PNC Bank 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

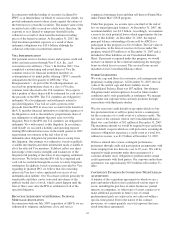

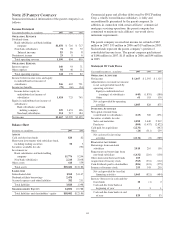

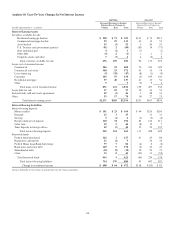

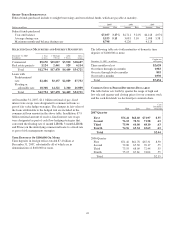

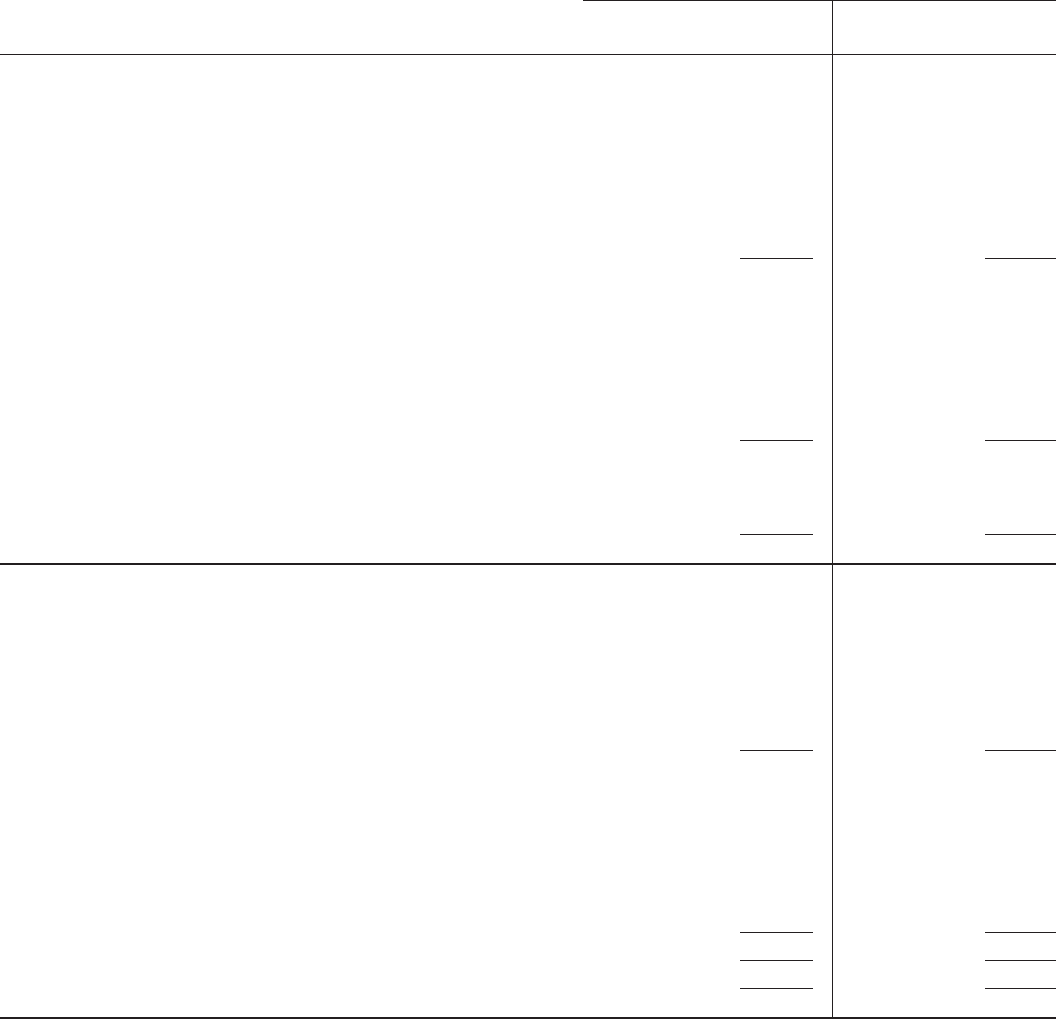

Analysis Of Year-To-Year Changes In Net Interest Income

2007/2006 2006/2005

Increase/(Decrease) in Income/

Expense Due to Changes in:

Increase/(Decrease) in Income/

Expense Due to Changes in:

Taxable-equivalent basis - in millions Volume Rate Total Volume Rate Total

Interest-Earning Assets

Securities available for sale

Residential mortgage-backed $ 228 $ 73 $ 301 $141 $ 74 $215

Commercial mortgage-backed 93 19 112 42 13 55

Asset-backed 55 (3) 52 32023

U.S. Treasury and government agencies (91) 2 (89) (85) 14 (71)

State and municipal 4 (1) 3 (1) (1)

Other debt (4) 2 (2) 112

Corporate stocks and other 7 (3) 4 4 (2) 2

Total securities available for sale 276 105 381 92 133 225

Loans, net of unearned income

Commercial 386 22 408 76 233 309

Commercial real estate 348 23 371 41 33 74

Lease financing (9) (38) (47) (8) (1) (9)

Consumer 103 55 158 (5) 109 104

Residential mortgage 97 40 137 41 13 54

Other 55(5) 9 4

Total loans, net of unearned income 871 161 1,032 129 407 536

Loans held for sale 17 10 27 19 34 53

Federal funds sold and resale agreements 49 (3) 46 52833

Other 53 17 70 (4) 27 23

Total interest-earning assets $1,271 $285 $1,556 $253 $617 $870

Interest-Bearing Liabilities

Interest-bearing deposits

Money market $ 141 $ 23 $ 164 $ 44 $216 $260

Demand 12 3 15 32 32

Savings 3 (1) 2 (3) (3) (6)

Retail certificates of deposit 120 74 194 85 126 211

Other time 39 5 44 (8) 15 7

Time deposits in foreign offices 49 (5) 44 52 53 105

Total interest-bearing deposits 349 114 463 111 498 609

Borrowed funds

Federal funds purchased 126 1 127 41 45 86

Repurchase agreements 11 (2) 9 36 36

Federal Home Loan Bank borrowings 77 7 84 (4) 2 (2)

Bank notes and senior debt 169 9 178 (2) 47 45

Subordinated debt (10) (8) (18) 19 53 72

Other 33 8 41 (90) 31 (59)

Total borrowed funds 416 5 421 (46) 224 178

Total interest-bearing liabilities 714 170 884 95 692 787

Change in net interest income $ 608 $ 64 $ 672 $138 $ (55) $ 83

Changes attributable to rate/volume are prorated into rate and volume components.

118