PNC Bank 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

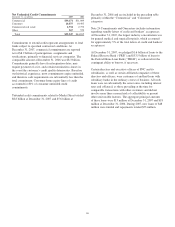

$.6 billion related to our obligation to provide shares of

BlackRock common stock to help fund certain BlackRock long-

term incentive plan ("LTIP") programs. Beginning with fourth

quarter 2006, we recognize gain or loss each quarter-end on our

remaining liability to provide shares of BlackRock common

stock to help fund certain BlackRock LTIP programs as that

liability is marked to market based on changes in BlackRock’s

common stock price. We recognized a pretax gain of $82 million

in the first quarter of 2007 from the transfer of BlackRock shares

for certain payouts under one of these programs. We will also

continue to recognize gains or losses on the future transfer of

shares for payouts under such LTIP programs.

The overall balance sheet impact of the BlackRock/MLIM

transaction was an increase to our shareholders’ equity of $1.6

billion. The increase to equity was comprised of an after-tax

gain of $1.3 billion, net of the expense associated with the

LTIP liability and the deferred taxes, and an after-tax increase

to capital surplus of $.3 billion. The recognition of the gain is

consistent with our existing accounting policy for the sale or

issuance by subsidiaries of their stock to third parties. The

gain represents the difference between our basis in BlackRock

stock prior to the BlackRock/MLIM transaction and the new

book value per share and resulting increase in value of our

investment realized from the transaction. The direct increase

to capital surplus rather than inclusion in the gain resulted

from the accounting treatment required due to existing

BlackRock repurchase commitments or programs.

For 2005 and for the nine months ended September 30, 2006,

our Consolidated Income Statement included our former 69%

– 71% ownership interest in BlackRock’s net income through

the closing date. However, beginning September 30, 2006, our

Consolidated Balance Sheet no longer reflected the

consolidation of BlackRock’s balance sheet but recognized

our ownership interest in BlackRock as an investment

accounted for under the equity method. This accounting has

resulted in a reduction in certain revenue and noninterest

expense categories on PNC's Consolidated Income Statement

as our share of BlackRock’s net income is now reported

within asset management noninterest income.

2005

Riggs National Corporation

We acquired Riggs National Corporation (“Riggs”), a

Washington, D.C. based banking company, effective May 13,

2005. Under the terms of the agreement, Riggs merged into

The PNC Financial Services Group, Inc. and PNC Bank,

National Association (“PNC Bank, N.A.”) acquired

substantially all of the assets of Riggs Bank, National

Association, the principal banking subsidiary of Riggs. The

acquisition gave us a substantial presence on which to build a

market leading franchise in the affluent Washington, D.C.

metropolitan area. In connection with the acquisition, Riggs

shareholders received an aggregate of approximately $297

million in cash and 6.6 million shares of PNC common stock

valued at $356 million.

Harris Williams & Co.

On October 11, 2005, we acquired Harris Williams & Co., one

of the nation’s largest firms focused on providing mergers and

acquisitions advisory and related services to middle market

companies, including private equity firms and private and

public companies.

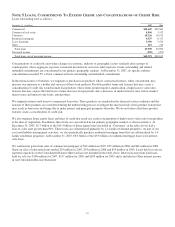

N

OTE

3V

ARIABLE

I

NTEREST

E

NTITIES

We are involved with various entities in the normal course of

business that may be deemed to be VIEs. We consolidated

certain VIEs as of December 31, 2007 and 2006 for which we

were determined to be the primary beneficiary.

We hold significant variable interests in VIEs that have not

been consolidated because we are not considered the primary

beneficiary. Information on these VIEs follows:

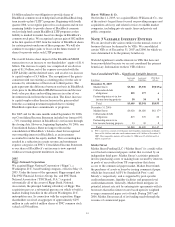

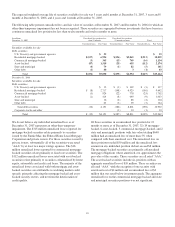

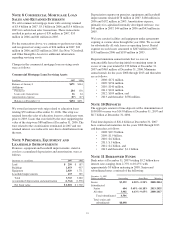

Non-Consolidated VIEs – Significant Variable Interests

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC Risk

of Loss

December 31, 2007

Market Street $5,304 $5,330 $9,019(a)

Collateralized debt

obligations 255 177 6

Partnership interests in low

income housing projects 50 34 8

Total $5,609 $5,541 $9,033

December 31, 2006

Market Street $4,020 $4,020 $6,117(a)

Collateralized debt

obligations 815 570 22

Partnership interests in

low income housing projects 33 30 8

Total $4,868 $4,620 $6,147

(a) PNC’s risk of loss consists of off-balance sheet liquidity commitments to Market

Street of $8.8 billion and other credit enhancements of $.2 billion at December 31,

2007. The comparable amounts at December 31, 2006 were $5.6 billion and $.6

billion, respectively.

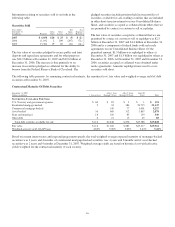

Market Street

Market Street Funding LLC (“Market Street”) is a multi-seller

asset-backed commercial paper conduit that is owned by an

independent third party. Market Street’s activities primarily

involve purchasing assets or making loans secured by interests

in pools of receivables from US corporations that desire

access to the commercial paper market. Market Street funds

the purchases of assets or loans by issuing commercial paper

which has been rated A1/P1 by Standard & Poor’s and

Moody’s, respectively, and is supported by pool-specific

credit enhancements, liquidity facilities and program-level

credit enhancement. Generally, Market Street mitigates its

potential interest rate risk by entering into agreements with its

borrowers that reflect interest rates based upon its weighted

average commercial paper cost of funds. During 2007 and

2006, Market Street met all of its funding needs through the

issuance of commercial paper.

81