PNC Bank 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

20 E

ARNINGS

P

ER

S

HARE

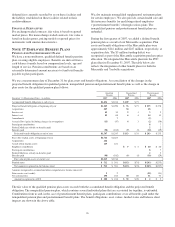

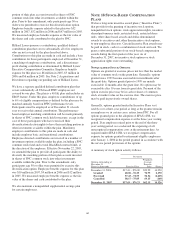

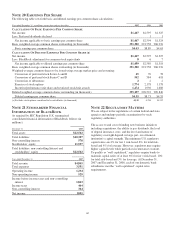

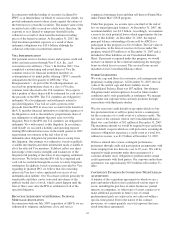

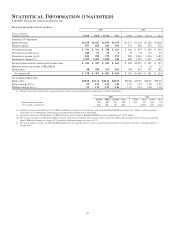

The following table sets forth basic and diluted earnings per common share calculations:

Year ended December 31 - in millions, except share and per share data 2007 2006 2005

C

ALCULATION

O

F

B

ASIC

E

ARNINGS

P

ER

C

OMMON

S

HARE

Net income $1,467 $2,595 $1,325

Less: Preferred dividends declared 11

Net income applicable to basic earnings per common share $1,467 $2,594 $1,324

Basic weighted-average common shares outstanding (in thousands) 331,300 291,758 286,276

Basic earnings per common share $4.43 $8.89 $4.63

C

ALCULATION

O

F

D

ILUTED

E

ARNINGS

P

ER

C

OMMON

S

HARE

(a)

Net income $1,467 $2,595 $1,325

Less: BlackRock adjustment for common stock equivalents 867

Net income applicable to diluted earnings per common share $1,459 $2,589 $1,318

Basic weighted-average common shares outstanding (in thousands) 331,300 291,758 286,276

Weighted-average common shares to be issued using average market price and assuming:

Conversion of preferred stock Series A and B 65 70 78

Conversion of preferred stock Series C and D 542 584 618

Conversion of debentures 222

Exercise of stock options 1,774 2,178 1,178

Incentive/performance unit share and restricted stock/unit awards 1,474 1,930 1,688

Diluted weighted-average common shares outstanding (in thousands) 335,157 296,522 289,840

Diluted earnings per common share $4.35 $8.73 $4.55

(a) Excludes stock options considered to be anti-dilutive (in thousands) 4,135 4,230 10,532

