PNC Bank 2007 Annual Report Download - page 32

Download and view the complete annual report

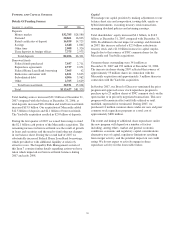

Please find page 32 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We estimate that at December 31, 2007 the effective duration

of securities available for sale was 2.8 years for an immediate

50 basis points parallel increase in interest rates and 2.5 years

for an immediate 50 basis points parallel decrease in interest

rates. Comparable amounts at December 31, 2006 were 2.6

years and 2.2 years, respectively.

L

OANS

H

ELD

F

OR

S

ALE

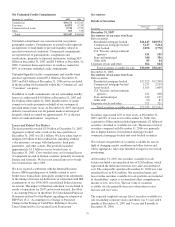

Loans held for sale totaled $3.9 billion at December 31, 2007

compared with $2.4 billion a year ago.

Loans held for sale included commercial mortgage loans

intended for securitization totaling $2.1 billion at December 31,

2007 and $.9 billion at December 31, 2006. The balance at

December 31, 2007 increased as market conditions were not

conducive to completing securitization transactions during the

fourth quarter of 2007. We also reduced our origination activity

in early 2008. During the fourth quarter of 2007, a lower of cost

or fair value adjustment was recorded of $26 million. This loss

was reflected in the other noninterest income line item in our

Consolidated Income Statement and in the results of the

Corporate & Institutional Banking business segment. In early

2008, spreads have been widening and there has been limited

activity in the CMBS securitization market. We value our

commercial mortgage loans held for sale based on securitization

prices. Therefore, if these conditions continue, additional losses

will be incurred that will be significantly higher than the losses

incurred during the fourth quarter of 2007. However, we do not

expect the impact to be significant to our capital position.

Currently, these valuation losses are unrealized (non-cash) and

all of the loans in this portfolio are performing.

Loans held for sale also included education loans held for sale

of $1.5 billion at December 31, 2007 and $1.3 billion at

December 31, 2006. Historically, we classified substantially

all of our education loans as loans held for sale. Gains on sales

of education loans totaled $24 million in 2007, $33 million for

2006 and $19 million for 2005. These gains are reflected in

the other noninterest income line item in our Consolidated

Income Statement and in the results of the Retail Banking

business segment.

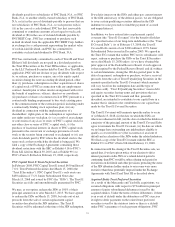

In the past, we have sold education loans to issuers of asset-

backed paper when the loans are placed into repayment status.

Recently, the secondary markets for education loans have been

impacted by liquidity issues similar to other asset classes. As a

result, we believe the ability to sell education loans and generate

related gains will be limited in 2008. Given this outlook and the

economic and customer relationship value inherent in this

product, in February 2008, we transferred the loans at lower of

cost or market value from held for sale to the loan portfolio.

G

OODWILL AND

O

THER

I

NTANGIBLE

A

SSETS

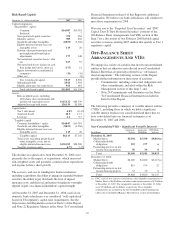

The sum of goodwill and other intangible assets increased

$5.5 billion at December 31, 2007 compared with the prior

year end, to $9.6 billion. We added $4.7 billion of goodwill

and other intangible assets in connection with the Mercantile

acquisition. In addition, our acquisitions of ARCS, Yardville

and Albridge collectively added $.9 billion of goodwill and

other intangible assets during 2007. Additional information is

included in Note 7 Goodwill And Other Intangible Assets in

the Notes To Consolidated Financial Statements under Item 8

of this Report.

O

THER

A

SSETS

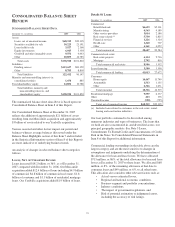

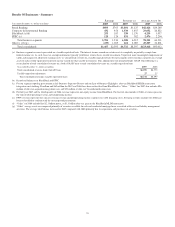

The increase of $4.1 billion in “Assets-Other” in the preceding

“Summarized Balance Sheet Data” table included the impact

of a $1.0 billion increase in Federal funds sold and resale

agreements and a $1.0 billion increase in other short-term

investments, including trading securities.

27