PNC Bank 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM

7-

MANAGEMENT

’

S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

E

XECUTIVE

S

UMMARY

T

HE

PNC F

INANCIAL

S

ERVICES

G

ROUP

,I

NC

.

PNC is one of the largest diversified financial services

companies in the United States based on assets, with

businesses engaged in retail banking, corporate and

institutional banking, asset management, and global fund

processing services. We provide many of our products and

services nationally and others in our primary geographic

markets located in Pennsylvania, New Jersey, Washington,

DC, Maryland, Virginia, Ohio, Kentucky and Delaware. We

also provide certain global fund processing services

internationally.

K

EY

S

TRATEGIC

G

OALS

Our strategy to enhance shareholder value centers on driving

positive operating leverage by achieving growth in revenue from

our diverse business mix that exceeds growth in expenses as a

result of disciplined cost management. In each of our business

segments, the primary drivers of revenue growth are the

acquisition, expansion and retention of customer relationships.

We strive to expand our customer base by providing convenient

banking options and leading technology systems, providing a

broad range of fee-based products and services, focusing on

customer service, and through a significantly enhanced branding

initiative. We may also grow revenue through appropriate and

targeted acquisitions and, in certain businesses, by expanding into

new geographical markets.

We have maintained a moderate risk profile characterized by

strong credit quality and limited exposure to earnings volatility

resulting from interest rate fluctuations and the shape of the

interest rate yield curve. Our actions have created a strong

balance sheet, ample liquidity and investment flexibility to

adjust, where appropriate, to changing interest rates and market

conditions. We continue to be disciplined in investing capital in

our businesses while returning a portion to shareholders through

dividends and share repurchases when appropriate.

A

CQUISITION

A

ND

D

IVESTITURE

A

CTIVITY

A summary of pending and recently completed acquisitions

and divestitures is included under Item 1 and in Note 2

Acquisitions and Divestitures in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

K

EY

F

ACTORS

A

FFECTING

F

INANCIAL

P

ERFORMANCE

Our financial performance is substantially affected by several

external factors outside of our control, including:

• General economic conditions,

• Loan demand, utilization of credit commitments and

standby letters of credit, and asset quality

• Customer demand for other products and services,

• Movement of customer deposits from lower to higher

rate accounts or to investment alternatives,

• The level of, direction, timing and magnitude of

movement in interest rates, and the shape of the

interest rate yield curve, and

• The functioning and other performance of, and

availability of liquidity in, the capital and other

financial markets.

• The impact of credit spreads on valuations of

commercial mortgage loans held for sale and the

market for securitization and sale of these assets.

Starting in the middle of 2007, and continuing at present, there

has been significant turmoil and volatility in worldwide

financial markets, accompanied by uncertain prospects for the

overall economy. Our performance in 2008 will be impacted

by developments in these areas. In addition, our success in

2008 will depend, among other things, upon:

• Further success in the acquisition, growth and

retention of customers,

• The successful integration of Yardville and progress

toward closing and integrating the Sterling

acquisition,

• Completing the divestiture of Hilliard Lyons,

• Continued development of the Mercantile franchise,

including full deployment of our product offerings,

• Revenue growth,

• A sustained focus on expense management and

creating positive operating leverage,

• Maintaining strong overall asset quality,

• Prudent risk and capital management, and

• Actions we take within the capital and other financial

markets.

S

UMMARY

F

INANCIAL

R

ESULTS

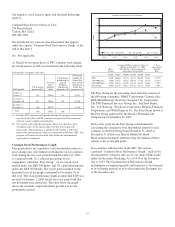

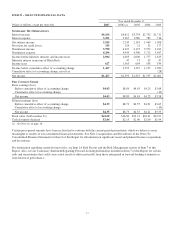

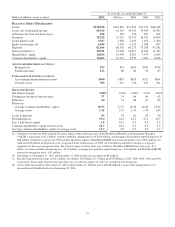

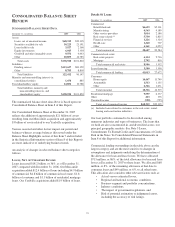

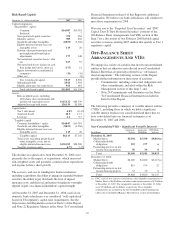

Year ended December 31

In billions, except for

per share data 2007 2006

Net income $1.467 $2.595

Diluted earnings per share $4.35 $8.73

Return on

Average common

shareholders’ equity 10.53% 27.97%

Average assets 1.19% 2.73%

We refer you to the Consolidated Income Statement Review

portion of the 2006 Versus 2005 section of this Item 7 for

significant items which collectively increased net income for

2006 by $1.1 billion, or $3.67 per diluted share.

Our performance in 2007 included the following

accomplishments:

• Our total assets at December 31, 2007 reached a

record level of $139 billion, as further detailed in the

Consolidated Balance Sheet Review section of this

Item 7. We achieved growth by expanding our

footprint, growing and deepening customer

relationships, and enhancing product capabilities.

• We differentiated ourselves with a diverse revenue

mix of both interest and noninterest

19