PNC Bank 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

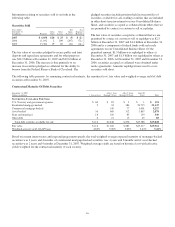

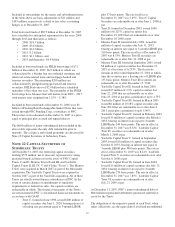

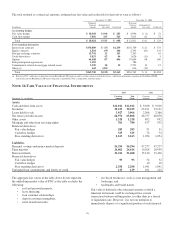

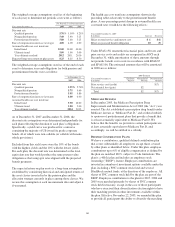

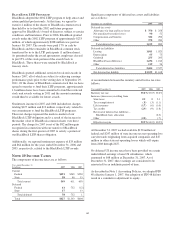

The total notional or contractual amounts, estimated net fair value and credit risk for derivatives were as follows:

December 31, 2007 December 31, 2006

In millions

Notional/

Contract

amount

Estimated net

fair value Credit risk

Notional/

Contract

amount

Estimated net

fair value Credit risk

Accounting hedges

Fair value hedges $ 10,568 $ 190 $ 283 $ 4,996 $ (1) $ 51

Cash flow hedges 7,856 325 325 7,815 62 72

Total $ 18,424 $ 515 $ 608 $ 12,811 $ 61 $ 123

Free-standing derivatives

Interest rate contracts $170,889 $ (17) $1,259 $101,749 $ 21 $ 533

Equity contracts 1,824 (69) 144 2,393 (63) 134

Foreign exchange contracts 15,741 13 153 7,203 61

Credit derivatives 5,823 42 96 3,626 (11) 5

Options 64,448 87 496 97,669 68 306

Risk participation agreements 1,183 786

Commitments related to mortgage-related assets 3,190 10 15 2,723 10 15

Other (a) 642 (201) 616 (12)

Total $263,740 $(135) $2,163 $216,765 $ 13 $1,054

(a) Relates to PNC’s obligation to help fund certain BlackRock LTIP programs and to certain customer-related derivatives. Additional information regarding the BlackRock/MLIM

transaction and our BlackRock LTIP shares obligation is included in Note 2 Acquisitions and Divestitures.

