PNC Bank 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

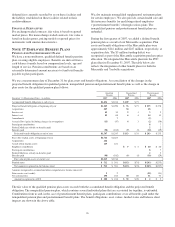

The guidelines also indicate which investments and strategies

the manager is permitted to use to achieve its performance

objectives, and which investments and strategies it is

prohibited from using.

Where public market investment strategies may include the

use of derivatives and/or currency management, language is

incorporated in the managers’ guidelines to define allowable

and prohibited transactions and/or strategies. Derivatives are

typically employed by investment managers to modify risk/

return characteristics of their portfolio(s), implement asset

allocation changes in a cost-effective manner, or reduce

transaction costs. Under the managers’ investment guidelines,

derivatives may not be used solely for speculation or leverage.

Derivatives are used only in circumstances where they offer

the most efficient economic means of improving the risk/

reward profile of the portfolio.

BlackRock, PFPC and our Retail Banking business segments

receive compensation for providing investment management,

trustee and custodial services for the majority of the Trust

portfolio. Compensation for such services is paid by PNC.

Non-affiliate service providers for the Trust are compensated

from plan assets.

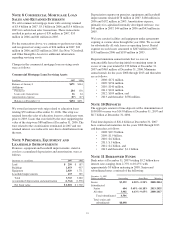

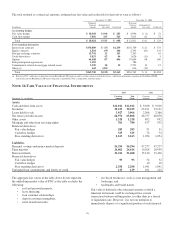

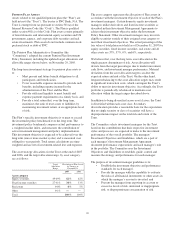

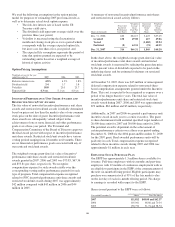

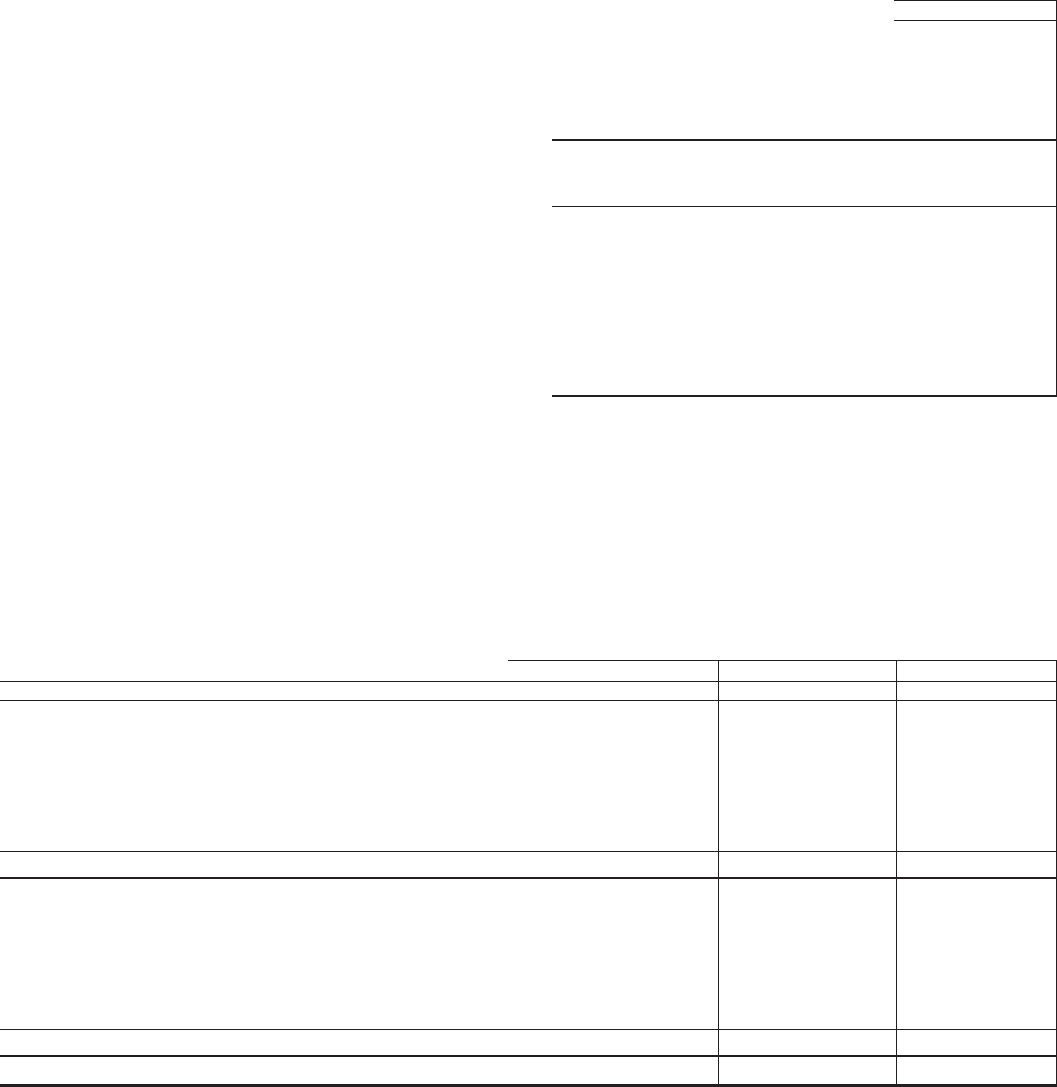

The following table provides information regarding our

estimated future cash flows related to our various plans:

Estimated Cash Flows

Postretirement Benefits

In millions

Qualified

Pension

Nonqualified

Pension

Gross

PNC

Benefit

Payments

Reduction

in PNC

