PNC Bank 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

S

UMMARIZED

B

ALANCE

S

HEET

D

ATA

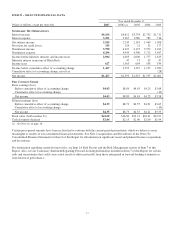

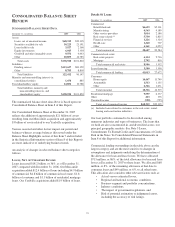

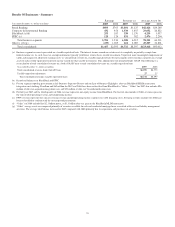

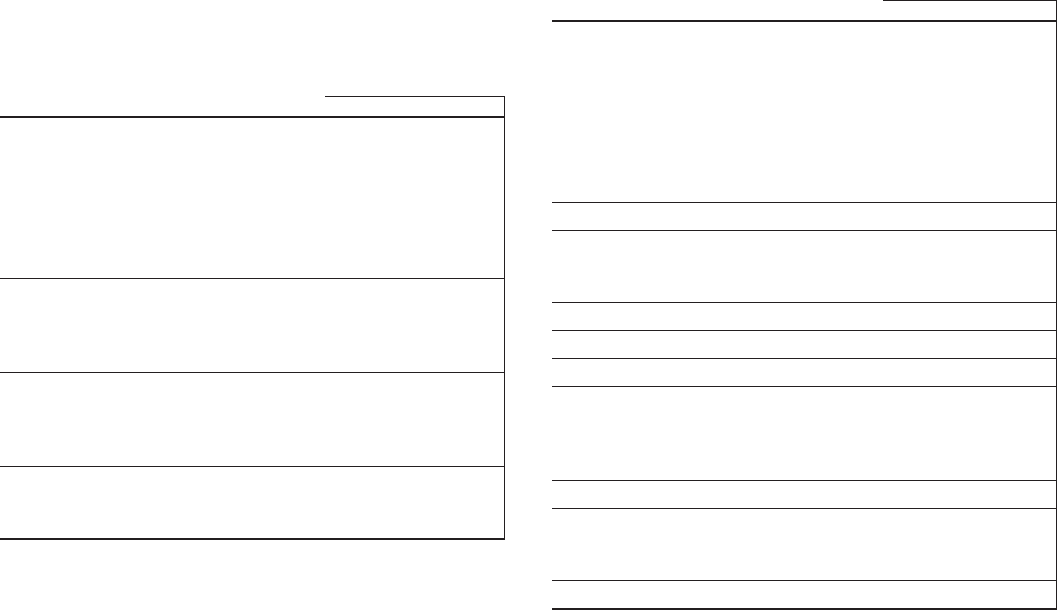

December 31 - in millions 2007 2006

Assets

Loans, net of unearned income $68,319 $50,105

Securities available for sale 30,225 23,191

Loans held for sale 3,927 2,366

Equity investments 6,045 5,330

Goodwill and other intangible assets 9,551 4,043

Other 20,853 16,785

Total assets $138,920 $101,820

Liabilities

Funding sources $113,627 $81,329

Other 8,785 8,818

Total liabilities 122,412 90,147

Minority and noncontrolling interests in

consolidated entities 1,654 885

Total shareholders' equity 14,854 10,788

Total liabilities, minority and

noncontrolling interests, and

shareholders' equity $138,920 $101,820

The summarized balance sheet data above is based upon our

Consolidated Balance Sheet in Item 8 of this Report.

Our Consolidated Balance Sheet at December 31, 2007

reflects the addition of approximately $21 billion of assets

resulting from our Mercantile acquisition and approximately

$3 billion of assets related to our Yardville acquisition.

Various seasonal and other factors impact our period-end

balances whereas average balances (discussed under the

Balance Sheet Highlights section of this Item 7 and included

in the Statistical Information section of Item 8 of this Report)

are more indicative of underlying business trends.

An analysis of changes in selected balance sheet categories

follows.

L

OANS

,N

ET OF

U

NEARNED

I

NCOME

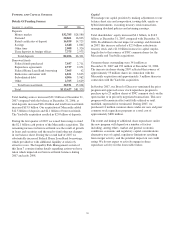

Loans increased $18.2 billion, or 36%, as of December 31,

2007 compared with December 31, 2006. Our Mercantile

acquisition added $12.4 billion of loans including $4.9 billion

of commercial, $4.8 billion of commercial real estate, $1.6

billion of consumer and $1.1 billion of residential mortgage

loans. Our Yardville acquisition added $1.9 billion of loans.

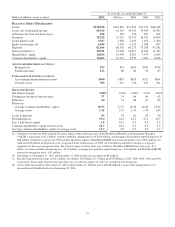

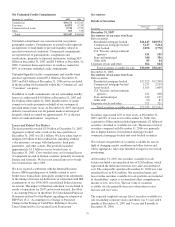

Details Of Loans

December 31 - in millions 2007 2006

Commercial

Retail/wholesale $6,653 $5,301

Manufacturing 4,563 4,189

Other service providers 3,014 2,186

Real estate related (a) 5,730 2,825

Financial services 1,226 1,324

Health care 1,260 707

Other 6,161 4,052

Total commercial 28,607 20,584

Commercial real estate

Real estate projects 6,114 2,716

Mortgage 2,792 816

Total commercial real estate 8,906 3,532

Lease financing 3,500 3,556

Total commercial lending 41,013 27,672

Consumer

Home equity 14,447 13,749

Automobile 1,513 1,135

Other 2,366 1,631

Total consumer 18,326 16,515

Residential mortgage 9,557 6,337

Other 413 376

Unearned income (990) (795)

Total, net of unearned income $68,319 $50,105

(a) Includes loans related to customers in the real estate, rental,

leasing and construction industries.

Our loan portfolio continued to be diversified among

numerous industries and types of businesses. The loans that

we hold are also concentrated in, and diversified across, our

principal geographic markets. See Note 5 Loans,

Commitments To Extend Credit and Concentrations of Credit

Risk in the Notes To Consolidated Financial Statements in

Item 8 of this Report for additional information.

Commercial lending outstandings in the table above are the

largest category and are the most sensitive to changes in

assumptions and judgments underlying the determination of

the allowance for loan and lease losses. We have allocated

$713 million, or 86%, of the total allowance for loan and lease

losses at December 31, 2007 to these loans. We allocated $68

million, or 8%, of the remaining allowance at that date to

consumer loans and $49 million, or 6%, to all other loans.

This allocation also considers other relevant factors such as:

• Actual versus estimated losses,

• Regional and national economic conditions,

• Business segment and portfolio concentrations,

• Industry conditions,

• The impact of government regulations, and

• Risk of potential estimation or judgmental errors,

including the accuracy of risk ratings.

25