PNC Bank 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

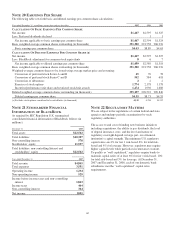

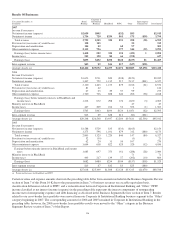

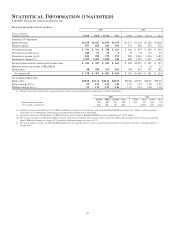

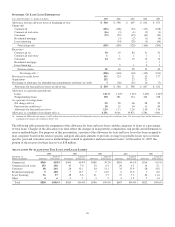

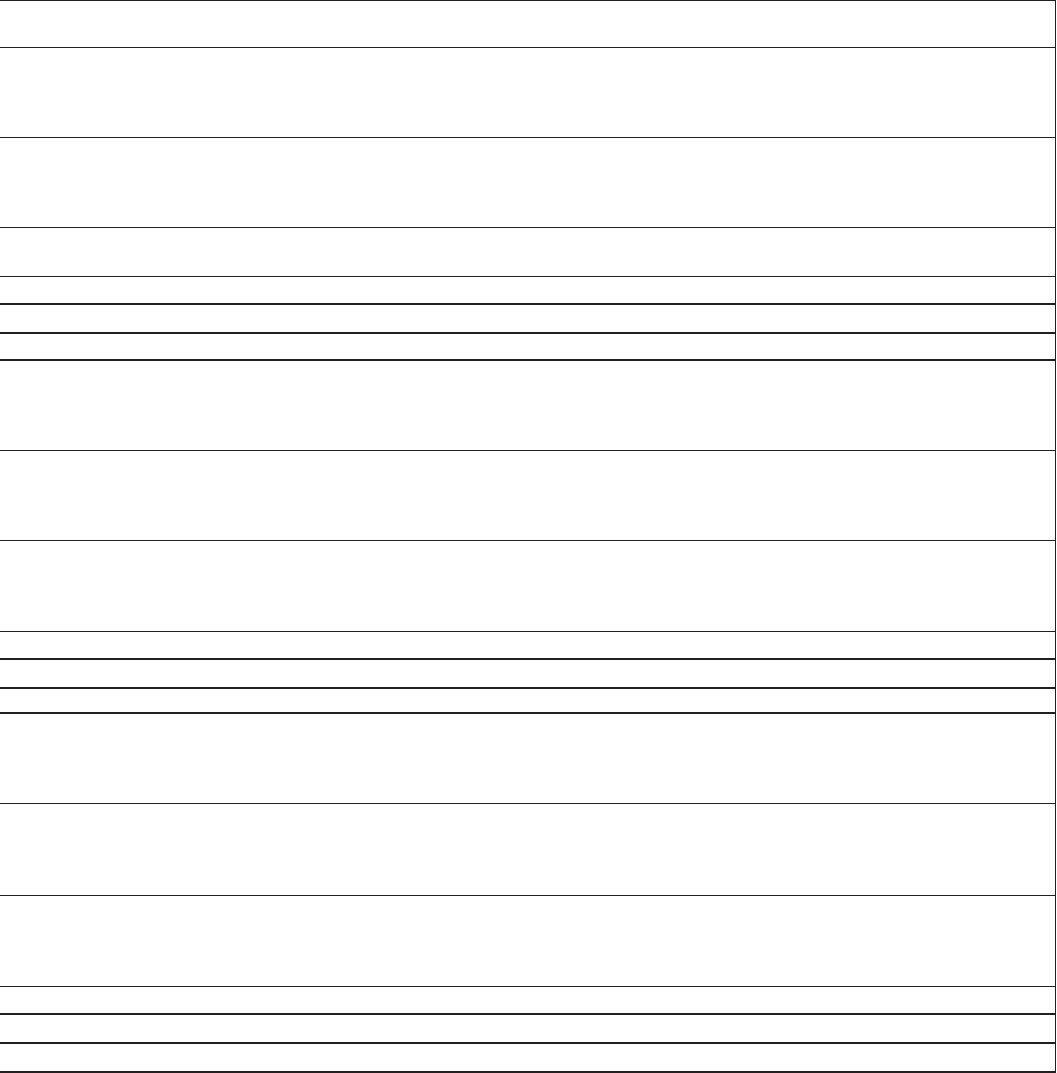

Results Of Businesses

Year ended December 31

In millions

Retail

Banking

Corporate &

Institutional

Banking BlackRock PFPC Other

Intercompany

Eliminations Consolidated

2007

I

NCOME

S

TATEMENT

Net interest income (expense) $2,059 $805 ($32) $83 $2,915

Noninterest income 1,736 720 $334 863 175 ($38) 3,790

Total revenue 3,795 1,525 334 831 258 (38) 6,705

Provision for (recoveries of) credit losses 138 125 52 315

Depreciation and amortization 124 22 60 97 303

Other noninterest expense 2,115 796 577 544 (39) 3,993

Earnings (loss) before income taxes 1,418 582 334 194 (435) 1 2,094

Income taxes 525 150 84 66 (198) 627

Earnings (loss) $893 $432 $250 $128 ($237) $1 $1,467

Inter-segment revenue $23 $9 $16 $17 ($27) ($38)

Average Assets (a) $42,424 $29,052 $4,259 $2,476 $48,885 ($3,678) $123,418

2006

I

NCOME

S

TATEMENT

Net interest income (expense) $1,673 $711 $20 ($38) ($121) $2,245

Noninterest income 1,447 752 1,135 917 2,137 ($61) 6,327

Total revenue 3,120 1,463 1,155 879 2,016 (61) 8,572

Provision for (recoveries of) credit losses 81 42 1 124

Depreciation and amortization 67 23 29 57 99 275

Other noninterest expense 1,760 726 828 646 266 (58) 4,168

Earnings (loss) before minority interests in BlackRock and

income taxes 1,212 672 298 176 1,650 (3) 4,005

Minority interests in BlackRock 47 47

Income taxes 447 209 104 52 552 (1) 1,363

Earnings (loss) $765 $463 $194 $124 $1,051 ($2) $2,595

Inter-segment revenue $13 $9 $28 $12 ($1) ($61)

Average Assets (a) $29,248 $26,548 $3,937 $2,204 $35,611 ($2,536) $95,012

2005

