PNC Bank 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F

UNDING AND

C

APITAL

S

OURCES

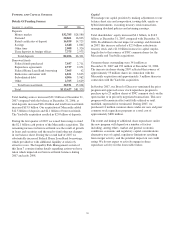

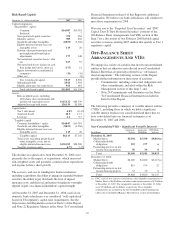

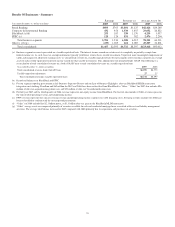

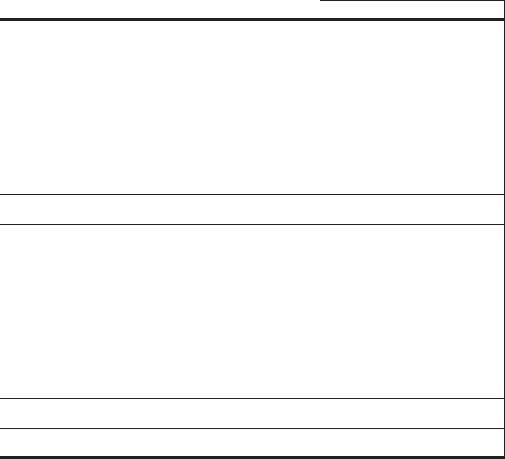

Details Of Funding Sources

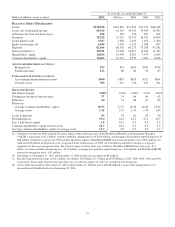

December 31 - in millions 2007 2006

Deposits

Money market $32,785 $28,580

Demand 20,861 16,833

Retail certificates of deposit 16,939 14,725

Savings 2,648 1,864

Other time 2,088 1,326

Time deposits in foreign offices 7,375 2,973

Total deposits 82,696 66,301

Borrowed funds

Federal funds purchased 7,037 2,711

Repurchase agreements 2,737 2,051

Federal Home Loan Bank borrowing 7,065 42

Bank notes and senior debt 6,821 3,633

Subordinated debt 4,506 3,962

Other 2,765 2,629

Total borrowed funds 30,931 15,028

Total $113,627 $81,329

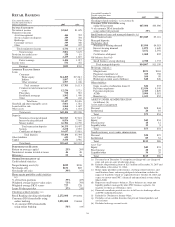

Total funding sources increased $32.3 billion at December 31,

2007 compared with the balance at December 31, 2006, as

total deposits increased $16.4 billion and total borrowed funds

increased $15.9 billion. Our acquisition of Mercantile added

$12.5 billion of deposits and $2.1 billion of borrowed funds.

The Yardville acquisition resulted in $2.0 billion of deposits.

During the first quarter of 2007 we issued borrowings to fund

the $2.1 billion cash portion of the Mercantile acquisition. The

remaining increase in borrowed funds was the result of growth

in loans and securities and the need to fund other net changes

in our balance sheet. During the second half of 2007 we

substantially increased Federal Home Loan Bank borrowings,

which provided us with additional liquidity at relatively

attractive rates. The Liquidity Risk Management section of

this Item 7 contains further details regarding actions we have

taken which impacted our borrowed funds balances during

2007 and early 2008.

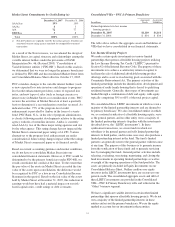

Capital

We manage our capital position by making adjustments to our

balance sheet size and composition, issuing debt, equity or

hybrid instruments, executing treasury stock transactions,

managing dividend policies and retaining earnings.

Total shareholders’ equity increased $4.1 billion, to $14.9

billion, at December 31, 2007 compared with December 31,

2006. In addition to the net impact of earnings and dividends

in 2007, this increase reflected a $2.5 billion reduction in

treasury stock and a $1.0 billion increase in capital surplus,

largely due to the issuance of PNC common shares for the

Mercantile and Yardville acquisitions.

Common shares outstanding were 341 million at

December 31, 2007 and 293 million at December 31, 2006.

The increase in shares during 2007 reflected the issuance of

approximately 53 million shares in connection with the

Mercantile acquisition and approximately 3 million shares in

connection with the Yardville acquisition.

In October 2007, our Board of Directors terminated the prior

program and approved a new stock repurchase program to

purchase up to 25 million shares of PNC common stock on the

open market or in privately negotiated transactions. This new

program will remain in effect until fully utilized or until

modified, superseded or terminated. During 2007, we

purchased 11 million common shares under our new and prior

common stock repurchase programs at a total cost of

approximately $800 million.

The extent and timing of additional share repurchases under

the new program will depend on a number of factors

including, among others, market and general economic

conditions, economic and regulatory capital considerations,

alternative uses of capital, regulatory limitations resulting

from merger activity, and the potential impact on our credit

rating. We do not expect to actively engage in share

repurchase activity for the foreseeable future.

28