PNC Bank 2007 Annual Report Download - page 88

Download and view the complete annual report

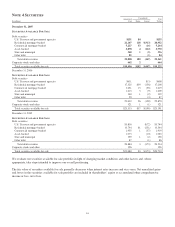

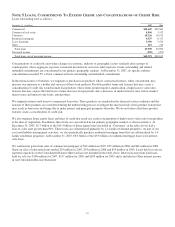

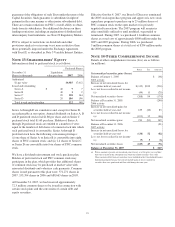

Please find page 88 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.investments are provided in the Consolidated VIEs – PNC Is

Primary Beneficiary table and reflected in the “Other”

business segment.

We have a significant variable interest in certain other limited

partnerships that sponsor affordable housing projects. We do

not own a majority of the limited partnership interests in these

entities and are not the primary beneficiary. We use the equity

method to account for our investment in these entities.

Information regarding these partnership interests is reflected

in the Non-Consolidated VIEs – Significant Variable Interests

table.

P

ERPETUAL

T

RUST

S

ECURITIES

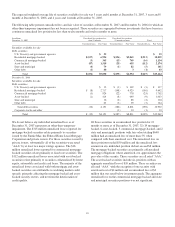

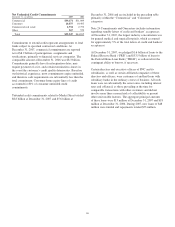

We issue certain hybrid capital vehicles that qualify as capital

for regulatory ratios and rating agency purposes.

In December 2006, one of our indirect subsidiaries, PNC

REIT Corp., sold $500 million of 6.517% Fixed-to-Floating

Rate Non-Cumulative Exchangeable Perpetual Trust

Securities (the “Trust Securities”) of PNC Preferred Funding

Trust I (“Trust I”) in a private placement. PNC REIT Corp.

had previously acquired the Trust Securities from the trust in

exchange for an equivalent amount of Fixed-to-Floating Rate

Non-Cumulative Perpetual Preferred Securities (the “LLC

Preferred Securities”), of PNC Preferred Funding LLC, (the

“LLC”), held by PNC REIT Corp. The LLC’s initial material

assets consist of indirect interests in mortgages and mortgage-

related assets previously owned by PNC REIT Corp.

In March 2007, PNC Preferred Funding LLC sold $500

million of 6.113% Fixed-to-Floating Rate Non-Cumulative

Exchangeable Perpetual Trust Securities of PNC Preferred

Funding Trust II (“Trust II”) in a private placement. In

connection with the private placement, Trust II acquired $500

million of LLC Preferred Securities.

PNC REIT Corp. owns 100% of the LLC’s common voting

securities. As a result, the LLC is an indirect subsidiary of

PNC and is consolidated on our Consolidated Balance Sheet.

Trust I and Trust II’s investment in the LLC Preferred

Securities is characterized as a minority interest on our

Consolidated Balance Sheet since we are not the primary

beneficiary of Trust I or Trust II. This minority interest totaled

approximately $980 million at December 31, 2007.

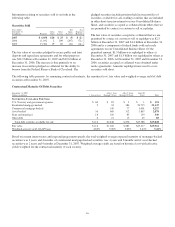

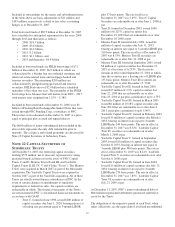

PNC Bank, N.A. has contractually committed to Trust I that if

full dividends are not paid in a dividend period on the Trust

Securities, LLC Preferred Securities or any other parity equity

securities issued by the LLC, neither PNC Bank, N.A. nor its

subsidiaries will declare or pay dividends or other

distributions with respect to, or redeem, purchase or acquire or

make a liquidation payment with respect to, any of its equity

capital securities during the next succeeding period (other than

to holders of the LLC Preferred Securities and any parity

equity securities issued by the LLC) except: (i) in the case of

dividends payable to subsidiaries of PNC Bank, N.A., to PNC

Bank, N.A. or another wholly-owned subsidiary of PNC Bank,

N.A. or (ii) in the case of dividends payable to persons that are

not subsidiaries of PNC Bank, N.A., to such persons only if,

(A) in the case of a cash dividend, PNC has first irrevocably

committed to contribute amounts at least equal to such cash

dividend or (B) in the case of in-kind dividends payable by

PNC REIT Corp., PNC has committed to purchase such

in-kind dividend from the applicable PNC REIT Corp. holders

in exchange for a cash payment representing the market value

of such in-kind dividend, and PNC has committed to

contribute such in-kind dividend to PNC Bank, N.A.

PNC has contractually committed to Trust II that if full

dividends are not paid in a dividend period on the Trust II

Securities, or the LLC Preferred Securities held by Trust II,

PNC will not declare or pay dividends with respect to, or

redeem, purchase or acquire, any of its equity capital

securities during the next succeeding dividend period, other

than: (i) purchases, redemptions or other acquisitions of shares

of capital stock of PNC in connection with any employment

contract, benefit plan or other similar arrangement with or for

the benefit of employees, officers, directors or consultants,

(ii) purchases of shares of common stock of PNC pursuant to a

contractually binding requirement to buy stock existing prior

to the commencement of the extension period, including under

a contractually binding stock repurchase plan, (iii) any

dividend in connection with the implementation of a

shareholders’ rights plan, or the redemption or repurchase of

any rights under any such plan, (iv) as a result of an exchange

or conversion of any class or series of PNC’s capital stock for

any other class or series of PNC’s capital stock, (v) the

purchase of fractional interests in shares of PNC capital stock

pursuant to the conversion or exchange provisions of such

stock or the security being converted or exchanged or (vi) any

stock dividends paid by PNC where the dividend stock is the

same stock as that on which the dividend is being paid.

83