I

NCOME

S

TATEMENT

Net interest income (expense) $1,588 $729 $35 ($33) ($165) $2,154

Noninterest income 1,275 596 1,191 879 312 ($80) 4,173

Total revenue 2,863 1,325 1,226 846 147 (80) 6,327

Provision for (recoveries of) credit losses 52 (30) (1) 21

Depreciation and amortization 62 20 31 56 107 276

Other noninterest expense 1,664 638 822 629 329 (52) 4,030

Earnings before minority interests in BlackRock and income

taxes 1,085 697 373 161 (288) (28) 2,000

Minority interests in BlackRock 71 71

Income taxes 403 217 139 57 (202) (10) 604

Earnings (loss) $682 $480 $234 $104 ($157) ($18) $1,325

Inter-segment revenue $13 $7 $32 $3 $25 ($80)

Average Assets (a) $27,618 $25,309 $1,848 $2,128 $33,315 ($1,670) $88,548

(a) Period-end balances for BlackRock and PFPC

Certain revenue and expense amounts shown in the preceding table differ from amounts included in the Business Segments Review

section of Item 7 of this Form 10-K due to the presentation in Item 7 of business revenues on a taxable-equivalent basis,

classification differences related to PFPC, and a reclassification between Corporate & Institutional Banking and “Other.” PFPC

income classified as net interest income (expense) in the preceding table represents the interest components of nonoperating

income (net of nonoperating expense) and debt financing as disclosed in the Business Segments Review section of Item 7. Results

related to our cross-border lease portfolio were moved from our Corporate & Institutional Banking business segment to the “Other”

category beginning in 2007. The corresponding amounts for 2006 and 2005 remained in Corporate & Institutional Banking in the

preceding table; however, the 2006 cross-border lease portfolio results were moved to the “Other” category in the Business

Segments Review section of Item 7 of this Report.

116