PNC Bank 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

guarantee of the obligations of such Trust under the terms of the

Capital Securities. Such guarantee is subordinate in right of

payment in the same manner as other junior subordinated debt.

There are certain restrictions on PNC’s overall ability to obtain

funds from its subsidiaries. For additional disclosure on these

funding restrictions, including an explanation of dividend and

intercompany loan limitations, see Note 22 Regulatory Matters.

PNC is subject to restrictions on dividends and other

provisions similar to or in some ways more restrictive than

those potentially imposed under the Exchange Agreement

with Trust II, as described in Note 3 Variable Interest Entities.

N

OTE

13 S

HAREHOLDERS

’E

QUITY

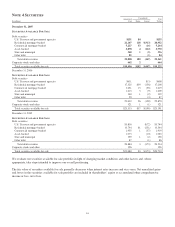

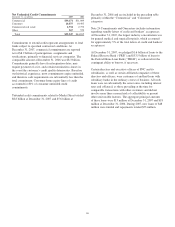

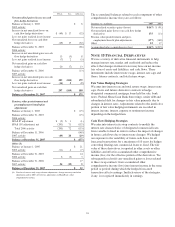

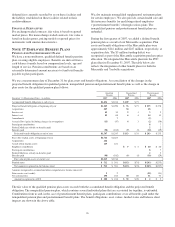

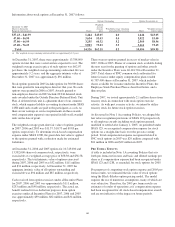

Information related to preferred stock is as follows:

Preferred Shares

December 31

Shares in thousands

Liquidation

value per share 2007 2006

Authorized

$1 par value 16,985 17,012

Issued and outstanding

Series A $ 40 77

Series B 40 12

Series C 20 128 144

Series D 20 186 196

Total issued and outstanding 322 349

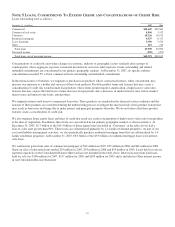

Series A through D are cumulative and, except for Series B,

are redeemable at our option. Annual dividends on Series A, B

and D preferred stock total $1.80 per share and on Series C

preferred stock total $1.60 per share. Holders of Series A

through D preferred stock are entitled to a number of votes

equal to the number of full shares of common stock into which

such preferred stock is convertible. Series A through D

preferred stock have the following conversion privileges:

(i) one share of Series A or Series B is convertible into eight

shares of PNC common stock; and (ii) 2.4 shares of Series C

or Series D are convertible into four shares of PNC common

stock.

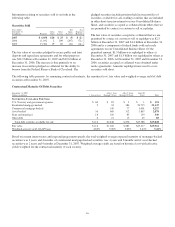

We have a dividend reinvestment and stock purchase plan.

Holders of preferred stock and PNC common stock may

participate in the plan, which provides that additional shares

of common stock may be purchased at market value with

reinvested dividends and voluntary cash payments. Common

shares issued pursuant to this plan were: 571,271 shares in

2007, 535,394 shares in 2006 and 688,665 shares in 2005.

At December 31, 2007, we had reserved approximately

72.3 million common shares to be issued in connection with

certain stock plans and the conversion of certain debt and

equity securities.

Effective October 4, 2007, our Board of Directors terminated

the 2005 stock repurchase program and approved a new stock

repurchase program to purchase up to 25 million shares of

PNC common stock on the open market or in privately

negotiated transactions. The 2007 program will remain in

effect until fully utilized or until modified, superseded or

terminated. During 2007, we purchased 11 million common

shares at a total cost of approximately $800 million under the

2005 and 2007 programs. During 2006, we purchased

5 million common shares at a total cost of $354 million under

the 2005 program.

N

OTE

14 O

THER

C

OMPREHENSIVE

I

NCOME

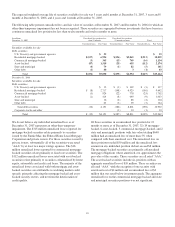

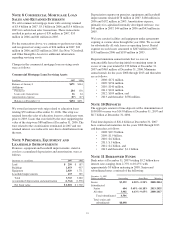

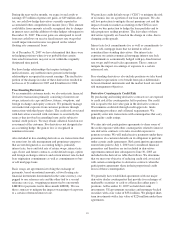

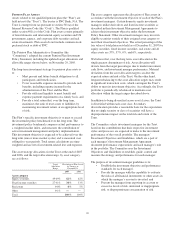

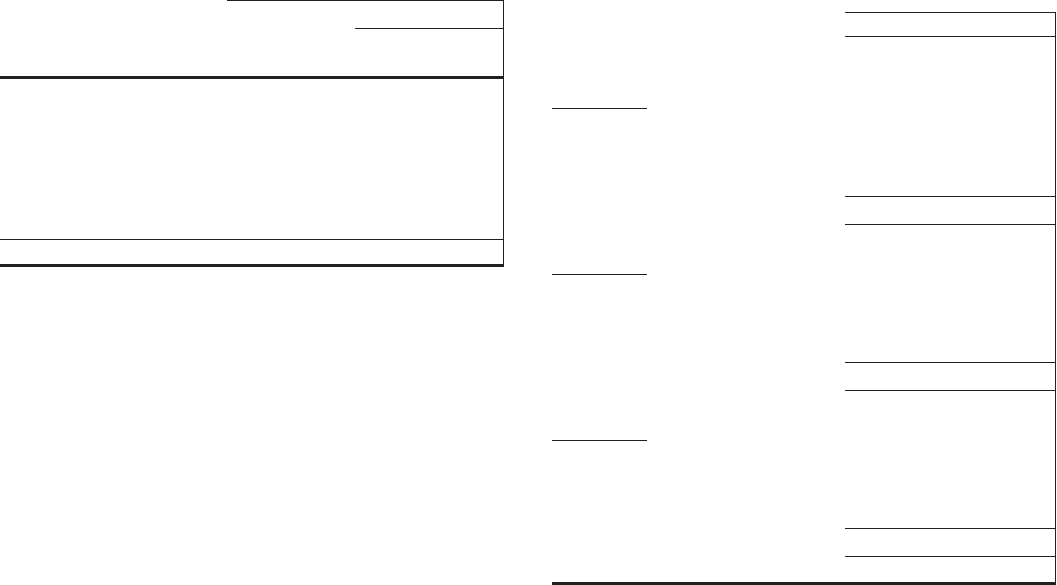

Details of other comprehensive income (loss) are as follows

(in millions):

Pretax Tax After-tax

Net unrealized securities gains (losses)

Balance at January 1, 2005 $ (66)

2005 activity

Increase in net unrealized losses for

securities held at year-end $ (312) $109 (203)

Less: net losses realized in net income

(a) (44) 15 (29)

Net unrealized securities losses (268) 94 (174)

Balance at December 31, 2005 (240)

2006 activity

Increase in net unrealized gains for

securities held at year-end 129 (46) 83

Less: net losses realized in net income

(a) (101) 35 (66)

Net unrealized securities gains 230 (81) 149

Balance at December 31, 2006 (91)

2007 activity

Increase in net unrealized losses for

securities held at year-end (134) 52 (82)

Less: net losses realized in net income

(a) (9) 3 (6)

Net unrealized securities losses (125) 49 (76)

Balance at December 31, 2007 $ (167)

(a) Pretax amounts represent net unrealized gains (losses) as of the prior year-end date

that were realized in the subsequent year when the related securities were sold.

These amounts differ from net securities losses included in the Consolidated Income

Statement primarily because they do not include gains or losses realized on

securities that were purchased and then sold during the same year.

93