PNC Bank 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our registrar, stock transfer agent, and dividend disbursing

agent is:

Computershare Investor Services, LLC

250 Royall Street

Canton, MA 02021

800-982-7652

We include here by reference the information that appears

under the caption “Common Stock Performance Graph” at the

end of this Item 5.

(b) Not applicable.

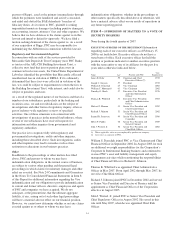

(c) Details of our repurchases of PNC common stock during

the fourth quarter of 2007 are included in the following table:

In thousands, except per share data

2007 period

Total shares

purchased (a)

Average

price

paid per

share

Total shares

purchased as

part of

publicly

announced

programs (b)

Maximum

number of

shares that

may yet be

purchased

under the

programs (b)

October 1 –

October 31 318 $70.86 145 24,855

November 1 –

November 30 433 $70.48 145 24,710

December 1 –

December 31 169 $69.39 24,710

Total 920 $70.41 290

(a) Includes PNC common stock purchased under the program referred to in

note (b) to this table and PNC common stock purchased in connection

with our various employee benefit plans.

(b) Our current stock repurchase program, allows us to purchase up to

25 million shares on the open market or in privately negotiated

transactions. This program was authorized on October 4, 2007 and

replaced the prior program, which was authorized in February 2005. This

program will remain in effect until fully utilized or until modified,

superseded or terminated.

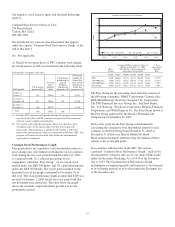

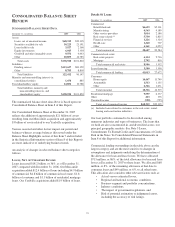

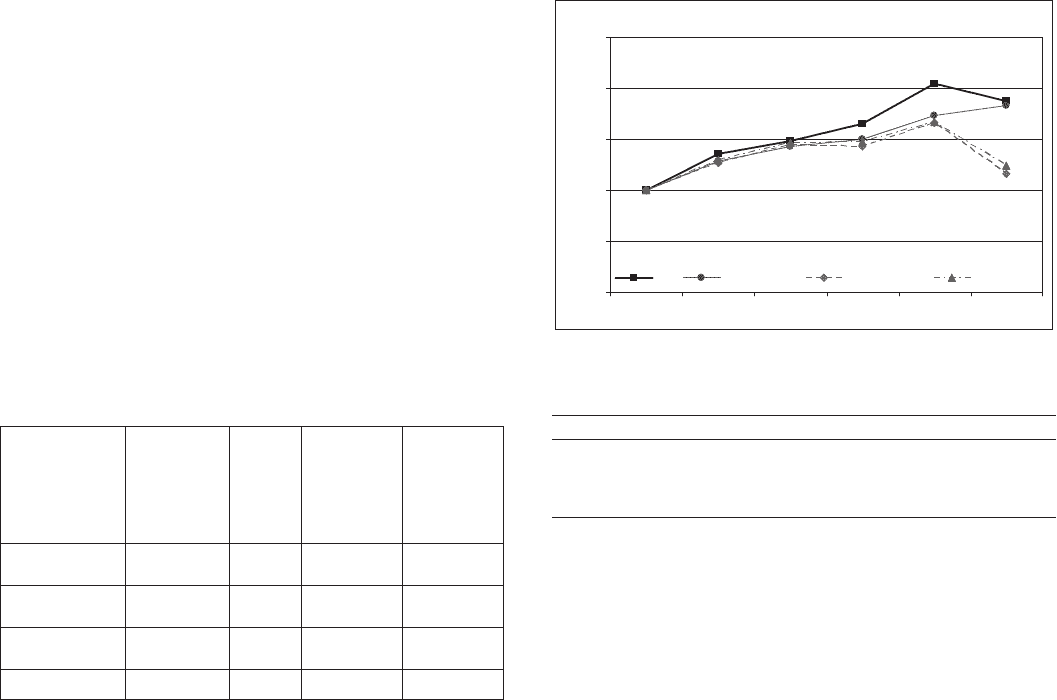

Common Stock Performance Graph

This graph shows the cumulative total shareholder return (i.e.,

price change plus reinvestment of dividends) on our common

stock during the five-year period ended December 31, 2007,

as compared with: (1) a selected peer group of our

competitors, called the “Peer Group;” (2) an overall stock

market index, the S&P 500 Index; and (3) a published industry

index, the S&P 500 Banks. The yearly points marked on the

horizontal axis of the graph correspond to December 31 of

that year. The stock performance graph assumes that $100 was

invested on January 1, 2003 for the five-year period and that

any dividends were reinvested. The table below the graph

shows the resultant compound annual growth rate for the

performance period.

Dec07Dec02 Dec03 Dec04 Dec05 Dec06

Comparison of Cumulative Five Year Total Return

0

50

100

150

200

250

Dollars

PNC S&P 500 Index S&P 500 Banks Peer Group

Base

Period

Assumes $100 investment at Close of

Market on December 31, 2002

Total Return = Price change plus

reinvestment of dividends

5-Year

Com-pound

Growth

Rate

Dec02 Dec03 Dec04 Dec05 Dec06 Dec07

PNC $100 136.06 148.25 165.41 204.29 187.41 13.39%

S&P 500 Index $100 128.67 142.65 149.65 173.26 182.78 12.82%

S&P 500 Banks $100 126.65 144.92 142.86 165.89 116.49 3.10%

Peer Group $100 129.36 146.85 147.23 167.31 123.96 4.39%

The Peer Group for the preceding chart and table consists of

the following companies: BB&T Corporation; Comerica Inc.;

Fifth Third Bancorp; KeyCorp; National City Corporation;

The PNC Financial Services Group, Inc.; SunTrust Banks,

Inc.; U.S. Bancorp.; Wachovia Corporation; Regions Financial

Corporation; and Wells Fargo & Co. The Peer Group shown is

the Peer Group approved by the Board’s Personnel and

Compensation Committee for 2007.

Each yearly point for the Peer Group is determined by

calculating the cumulative total shareholder return for each

company in the Peer Group from December 31, 2002 to

December 31 of that year (End of Month Dividend

Reinvestment Assumed) and then using the median of these

returns as the yearly plot point.

In accordance with the rules of the SEC, this section,

captioned “Common Stock Performance Graph,” shall not be

incorporated by reference into any of our future filings made

under the Securities Exchange Act of 1934 or the Securities

Act of 1933. The Common Stock Performance Graph,

including its accompanying table and footnotes, is not deemed

to be soliciting material or to be filed under the Exchange Act

or the Securities Act.

16