PNC Bank 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

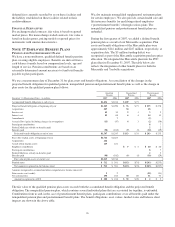

N

OTE

7G

OODWILL AND

O

THER

I

NTANGIBLE

A

SSETS

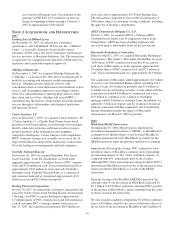

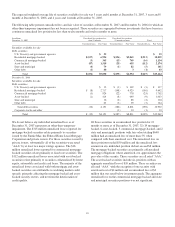

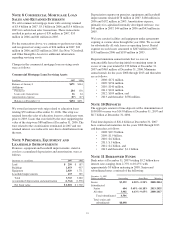

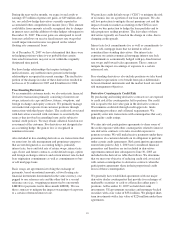

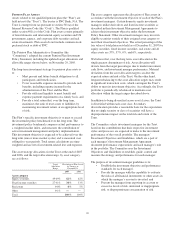

A summary of the changes in goodwill by business segment

during 2007 follows:

Goodwill

In millions

Dec. 31

2006

Additions/

Adjustments

Dec. 31

2007

Retail Banking $1,466 $4,162 $5,628

Corporate & Institutional

Banking 938 553 1,491

PFPC 968 261 1,229

BlackRock 30 27 57

Total $3,402 $5,003 $8,405

Assets and liabilities of acquired entities are recorded at

estimated fair value as of the acquisition date and are subject

to refinement as information relative to the fair values at that

date becomes available. We are awaiting certain information

relating to pre-acquisition contingencies. Revisions would

likely result in subsequent adjustments to goodwill. The

goodwill and other intangible assets related to Mercantile and

Yardville are reported in the Retail Banking and Corporate &

Institutional Banking business segments.

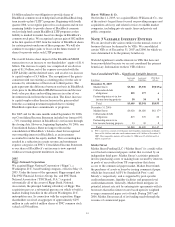

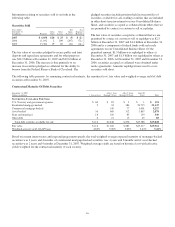

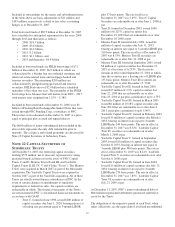

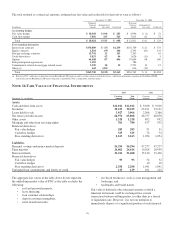

The gross carrying amount, accumulated amortization and net

carrying amount of other intangible assets by major category

consisted of the following:

