PNC Bank 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

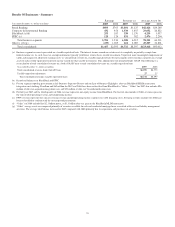

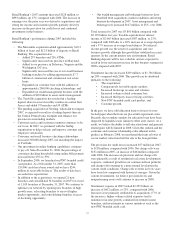

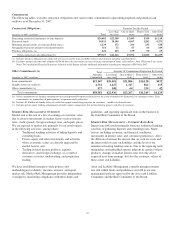

PFPC

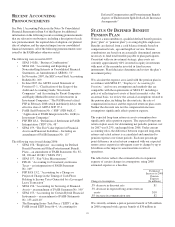

Year ended December 31

Dollars in millions except as noted 2007 2006

I

NCOME

S

TATEMENT

Servicing revenue (a) $863 $800

Operating expense (a) 637 586

Operating income 226 214

Debt financing 38 42

Nonoperating income (b) 64

Pretax earnings 194 176

Income taxes 66 52

Earnings $128 $124

P

ERIOD

-

END

B

ALANCE

S

HEET

Goodwill and other intangible assets $1,315 $1,012

Other assets 1,161 1,192

Total assets $2,476 $2,204

Debt financing $989 $792

Other liabilities 865 917

Shareholder’s equity 622 495

Total funds $2,476 $2,204

P

ERFORMANCE

R

ATIOS

Return on average equity 23% 29%

Operating margin (c) 26 27

S

ERVICING

S

TATISTICS

(at December 31)

Accounting/administration net fund

assets (in billions) (d)

Domestic $869 $746

Offshore 121 91

Total $990 $837

Asset type (in billions)

Money market $373 $281

Equity 390 354

Fixed income 123 117

Other 104 85

Total $990 $837

Custody fund assets (in billions) $500 $427

Shareholder accounts (in millions)

Transfer agency 19 18

Subaccounting 53 50

Total 72 68

O

THER INFORMATION

Full-time employees (at December 31) 4,784 4,381

(a) Certain out-of-pocket expense items which are then client billable are included in

both servicing revenue and operating expense above, but offset each other entirely

and therefore have no effect on operating income. Distribution revenue and expenses

which related to 12b-1 fees that PFPC receives from certain fund clients for the

payment of marketing, sales and service expenses also entirely offset each other, but

are netted for presentation purposes above. Amounts for 2006 have been reclassified

to conform with the 2007 presentation.

(b) Net of nonoperating expense.

(c) Total operating income divided by total servicing revenue.

(d) Includes alternative investment net assets serviced.

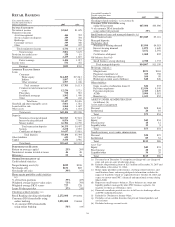

PFPC earned $128 million for 2007 compared with $124

million in 2006. Results for 2006 benefited from the impact of

a $14 million reversal of deferred taxes related to earnings

from foreign subsidiaries following management’s

determination that the earnings would be indefinitely

reinvested outside of the United States. Apart from the impact

of this item, earnings increased $18 million in 2007 reflecting

the successful conversion of net new business, organic growth

and market appreciation.

Highlights of PFPC’s performance in 2007 included:

• Acquisitions of Albridge and Coates Analytics in

December 2007 which will allow PFPC to add

analytical information tools to its current product

offerings.

• Expansion in Europe included the approval of a

banking license in Ireland and a branch in

Luxembourg, which will allow PFPC to provide

depositary services in Europe’s leading domicile for

traditional investment funds and the second largest

worldwide domicile after the United States. The

opening of a new sales office in London will enhance

efforts to expand global business development efforts

afforded by these approvals.

• Increases in total fund assets serviced from $2.2

trillion to $2.5 trillion, or 14%, and in total

shareholder accounts serviced from 68 million to

72 million, or 6%, during the past year reflected the

successful conversion of new business as well as

organic growth from existing customers.

• Combined revenue growth of 21% from managed

accounts, offshore operations, and alternative

investments, all targeted growth businesses, over the

past year resulted from increased assets. Offshore and

managed account assets serviced each exceeded $100

billion.

Servicing revenue for 2007 increased by $63 million, or 8%,

over 2006, to $863 million. Increases in offshore operations,

transfer agency, managed accounts, and alternative

investments drove the higher servicing revenue.

Operating expense increased $51 million, or 9%, to $637

million in 2007 compared with 2006. The majority of this

increase is attributable to increased headcount and technology

costs to support new business achieved over the past year, as

well as costs related to the 2007 acquisitions.

The discussions of PFPC under Item 1 and the Executive

Summary portion of Item 7 of this Report include additional

information regarding the Albridge and Coates Analytics

acquisitions.

42