PNC Bank 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

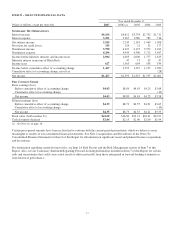

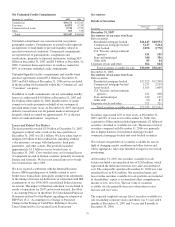

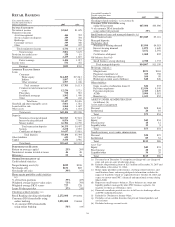

Net Unfunded Credit Commitments

December 31 - in millions 2007 2006

Commercial $39,171 $32,265

Consumer 10,875 9,239

Commercial real estate 2,734 2,752

Other 567 579

Total $53,347 $44,835

Unfunded commitments are concentrated in our primary

geographic markets. Commitments to extend credit represent

arrangements to lend funds or provide liquidity subject to

specified contractual conditions. Commercial commitments

are reported net of participations, assignments and

syndications, primarily to financial institutions, totaling $8.9

billion at December 31, 2007 and $8.3 billion at December 31,

2006. Consumer home equity lines of credit accounted for

80% of consumer unfunded credit commitments.

Unfunded liquidity facility commitments and standby bond

purchase agreements totaled $9.4 billion at December 31,

2007 and $6.0 billion at December 31, 2006 and are included

in the preceding table primarily within the “Commercial” and

“Consumer” categories.

In addition to credit commitments, our net outstanding standby

letters of credit totaled $4.8 billion at December 31, 2007 and

$4.4 billion at December 31, 2006. Standby letters of credit

commit us to make payments on behalf of our customers if

specified future events occur. At December 31, 2007, the largest

industry concentration was for general medical and surgical

hospitals, which accounted for approximately 5% of the total

letters of credit and bankers’ acceptances.

Leases and Related Tax Matters

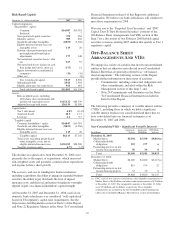

The lease portfolio totaled $3.5 billion at December 31, 2007.

Aggregate residual value at risk on the lease portfolio at

December 31, 2007 was $1.1 billion. We have taken steps to

mitigate $.6 billion of this residual risk, including residual

value insurance coverage with third parties, third party

guarantees, and other actions. The portfolio included

approximately $1.7 billion of cross-border leases at

December 31, 2007. Cross-border leases are leveraged leases

of equipment located in foreign countries, primarily in western

Europe and Australia. We have not entered into cross-border

lease transactions since 2003.

We have reached a settlement with the Internal Revenue

Service (IRS) regarding our tax liability related to cross-

border lease transactions, principally arising from adjustments

to the timing of income tax deductions in connection with IRS

examinations of our 1998-2003 consolidated Federal income

tax returns. The impact of the final settlement was included in

results of operations for 2007 and was not material. See Note

1 Accounting Policies in the Notes To Consolidated Financial

Statements in Item 8 of this Report regarding our adoption of

FSP FAS 13-2, “Accounting for a Change or Projected

Change in the Timing of Cash Flows Relating to Income

Taxes Generated by a Leveraged Lease Transaction.”

S

ECURITIES

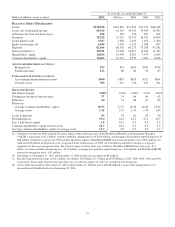

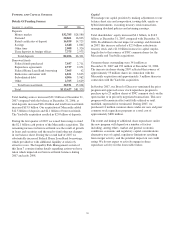

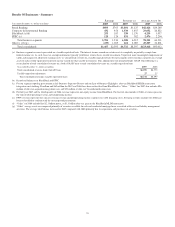

Details of Securities

In millions

Amortized

Cost

Fair

Value

December 31, 2007

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

Residential mortgage-backed $21,147 $20,952

Commercial mortgage-backed 5,227 5,264

Asset-backed 2,878 2,770

U.S. Treasury and government

agencies 151 155

State and municipal 340 336

Other debt 85 84

Corporate stocks and other 662 664

Total securities available for sale $30,490 $30,225

December 31, 2006

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

Residential mortgage-backed $17,325 $17,208

Commercial mortgage-backed 3,231 3,219

Asset-backed 1,615 1,609

U.S. Treasury and government

agencies 611 608

State and municipal 140 139

Other debt 90 87

Corporate stocks and other 321 321

Total securities available for sale $23,333 $23,191

Securities represented 22% of total assets at December 31,

2007 and 23% of total assets at December 31, 2006. Our

acquisition of Mercantile included approximately $2 billion of

securities classified as available for sale. The increase in total

securities compared with December 31, 2006 was primarily

due to higher balances in residential mortgage-backed,

commercial mortgage-backed and asset-backed securities.

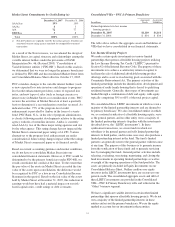

We evaluate our portfolio of securities available for sale in

light of changing market conditions and other factors and,

where appropriate, take steps intended to improve our overall

positioning.

At December 31, 2007, the securities available for sale

balance included a net unrealized loss of $265 million, which

represented the difference between fair value and amortized

cost. The comparable amount at December 31, 2006 was a net

unrealized loss of $142 million. Net unrealized gains and

losses in the securities available for sale portfolio are included

in shareholders’ equity as accumulated other comprehensive

income or loss, net of tax. The fair value of securities

available for sale generally decreases when interest rates

increase and vice versa.

The expected weighted-average life of securities available for

sale (excluding corporate stocks and other) was 3 years and 6

months at December 31, 2007 and 3 years and 8 months at

December 31, 2006.

26