N

OTE

16 F

AIR

V

ALUE OF

F

INANCIAL

I

NSTRUMENTS

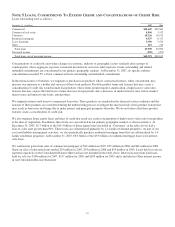

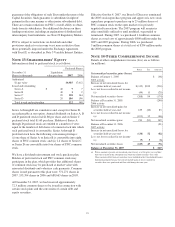

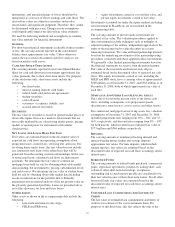

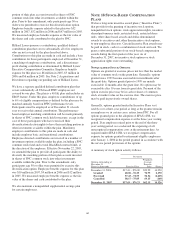

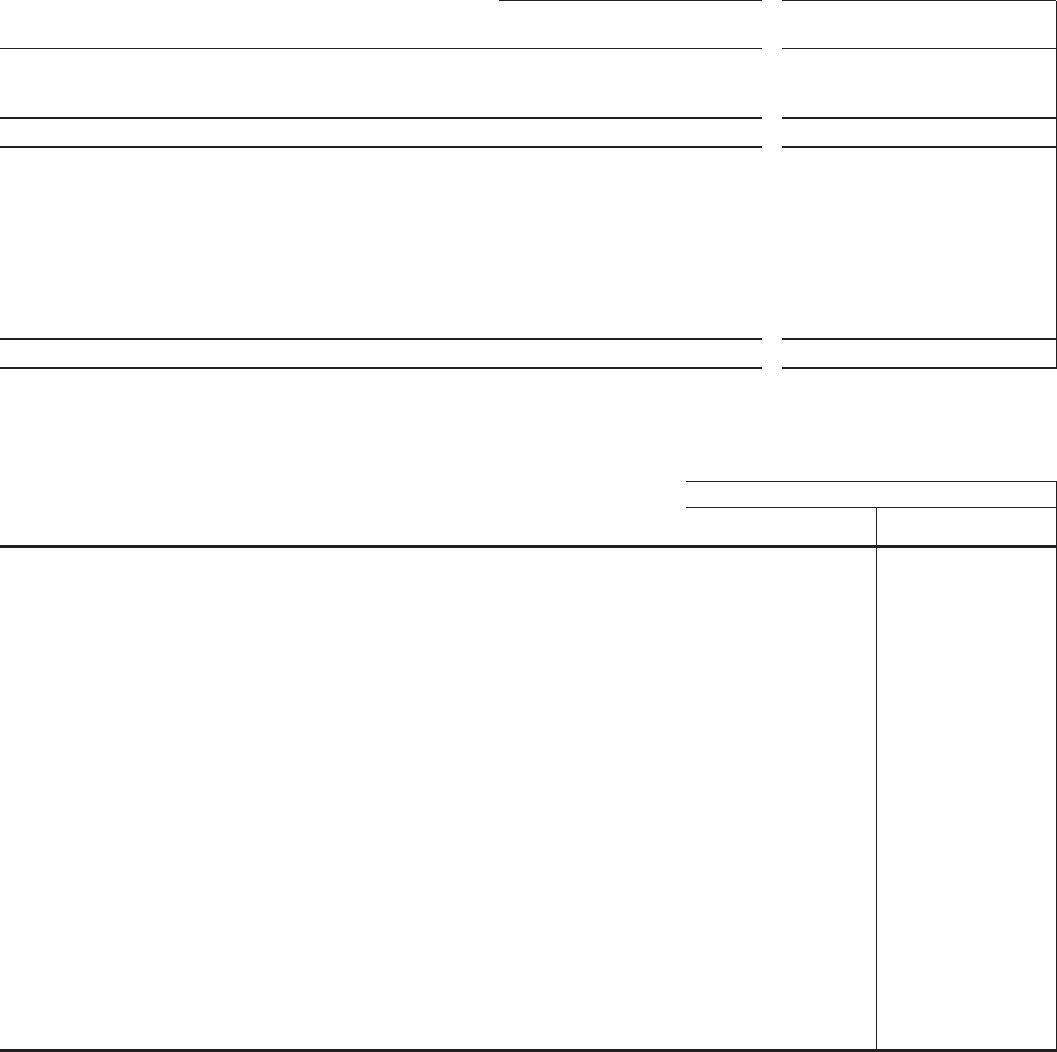

2007 2006

December 31 - in millions

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Assets

Cash and short-term assets $11,012 $11,012 $ 9,016 $ 9,016

Securities 30,225 30,225 23,191 23,191

Loans held for sale 3,927 3,966 2,366 2,366

Net loans (excludes leases) 64,976 65,808 46,757 46,878

Other assets 1,328 1,328 892 892

Mortgage and other loan servicing rights 701 780 477 552

Financial derivatives

Fair value hedges 283 283 51 51

Cash flow hedges 325 325 72 72

Free-standing derivatives 2,163 2,163 1,054 1,054

Liabilities

Demand, savings and money market deposits 56,294 56,294 47,277 47,277

Time deposits 26,402 26,416 19,024 18,959

Borrowed funds 31,254 31,608 15,310 15,496

Financial derivatives

Fair value hedges 93 93 52 52

Cash flow hedges 10 10

Free-standing derivatives 2,298 2,298 1,041 1,041

Unfunded loan commitments and letters of credit 129 129 101 122

The aggregate fair values in the table above do not represent

the underlying market value of PNC as the table excludes the

following:

• real and personal property,

• lease financing,

• loan customer relationships,

• deposit customer intangibles,

• retail branch networks,

• fee-based businesses, such as asset management and

brokerage, and

• trademarks and brand names.

Fair value is defined as the estimated amount at which a

financial instrument could be exchanged in a current

transaction between willing parties, or other than in a forced

or liquidation sale. However, it is not our intention to

immediately dispose of a significant portion of such financial

96