PNC Bank 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Control Strategies

We centrally manage policy development and exception

oversight through corporate-level risk management. Corporate

risk management is authorized to take action to either prevent

or mitigate exceptions to policies and is responsible for

monitoring compliance with risk management policies. The

Corporate Audit function performs an independent assessment

of the internal control environment. Corporate Audit plays a

critical role in risk management, testing the operation of the

internal control system and reporting findings to management

and to the Audit Committee of the Board.

Risk Monitoring

Corporate risk management reports on a regular basis to our

Board regarding the enterprise risk profile of the Corporation.

These reports aggregate and present the level of risk by type

of risk and communicate significant risk issues, including

performance relative to risk tolerance limits. Both the Board

and the ERMC provide guidance on actions to address key

risk issues as identified in these reports.

C

REDIT

R

ISK

M

ANAGEMENT

Credit risk represents the possibility that a customer,

counterparty or issuer may not perform in accordance with

contractual terms. Credit risk is inherent in the financial

services business and results from extending credit to

customers, purchasing securities, and entering into financial

derivative transactions. Credit risk is one of our most

significant risks.

Approved risk tolerances, in addition to credit policies and

procedures, set portfolio objectives for the level of credit risk.

We have established guidelines for problem loans, acceptable

levels of total borrower exposure, and other credit measures.

We seek to achieve our credit portfolio objectives by

maintaining a customer base that is diverse in borrower

exposure and industry types. We use loan participations with

third parties, loan sales and syndications, and the purchase of

credit derivatives to reduce risk concentrations.

The credit granting businesses maintain direct responsibility

for monitoring credit risk within PNC. The Corporate Credit

Policy area provides independent oversight to the

measurement, monitoring and reporting of our credit risk and

reports to the Chief Administrative Officer. Corporate Audit

also provides an independent assessment of the effectiveness

of the credit risk management process.

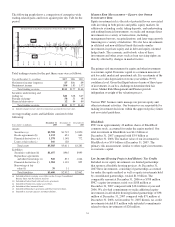

Nonperforming, Past Due And Potential Problem Assets

See the Nonperforming Assets And Related Information table

in the Statistical Information (Unaudited) section of Item 8 of

this Report and included here by reference for details of the

types of nonperforming assets that we held at December 31 of

each of the past five years. In addition, certain performing

assets have interest payments that are past due or have the

potential for future repayment problems.

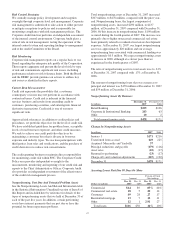

Total nonperforming assets at December 31, 2007 increased

$307 million, to $478 million, compared with the prior year-

end. Nonperforming loans, the largest component of

nonperforming assets, increased $290 million, to $437

million, at December 31, 2007 compared with December 31,

2006. Of this increase in nonperforming loans, $190 million

occurred during the fourth quarter of 2007. The increase was

primarily due to higher nonaccrual commercial real estate

loans primarily related to residential real estate development

exposure. At December 31, 2007, our largest nonperforming

asset was approximately $20 million and our average

nonperforming loan associated with commercial lending was

approximately $0.5 million. We expect nonperforming assets

to increase in 2008, although at a slower pace than we

experienced in the fourth quarter of 2007.

The ratio of nonperforming assets to total assets rose to .34%

at December 31, 2007 compared with .17% at December 31,

2006.

The amount of nonperforming loans that was current as to

principal and interest was $178 million at December 31, 2007

and $59 million at December 31, 2006.

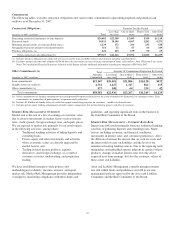

Nonperforming Assets By Business

In millions

December 31

2007

December 31

2006

Retail Banking $225 $106

Corporate & Institutional Banking 243 63

Other 10 2

Total nonperforming assets $478 $171

Change In Nonperforming Assets

In millions 2007 2006

January 1 $171 $216

Transferred from accrual 649 225

Acquired- Mercantile and Yardville 37

Principal reductions and payoffs (179) (116)

Asset sales (10) (17)

Returned to performing (23) (17)

Charge-offs and valuation adjustments (167) (120)

December 31 $478 $171

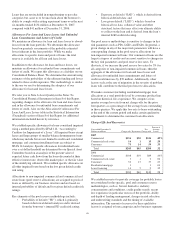

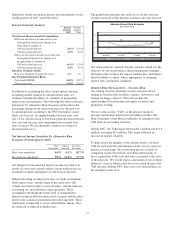

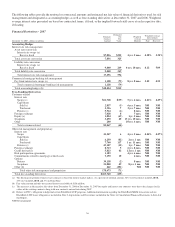

Accruing Loans Past Due 90 Days Or More

Amount

Percent of Total

Outstandings

Dollars in millions

Dec. 31

2007

Dec. 31

2006

Dec. 31

2007

Dec. 31

2006

Commercial $14 $9 .05% .04%

Commercial real estate 18 5.20 .14

Consumer 49 28 .27 .17

Residential mortgage 13 7.14 .11

Other 12 12.91 .27

Total loans $106 $50 .16% .10%

47