PNC Bank 2007 Annual Report Download - page 37

Download and view the complete annual report

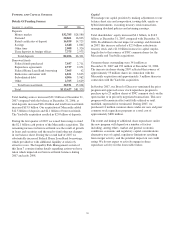

Please find page 37 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Information regarding these partnership interests is reflected in

the Non-Consolidated VIEs – Significant Variable Interests table.

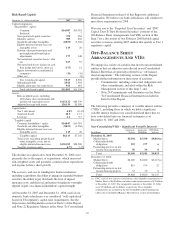

Perpetual Trust Securities

We issue certain hybrid capital vehicles that qualify as capital

for regulatory and rating agency purposes.

In December 2006, one of our indirect subsidiaries, PNC REIT

Corp., sold $500 million of 6.517% Fixed-to-Floating Rate

Non-Cumulative Exchangeable Perpetual Trust Securities (the

“Trust Securities”) of PNC Preferred Funding Trust I (“Trust

I”) in a private placement. PNC REIT Corp. had previously

acquired the Trust Securities from the trust in exchange for an

equivalent amount of Fixed-to-Floating Rate Non-Cumulative

Perpetual Preferred Securities (the “LLC Preferred Securities”),

of PNC Preferred Funding LLC (the “LLC”), held by PNC

REIT Corp. The LLC’s initial material assets consist of indirect

interests in mortgages and mortgage-related assets previously

owned by PNC REIT Corp.

In March 2007, PNC Preferred Funding LLC sold $500

million of 6.113% Fixed-to-Floating Rate Non-Cumulative

Exchangeable Perpetual Trust Securities of PNC Preferred

Funding Trust II (“Trust II”), in a private placement. In

connection with the private placement, Trust II acquired $500

million of LLC Preferred Securities.

In February 2008, PNC Preferred Funding LLC sold $375

million of 8.700% Fixed-to-Floating Rate Non-Cumulative

Exchangeable Perpetual Trust Securities of PNC Preferred

Funding Trust III (“Trust III”) in a private placement. In

connection with the private placement, Trust III acquired $375

million of LLC Preferred Securities.

PNC REIT Corp. owns 100% of the LLC’s common voting

securities. As a result, the LLC is an indirect subsidiary of PNC

and is consolidated on our Consolidated Balance Sheet. Trust I,

Trust II and Trust III’s investment in the LLC Preferred

Securities is characterized as a minority interest on our

Consolidated Balance Sheet since we are not the primary

beneficiary of Trust I, Trust II or Trust III. This minority

interest totaled approximately $980 million at December 31,

2007 (excluding Trust III, which was not yet formed). Each

Trust I Security is automatically exchangeable into a share of

Series F Non-Cumulative Perpetual Preferred Stock of PNC

Bank, N.A. (the “PNC Bank Preferred Stock”), each Trust II

Security is automatically exchangeable into a share of Series I

Non-Cumulative Perpetual Preferred Stock of PNC (the “Series

I Preferred Stock”), and each Trust III Security is automatically

exchangeable into a share of Series J Non-Cumulative Perpetual

Preferred Stock of PNC, in each case under certain conditions

relating to the capitalization or the financial condition of PNC

Bank, N.A. and upon the direction of the Office of the

Comptroller of the Currency.

We entered into a replacement capital covenant in connection

with each of the closing of the Trust Securities sale (the “Trust

Covenant”) and the closing of the Trust II Securities sale (the

“Trust II Covenant”), in each case for the benefit of holders of

a specified series of our long-term indebtedness (the “Covered

Debt”). As of December 31, 2007, Covered Debt consists of

our $200 million Floating Rate Junior Subordinated Notes

issued on June 9, 1998.

We agreed in the Trust Covenant that neither we nor our

subsidiaries (other than PNC Bank, N.A. and its subsidiaries)

would purchase the Trust Securities, the LLC Preferred Securities

or the PNC Bank Preferred Stock (collectively, the “Trust

Covered Securities”) unless: (i) we have received the prior

approval of the Federal Reserve Board, if such approval is then

required under the Federal Reserve Board’s capital guidelines

applicable to bank holding companies and (ii) during the 180-day

period prior to the date of purchase, we or our subsidiaries, as

applicable, have received proceeds from the sale of Qualifying

Securities in the amounts specified in the Trust Covenant (which

amounts will vary based on the type of securities sold). The Trust

Covenant does not apply to redemptions of the Trust Covered

Securities by the issuers of those securities.

We agreed in the Trust II Covenant that until March 29, 2017,

neither we nor our subsidiaries would purchase or redeem the

Trust II Securities, the LLC Preferred Securities or the Series I

Preferred Stock (collectively, the “Trust II Covered

Securities”), unless: (i) we have received the prior approval of

the Federal Reserve Board, if such approval is then required

under the Federal Reserve Board’s capital guidelines

applicable to bank holding companies and (ii) during the

180-day period prior to the date of purchase, PNC, PNC Bank,

N.A. or PNC Bank N.A.’s subsidiaries, as applicable, have

received proceeds from the sale of Qualifying Securities in the

amounts specified in the Trust II Covenant (which amounts

will vary based on the type of securities sold).

“Qualifying Securities” means debt and equity securities

having terms and provisions that are specified in the Trust

Covenant or the Trust II Covenant, as applicable and that,

generally described, are intended to contribute to our capital

base in a manner that is similar to the contribution to our

capital base made by the Trust Covered Securities or the Trust

II Covered Securities, as applicable. We filed a copy of each

of the Trust Covenant and the Trust II Covenant with the SEC

as Exhibit 99.1 to PNC’s Form 8-K filed on December 8, 2006

and as Exhibit 99.1 to PNC’s Form 8-K filed on March 30,

2007, respectively.

PNC Bank, N.A. has contractually committed to Trust I that if

full dividends are not paid in a dividend period on the Trust

Securities, LLC Preferred Securities or any other parity equity

securities issued by the LLC, neither PNC Bank, N.A. nor its

subsidiaries will declare or pay dividends or other

distributions with respect to, or redeem, purchase or acquire or

make a liquidation payment with respect to, any of its equity

capital securities during the next succeeding period (other than

to holders of the LLC Preferred Securities and any parity

equity securities issued by the LLC) except: (i) in the case of

32