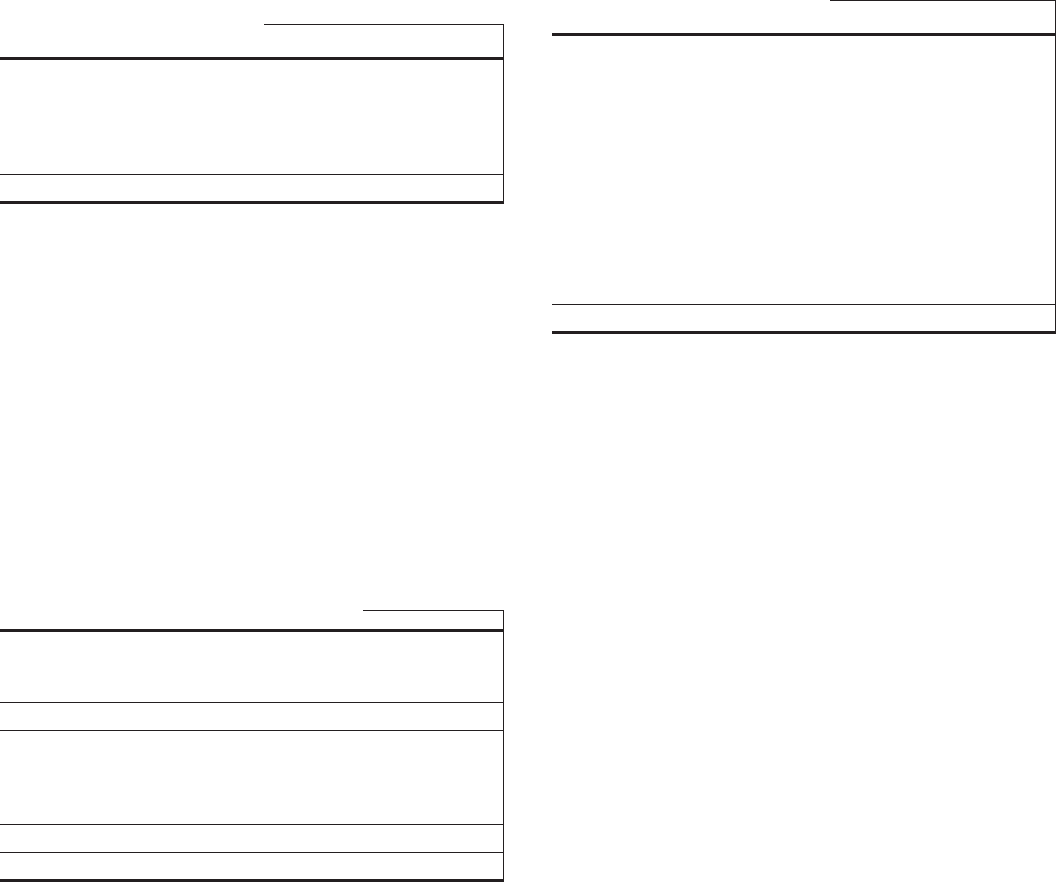

Other Intangible Assets

December 31 - in millions 2007 2006

Customer-related and other intangibles

Gross carrying amount $ 708 $ 342

Accumulated amortization (263) (178)

Net carrying amount $ 445 $ 164

Mortgage and other loan

servicing rights

Gross carrying amount $1,001 $ 689

Accumulated amortization (300) (212)

Net carrying amount $ 701 $ 477

Total $1,146 $ 641

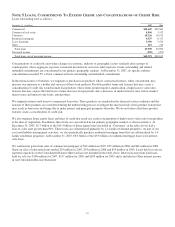

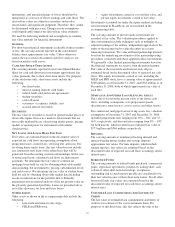

While most of our other intangible assets have finite lives and

are amortized primarily on a straight-line basis, mortgage and

other loan servicing rights and certain core deposit intangibles

are amortized on an accelerated basis.

For customer-related intangibles, the estimated remaining

useful lives range from less than one year to 15 years, with a

weighted-average remaining useful life of approximately 9

years. Our mortgage and other loan servicing rights are

amortized primarily over a period of 5 to 10 years in

proportion to the estimated net servicing cash flows from the

related loans.

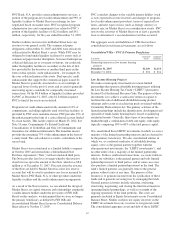

The changes in the carrying amount of goodwill and net other

intangible assets during 2007 follows:

Changes in Goodwill and Other Intangibles

In millions Goodwill

Customer-

Related

Servicing

Rights

December 31, 2006 $3,402 $164 $477

Additions/adjustments:

Mercantile acquisition 4,363 281 9

ARCS acquisition (a) 83 1 188

Yardville acquisition 273 28

Albridge and Coates Analytics

acquisitions 261 56

BlackRock 27

Mortgage and other loan servicing

rights 115

Other (4)

Amortization (85) (88)

December 31, 2007 $8,405 $445 $701

(a) ARCS goodwill is expected to be deductible for tax purposes over 15 years.

Our investment in BlackRock changes when BlackRock

repurchases its shares in the open market or issues shares for

an acquisition or pursuant to its employee compensation plans.

We record goodwill when BlackRock repurchases its shares at

an amount greater than book value per share and this results in

an increase in our percentage ownership interest.

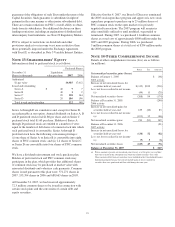

Servicing revenue from both commercial and residential

mortgage servicing assets and liabilities generated

contractually specified servicing fees, net interest income

from servicing portfolio deposit balances and ancillary fees

totaling $192 million and $139 million for the years ended

December 31, 2007 and 2006, respectively. We also generate

servicing revenue from fee-based activities provided to others.

Amortization expense on intangible assets for 2007, 2006 and

2005 was $173 million, $99 million and $74 million,

respectively. Amortization expense on existing intangible

assets for 2008 through 2012 is estimated to be as follows:

• 2008: $193 million,

• 2009: $162 million,

• 2010: $141 million,

• 2011: $131 million, and

• 2012: $115 million.

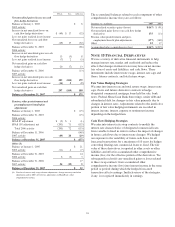

We conduct a goodwill impairment test on our reporting units

at least annually or more frequently if any adverse triggering

events occur. Based on the results of our analysis, there were

no impairment charges related to goodwill recognized in 2007,

2006 or 2005. The fair value of our reporting units is

determined by using discounted cash flow and market

comparability methodologies.

90