FIN 48, “Accounting for Uncertainty in Income

Taxes – an interpretation of FASB Statement

No. 109”

• FSP FAS 13-2, “Accounting for a Change or

Projected Change in the Timing of Cash Flows

Relating to Income Taxes Generated by a Leveraged

Lease Transaction”

• SFAS 156, “Accounting for Servicing of Financial

Assets – an amendment of FASB Statement No. 140”

• SFAS 155, “Accounting for Certain Hybrid Financial

Instruments – an amendment of FASB Statements

No. 133 and 140”

• The Emerging Issues Task Force (“EITF”) of the

FASB issued EITF Issue 06-4, “Accounting for

Deferred Compensation and Postretirement Benefit

Aspects of Endorsement Split-Dollar Life Insurance

Arrangements”

S

TATUS

O

F

D

EFINED

B

ENEFIT

P

ENSION

P

LAN

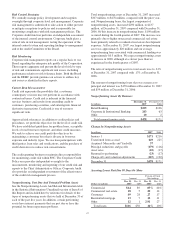

We have a noncontributory, qualified defined benefit pension

plan (“plan” or “pension plan”) covering eligible employees.

Benefits are derived from a cash balance formula based on

compensation levels, age and length of service. Pension

contributions are based on an actuarially determined amount

necessary to fund total benefits payable to plan participants.

Consistent with our investment strategy, plan assets are

currently approximately 60% invested in equity investments

with most of the remainder invested in fixed income

instruments. Plan fiduciaries determine and review the plan’s

investment policy.

We calculate the expense associated with the pension plan in

accordance with SFAS 87, “Employers’ Accounting for

Pensions,” and we use assumptions and methods that are

compatible with the requirements of SFAS 87, including a

policy of reflecting trust assets at their fair market value. On

an annual basis, we review the actuarial assumptions related to

the pension plan, including the discount rate, the rate of

compensation increase and the expected return on plan assets.

Neither the discount rate nor the compensation increase

assumptions significantly affects pension expense.

The expected long-term return on assets assumption does

significantly affect pension expense. The expected long-term

return on plan assets for determining net periodic pension cost

for 2007 was 8.25%, unchanged from 2006. Under current

accounting rules, the difference between expected long-term

returns and actual returns is accumulated and amortized to

pension expense over future periods. Each one percentage

point difference in actual return compared with our expected

return causes expense in subsequent years to change by up to

$4 million as the impact is amortized into results of

operations.

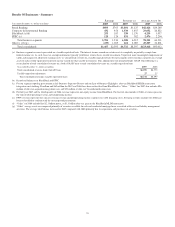

The table below reflects the estimated effects on pension

expense of certain changes in assumptions, using 2008

estimated expense as a baseline.

Change in Assumption

Estimated

Increase to 2008

Pension

Expense

(In millions)

.5% decrease in discount rate $1

.5% decrease in expected long-term return on

assets $10

.5% increase in compensation rate $2

We currently estimate a pretax pension benefit of $26 million

in 2008 compared with a pretax benefit of $30 million in

45