PNC Bank 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

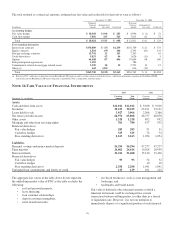

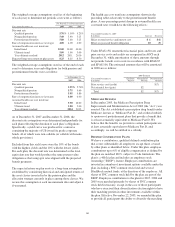

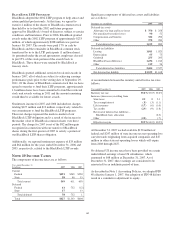

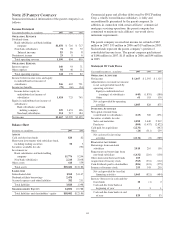

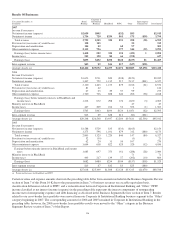

Upon adoption at January 1, 2007, we had $49 million of

unrecognized tax benefits. The unrecognized tax benefits were

composed of the following three broad categories.

January 1, 2007

In millions

Unrecognized tax benefits related to:

Acquired companies’ tax positions $10

Temporary differences 20

Permanent differences 19

Total $49

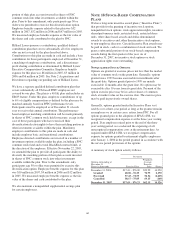

Changes in Unrecognized Tax Benefits (in millions):

Balance of Gross Unrecognized Tax Benefits at January 1,

2007 $ 49

Gross amount of increase in unrecognized tax benefits as a

result of tax positions taken during a prior period (a): 52

Gross amount of decrease in unrecognized tax benefits as a

result of tax positions taken during a prior period: (2)

Gross amount of increase in unrecognized tax benefits as a

result of tax positions taken during the current period: 1

Amounts of decrease in the unrecognized tax benefits relating

to settlements with taxing authorities (b): (39)

Reductions to unrecognized tax benefits as a result of a lapse

of the applicable statute of limitations: (4)

Balance of Gross Unrecognized Tax Benefits at December 31,

2007 $57

(a) Increase primarily due to our acquisition of Mercantile.

(b) Decrease primarily due to PNC and Mercantile settlement of IRS audit issues.

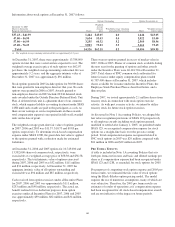

December 31, 2007

In millions

Unrecognized tax benefits related to:

Acquired companies’ tax positions $31

Temporary differences 10

Permanent differences 16

Total $57

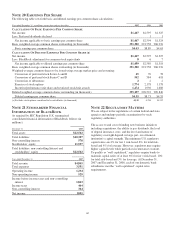

Under current GAAP, $30 million of any change in the

amount of unrecognized tax benefits related to acquired

companies’ tax positions would result in an adjustment to the

goodwill associated with the particular acquisition. See Note 1

Accounting Policies regarding SFAS 141(R) which will

become effective January 1, 2009 and which will change this

accounting.

Any changes in the amounts of unrecognized tax benefits

related to temporary differences would result in a

reclassification to deferred tax liability; any changes in the

amounts of unrecognized tax benefits related to permanent

differences would result in an adjustment to income tax

expense and therefore our effective tax rate. The unrecognized

tax benefits included above that if recognized would affect the

effective tax rate is $11 million. This is less than the total

amount of unrecognized tax benefit related to permanent

differences because a portion of those unrecognized benefits

relate to state tax matters.

It is difficult to project the positions for which unrecognized

tax benefits will change over the next 12 months, but it is

reasonably possible that they could change significantly due to

events such as completion of taxing authority audits and

expirations of the statutes of limitations. However, we do not

expect that any changes in unrecognized tax benefits would

have a material impact on income tax expense during the next

12 months.

Our consolidated federal income tax returns through 2003

have been audited by the Internal Revenue Service and we

have resolved all disputed matters through the IRS appeals

division. The Internal Revenue Service is currently examining

our 2004 through 2006 consolidated federal income tax

returns.

The states of New York, New Jersey and Maryland (following

our acquisition of Mercantile) and New York City are

principally where we are subject to state and local income tax.

The state of New York is currently auditing our 2002 to 2004

filings. Subsequent years remain subject to examination in that

jurisdiction. New York City is currently auditing 2004 and

2005. However, years 2002 and 2003 remain subject to

examination pending the completion of the New York state

audit. Through 2006 BlackRock is included in our New York

and New York City combined tax filings and constituted most

of the tax liability. Years subsequent to 2002 remain subject to

examination by New Jersey and years subsequent to 2003

remain subject to examination by Maryland.

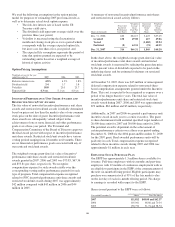

Our policy is to classify interest and penalties associated with

income taxes as income taxes. Upon adoption at January 1,

2007, we had accrued $72 million of interest related to tax

positions, most of which related to our cross-border leasing

transactions. The total accrued interest at December 31, 2007

was $91 million. The $19 million increase was primarily due

to $11 million accrued during 2007 as a component of income

tax expense on the Consolidated Income Statement. The

remainder resulted from our acquisition of Mercantile. The

accrued liability is a component of Other liabilities on the

Balance Sheet.

106