N

OTE

21 S

UMMARIZED

F

INANCIAL

I

NFORMATION OF

B

LACK

R

OCK

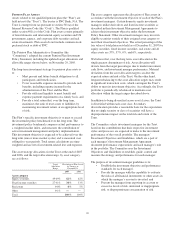

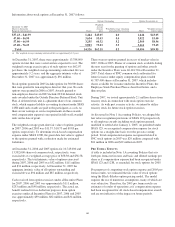

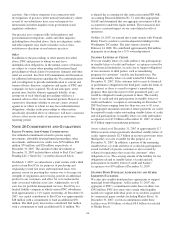

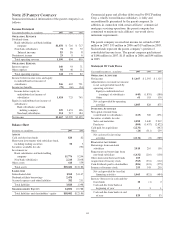

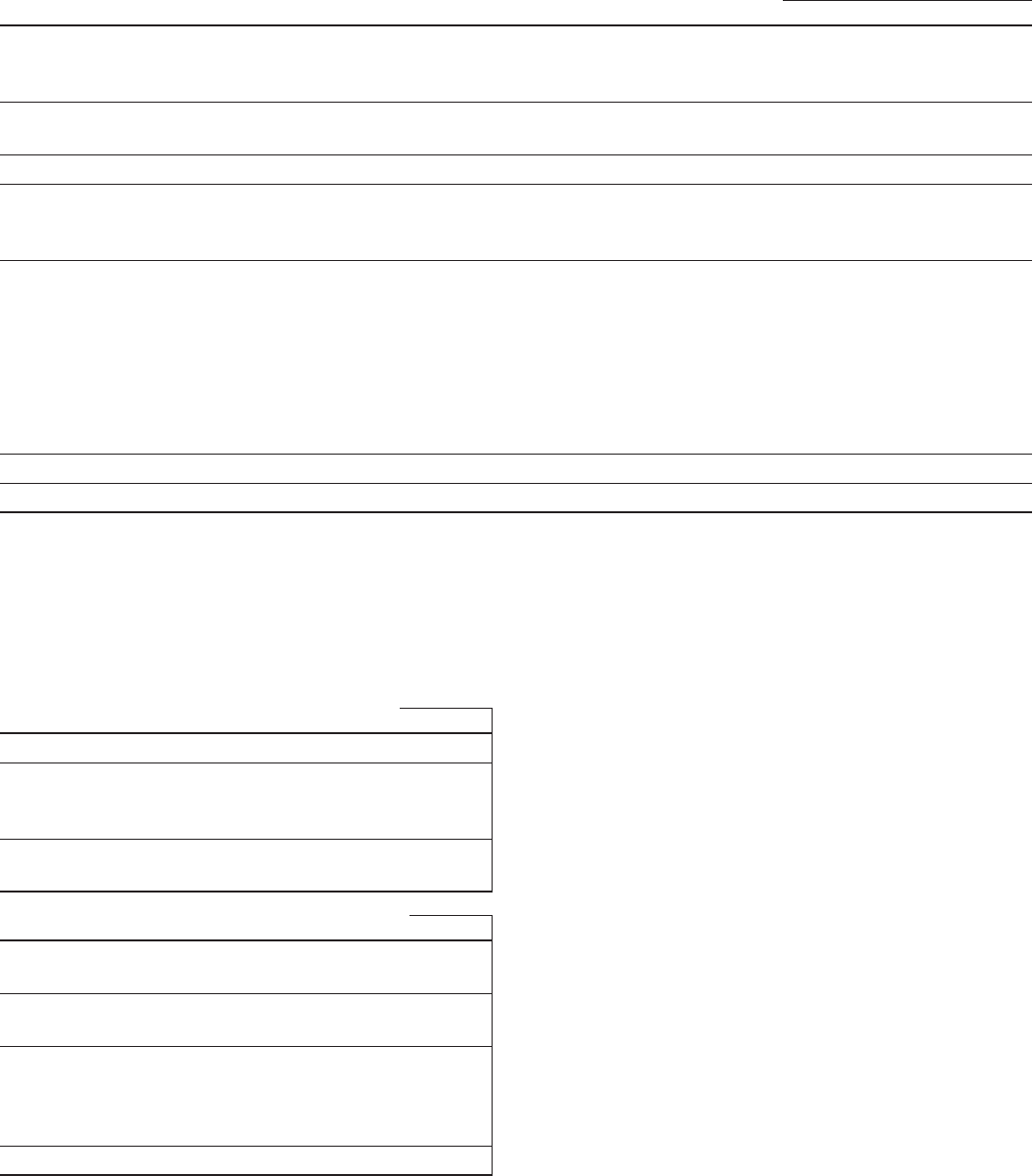

As required by SEC Regulation S-X, summarized

consolidated financial information of BlackRock follows (in

millions).

December 31 2007

Total assets $22,562

Total liabilities $10,387

Non-controlling interest 578

Stockholders’ equity 11,597

Total liabilities, non-controlling Interest and

stockholders’ equity $22,562

Year ended December 31 2007

Total revenue $4,845

Total expenses 3,551

Operating income 1,294

Non-operating income 529

Income before income taxes and non-controlling

interest 1,823

Income taxes 464

Non-controlling interest 364

Net income $995

N

OTE

22 R

EGULATORY

M

ATTERS

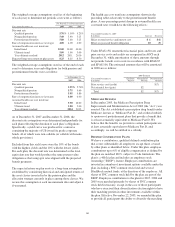

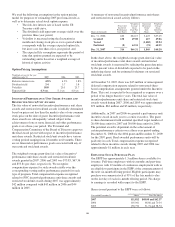

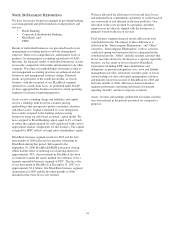

We are subject to the regulations of certain federal and state

agencies and undergo periodic examinations by such

regulatory authorities.

The access to and cost of funding new business initiatives

including acquisitions, the ability to pay dividends, the level

of deposit insurance costs, and the level and nature of

regulatory oversight depend, in large part, on a financial

institution’s capital strength. The minimum U.S. regulatory

capital ratios are 4% for tier 1 risk-based, 8% for total risk-

based and 4% for leverage. However, regulators may require

higher capital levels when particular circumstances warrant.

To qualify as “well capitalized,” regulators require banks to

maintain capital ratios of at least 6% for tier 1 risk-based, 10%

for total risk-based and 5% for leverage. At December 31,

2007 and December 31, 2006, each of our domestic bank

subsidiaries met the “well capitalized” capital ratio

requirements.

107