PNC Bank 2007 Annual Report Download - page 64

Download and view the complete annual report

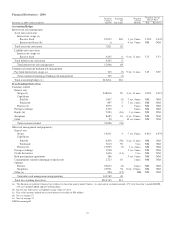

Please find page 64 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expansion of the branch network, including our expansion into

the greater Washington, DC area that began in May 2005, and

various pricing actions resulting from the One PNC initiative

all contributed to the increase in 2006.

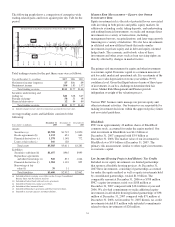

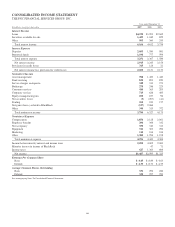

Brokerage fees increased $21 million, to $246 million, for

2006 compared with the prior year. The increase was

primarily due to higher annuity income and mutual fund-

related revenues, including favorable production from the

fee-based fund advisory business.

Consumer services fees increased $72 million, to $365

million, in 2006 compared with 2005. Higher fees reflected

the impact of consolidating our merchant services activities in

the fourth quarter of 2005 as a result of our increased

ownership interest in the merchant services business. The

increase was also due to higher debit card revenues resulting

from higher transaction volumes, our expansion into the

greater Washington, DC area, and pricing actions related to

the One PNC initiative. These factors were partially offset by

lower ATM surcharge revenue in 2006 resulting from

changing customer behavior and a strategic decision to reduce

the out-of-footprint ATM network.

Corporate services revenue was $626 million for 2006,

compared with $485 million in 2005. The increase in

corporate services revenue compared with the prior year was

primarily due to the full year benefit in 2006 of our October

2005 acquisition of Harris Williams.

Equity management (private equity) net gains on portfolio

investments totaled $107 million in 2006 and $96 million for

2005. Based on the nature of private equity activities, net

gains or losses may be volatile from period to period.

Net securities losses totaled $207 million in 2006 and $41

million in 2005. We took actions during the third quarter of

2006 that resulted in the sale of approximately $6 billion of

securities available for sale at an aggregate pretax loss of $196

million during that quarter.

Noninterest revenue from trading activities, which is primarily

customer-related, totaled $183 million in 2006 compared with

$157 million for 2005. We provide additional information on

our trading activities under Market Risk Management –

Trading Risk in the Risk Management section of this Item 7.

Net gains related to our BlackRock investment were $2.066

billion in 2006, comprised of the $2.078 billion gain on the

BlackRock/MLIM transaction partially offset by a fourth

quarter mark-to-market adjustment of $12 million on our

BlackRock LTIP obligation. See the BlackRock portion of the

Business Segments Review section of this Item 7 for further

information.

Other noninterest income decreased $57 million, to $315

million, in 2006 compared with 2005. Other noninterest

income for 2006 included the impact of a $48 million pretax

loss incurred in the third quarter of 2006 in connection with

the rebalancing of our residential mortgage portfolio.

Noninterest Expense

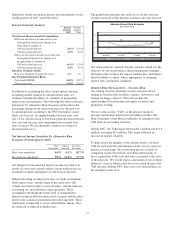

Total noninterest expense was $4.443 billion for 2006, an

increase of $137 million compared with 2005. Item 6 of this

Report includes our efficiency ratios for 2006 and 2005 and

information regarding certain significant items impacting

noninterest income and expense in 2006.

Noninterest expense for 2006 included the following:

• Our share of integration costs related to the

BlackRock/MLIM transaction totaling $91 million,

which were almost entirely offset by a decrease in

other BlackRock expenses of $87 million due to our

deconsolidation of BlackRock effective

September 29, 2006,

• An increase of $71 million of expenses related to

Harris Williams, which we acquired in October 2005,

• An increase of $60 million related to the

consolidation of our merchant services activities in

the fourth quarter of 2005, and

• An increase of $23 million in PFPC’s distribution/

out-of-pocket expenses, the increase of which was

entirely offset in noninterest income and which had

no impact on our earnings.

Apart from the impact of these items, noninterest expense for

2006 decreased $21 million compared with 2005 as the benefit

of the One PNC initiative more than offset the impact of our

expansion into the greater Washington, DC area and other

investments in the business.

E

FFECTIVE

T

AX

R

ATE

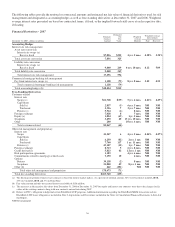

Our effective tax rate was 34% for 2006 and 30.2% for 2005.

The Consolidated Income Statement Review section of this

Item 7 outlines the factors that contributed to the 2006

effective tax rate. The effective tax rate for 2005 reflected the

benefit in that year of a reversal of deferred tax liabilities in

connection with the transfer of our ownership in BlackRock to

our intermediate bank holding company. This transaction

reduced our first quarter 2005 tax provision by $45 million, or

$.16 per diluted share.

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

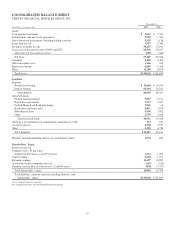

Loans

Loans increased $1.0 billion, or 2%, as of December 31, 2006

compared with December 31, 2005. Increases in total

commercial lending and consumer loans, driven by targeted

sales efforts across our banking businesses, more than offset

the decline in residential mortgage loans that resulted

primarily from our third quarter 2006 mortgage loan

repositioning.

Securities

Total securities at December 31, 2006 were $23.2 billion

compared with $20.7 billion at December 31, 2005. Securities

59