PNC Bank 2007 Annual Report Download - page 42

Download and view the complete annual report

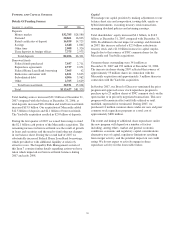

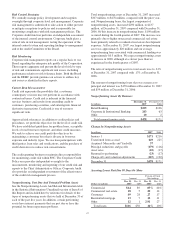

Please find page 42 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Retail Banking’s 2007 earnings increased $128 million, to

$893 million, up 17% compared with 2006. The increase in

earnings over the prior year was driven by acquisitions and

strong fee income and customer growth, partially offset by

increases in the provision for credit losses and continued

investments in the business.

Retail Banking’s performance during 2007 included the

following:

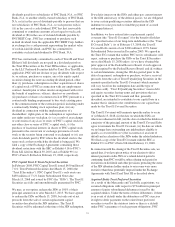

• The Mercantile acquisition added approximately $10.3

billion of loans and $12.0 billion of deposits to Retail

Banking. The acquisition also:

– Added 235 branches and 256 ATMs,

– Significantly increased our presence in Maryland,

– Added to our presence in Delaware, Virginia and the

Washington, DC area,

– Significantly increased the size of our small business

banking franchise by adding approximately $7.7

billion of commercial and commercial real estate

loans,

– Expanded our customer base with the addition of

approximately 286,000 checking relationships, and

– Expanded our wealth management business with the

addition of $22 billion in assets under management.

• The Yardville acquisition has resulted in a leading

deposit share in several wealthy counties in central New

Jersey and added 35 branches and 39 ATMs.

• The pending acquisition of Sterling, which did not impact

2007, is expected to result in a leading deposit share in

the Central Pennsylvania footprint and enhance our

presence in surrounding markets.

• Customer service and customer retention continues to be

our focus. In 2007, we partnered with the Gallup

organization to help evaluate and improve customer and

employee satisfaction.

• Consumer and small business checking relationships

increased 318,000 during 2007, not including the impact

of Yardville.

• Our investment in online banking capabilities continues

to pay off. Since December 31, 2006, the percentage of

consumer checking households using online bill payment

increased from 23% to 33%.

• In September 2006, we launched our PNC-branded credit

card product. As of December 31, 2007, more than

155,000 cards have been issued and we have $244

million in receivable balances. The results to date have

exceeded our expectations.

• In addition to the acquisitions, we opened 21 new

branches and consolidated 34 branches in 2007 for a total

of 1,109 branches at December 31, 2007. We continue to

optimize our network by opening new branches in high

growth areas, relocating branches to areas of higher

market opportunity, and consolidating branches in areas

of declining opportunity.

• Our wealth management and brokerage businesses have

benefited from acquisitions, market conditions and strong

business development in 2007. Asset management and

brokerage fees increased $147 million, or 25%, over 2006.

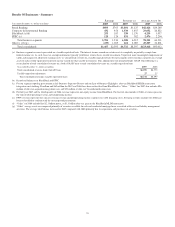

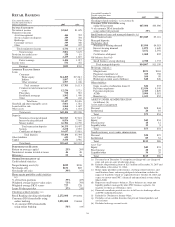

Total revenue for 2007 was $3.801 billion compared with

$3.125 billion last year. Taxable-equivalent net interest

income of $2.065 billion increased $387 million, or 23%,

compared with 2006 due to a 20% increase in average deposits

and a 37% increase in average loan balances. Net interest

income growth was the result of acquisitions and core

business growth, although this growth has stabilized in recent

quarters. In the current interest rate environment, Retail

Banking deposits will be less valuable, and are expected to

result in lower net interest income for this business segment in

2008 compared with 2007.

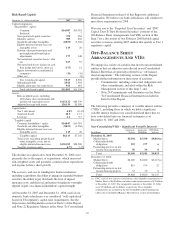

Noninterest income increased $289 million, to $1.736 billion,

up 20% compared with 2006. This growth can be attributed

primarily to the following:

• The acquisitions,

• Comparatively favorable equity markets,

• Increased brokerage revenue and volumes,

• Increased volume-related consumer fees,

• Increased third party loan servicing activities,

• New PNC-branded credit card product, and

• Customer growth.

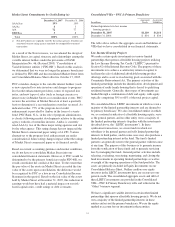

In the past, we have sold education loans to issuers of asset-

backed paper when the loans are placed into repayment status.

Recently, the secondary markets for education loans have been

impacted by liquidity issues similar to other asset classes. As a

result, we believe the ability to sell education loans and generate

related gains will be limited in 2008. Given this outlook and the

economic and customer relationship value inherent in this

product, in February 2008, we transferred the loans at lower of

cost or market value from held for sale to the loan portfolio.

The provision for credit losses increased $57 million in 2007,

to $138 million, compared with 2006. Net charge-offs were

$131 million in 2007, an increase of $46 million compared

with 2006. The increases in provision and net charge-offs

were primarily a result of residential real estate development

exposure, continued growth in our commercial loan portfolio

and charge-offs returning to a more normal level given the

current credit conditions. Charge-offs over the last few years

have been low compared with historical averages. Given the

current environment, we believe provision levels and

nonperforming assets will continue to increase in 2008.

Noninterest expense in 2007 totaled $2.239 billion, an

increase of $412 million, or 23%, compared with 2006.

Increases were primarily attributable to acquisitions (77% of

the increase), higher volume-related expenses tied to

noninterest income growth, continued investment in new

branches, and investments in various initiatives such as the

new PNC-branded credit card.

37