PNC Bank 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.risk and criticality. Comprehensive testing validates our

resiliency capabilities on an ongoing basis, and an integrated

governance model is designed to help assure transparent

management reporting.

Insurance

As a component of our risk management practices, we

purchase insurance designed to protect us against accidental

loss or losses which, in the aggregate, may significantly affect

personnel, property, financial objectives, or our ability to

continue to meet our responsibilities to our various

stakeholder groups.

PNC, through a subsidiary company, Alpine Indemnity

Limited, participates as a direct writer for its general liability,

automobile liability, workers’ compensation, property and

terrorism programs. PNC’s risks associated with its

participation as a direct writer for these programs are

mitigated through policy limits and annual aggregate limits.

Risks in excess of Alpine policy limits and annual aggregates

are mitigated through the purchase of direct coverage

provided by various insurers up to limits established by PNC’s

Corporate Insurance Committee.

L

IQUIDITY

R

ISK

M

ANAGEMENT

Liquidity risk is the risk of potential loss if we were unable to

meet our funding requirements at a reasonable cost. We

manage liquidity risk to help ensure that we can obtain cost-

effective funding to meet current and future obligations under

both normal “business as usual” and stressful circumstances.

Our largest source of liquidity on a consolidated basis is the

deposit base that comes from our retail and corporate and

institutional banking activities. Other borrowed funds come

from a diverse mix of short and long-term funding sources.

Liquid assets and unused borrowing capacity from a number

of sources are also available to maintain our liquidity position.

Liquid assets consist of short-term investments (federal funds

sold, resale agreements and other short-term investments,

including trading securities) and securities available for sale.

At December 31, 2007, our liquid assets totaled $37.1 billion,

with $24.2 billion pledged as collateral for borrowings, trust,

and other commitments.

Bank Level Liquidity

PNC Bank, N.A. can borrow from the Federal Reserve Bank of

Cleveland’s discount window to meet short-term liquidity

requirements. These borrowings are secured by securities and

commercial loans. PNC Bank, N.A. is also a member of the

Federal Home Loan Bank (“FHLB”)-Pittsburgh and as such has

access to advances from FHLB-Pittsburgh secured generally by

residential mortgage loans. At December 31, 2007, we

maintained significant unused borrowing capacity from the

Federal Reserve Bank of Cleveland’s discount window and

FHLB-Pittsburgh under current collateral requirements.

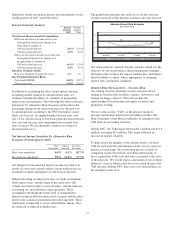

During the second half of 2007 we substantially increased

FHLB borrowings, which provided us with additional liquidity

at relatively attractive rates. Total FHLB borrowings were

$7.1 billion at December 31, 2007 compared with $42 million

at December 31, 2006.

We can also obtain funding through traditional forms of

borrowing, including federal funds purchased, repurchase

agreements, and short and long-term debt issuances. In July 2004,

PNC Bank, N.A. established a program to offer up to $20 billion

in senior and subordinated unsecured debt obligations with

maturities of more than nine months. Through December 31,

2007, PNC Bank, N.A. had issued $5.8 billion of debt under this

program, including the following 2007 issuances:

• In April 2007, $500 million of senior bank notes

were issued that mature on October 3, 2008. Interest

will be reset monthly to 1-month LIBOR minus 6

basis points and will be paid monthly.

• In May 2007, $1 billion of senior bank notes were

issued that mature June 17, 2008. Interest will be

reset monthly to 1-month LIBOR minus 5 basis

points and will be paid monthly.

• In June 2007, $1 billion of senior bank notes were

issued that mature on December 29, 2008. Interest

will be reset monthly to 1-month LIBOR minus 4

basis points and will be paid monthly.

• In December 2007, $350 million of subordinated

bank notes were issued that mature on December 7,

2017. These notes pay interest semiannually at a

fixed rate of 6.0%.

In January 2008, $50 million of senior bank notes were issued

that mature on January 25, 2011. Interest will be reset

quarterly to 3-month LIBOR plus 55 basis points and will be

paid quarterly.

In January 2008, $100 million of senior bank notes were

issued that mature on January 25, 2010. Interest will be reset

quarterly to 3-month LIBOR plus 45 basis points and will be

paid quarterly.

In February 2008, $175 million of senior bank notes were issued

that mature on February 1, 2010. Interest will be reset quarterly to

3-month LIBOR plus 45 basis points and will be paid quarterly.

In February 2008, $500 million of senior bank notes were

issued that mature on August 5, 2009. Interest will be reset

quarterly to 3-month LIBOR plus 40 basis points and will be

paid quarterly.

None of the 2007 or 2008 issuances described above are

redeemable by us or the holders prior to maturity.

We have the ability to issue additional trust preferred securities

out of our PNC Preferred Funding structure, subject to certain

contractual restrictions. In February 2008, PNC Preferred Funding

Trust III issued $375 million of 8.700% Fixed-to-Floating Rate

Non-Cumulative Exchangeable Perpetual Trust Securities. See

“Perpetual Trust Securities” in the Off-Balance Sheet

Arrangements And VIEs section of this Item 7.

50