Benefit

Payments

Due to

Medicare

Part D

Subsidy

Estimated 2008

employer

contributions — $12 $ 22 $2

Estimated future

benefit

payments

2008 $130 $12 $ 22 $2

2009 132 12 23 2

2010 130 13 23 2

2011 129 12 23 1

2012 122 11 22 1

2013 – 2017 579 48 107 6

The qualified pension plan contributions are deposited into the

Trust, and the qualified pension plan benefit payments are

paid from the Trust. For the other plans, total contributions

and the benefit payments are the same and represent expected

benefit amounts, which are paid from general assets.

Postretirement benefits are net of participant contributions.

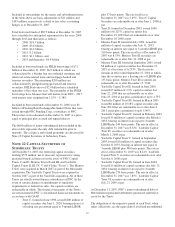

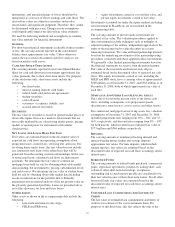

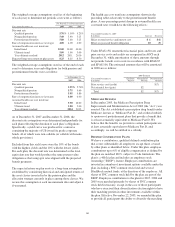

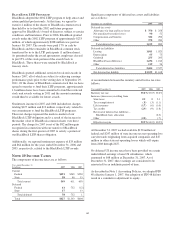

The components of net periodic benefit cost/(income) and other amounts recognized in other comprehensive income were as

follows:

Qualified Pension Plan Nonqualified Pension Plan Postretirement Benefits

Year ended December 31 – in millions 2007 2006 2005 2007 2006 2005 2007 2006 2005

Net periodic cost consists of:

Service cost $42 $34 $33 $2 $1 $1 $3 $2 $2

Interest cost 82 68 65 64414 13 14

Expected return on plan assets (156) (129) (128)

Amortization of prior service cost (1) (1) (7) (6) (7)

Amortization of actuarial losses (gains) 216 23 233 14

Net periodic cost $ (30) $ (12) $ (8) $10 $8 $8 $10 $10 $13

Other changes in plan assets and benefit obligations

recognized in other comprehensive income:

Current year prior service cost/(credit) $ (5)

Amortization of prior service (cost)/credit 7

Current year actuarial loss/(gain) $ 16 $ 4 (2)

Amortization of actuarial (loss)/gain (2) (2)

Total recognized in OCI 14 2

Total recognized in net periodic cost and OCI $ (16) $12 $10

100