PNC Bank 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

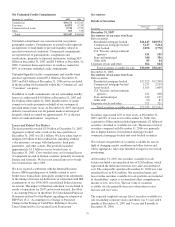

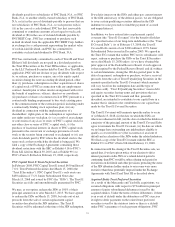

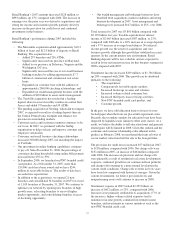

Market Street Commitments by Credit Rating (a)

December 31, 2007 December 31, 2006

AAA/Aaa 19% 10%

AA/Aa 65

A/A 72 77

BBB/Baa 38

Total 100% 100%

a) Not all Facilities are explicitly rated by the rating agencies. Facilities are

structured to meet rating agency standards for comparably structured

transactions.

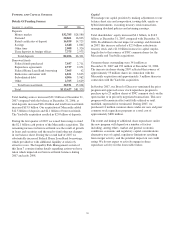

As a result of the Note issuance, we reevaluated the design of

Market Street, its capital structure and relationships among the

variable interest holders under the provisions of FASB

Interpretation No. 46, (Revised 2003) “Consolidation of

Variable Interest entities (“FIN 46R”). Based on this analysis,

we determined that we were no longer the primary beneficiary

as defined by FIN 46R and deconsolidated Market Street from

our Consolidated Balance Sheet effective October 17, 2005.

PNC considers changes to the variable interest holders (such

as new expected loss note investors and changes to program-

level credit enhancement providers), terms of expected loss

notes, and new types of risks (such as foreign currency or

interest rate) in Market Street as reconsideration events. PNC

reviews the activities of Market Street on at least a quarterly

basis to determine if a reconsideration event has occurred. As

indicated earlier, 75% of the program-level credit

enhancement is provided by Ambac in the form of a surety

bond. PNC Bank, N.A., in the role of program administrator,

is closely following market developments relative to the rating

agency outlooks of monoline insurers. Ambac is currently

rated AAA by two of the three major rating agencies and AA

by the other agency. This rating change has not impacted the

Market Street commercial paper ratings of A1/P1. Various

alternatives to the program-level enhancement are under

consideration if future rating changes impact either the ratings

of Market Street commercial paper or its financial results.

Based on current accounting guidance and market conditions,

we do not have to consolidate Market Street into our

consolidated financial statements. However, if PNC would be

determined to be the primary beneficiary under FIN 46R, we

would consolidate the conduit at that time. To the extent that

the par value of the assets in Market Street exceeded the fair

value of the assets upon consolidation, the difference would

be recognized by PNC as a loss in our Consolidated Income

Statement in that period. Based on the fair value of the assets

held by Market Street at December 31, 2007, this reduction in

earnings would not have had a material impact on our risk-

based capital ratios, credit ratings or debt covenants.

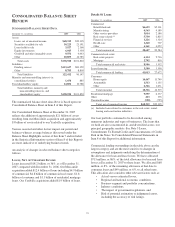

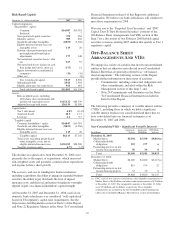

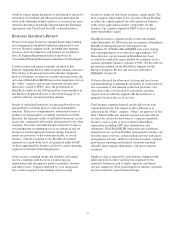

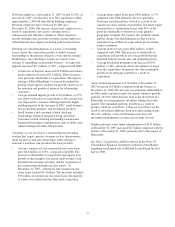

Consolidated VIEs – PNC Is Primary Beneficiary

In millions

Aggregate

Assets

Aggregate

Liabilities

Partnership interests in low income

housing projects

December 31, 2007 $1,110 $1,110

December 31, 2006 $ 834 $ 834

The table above reflects the aggregate assets and liabilities of

VIEs that we have consolidated in our financial statements.

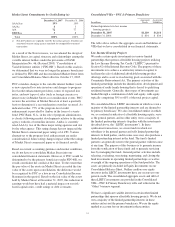

Low Income Housing Projects

We make certain equity investments in various limited

partnerships that sponsor affordable housing projects utilizing

the Low Income Housing Tax Credit (“LIHTC”) pursuant to

Section 42 of the Internal Revenue Code. The purpose of these

investments is to achieve a satisfactory return on capital, to

facilitate the sale of additional affordable housing product

offerings and to assist us in achieving goals associated with the

Community Reinvestment Act. The primary activities of the

limited partnerships include the identification, development and

operation of multi-family housing that is leased to qualifying

residential tenants. Generally, these types of investments are

funded through a combination of debt and equity, with equity

typically comprising 30% to 60% of the total project capital.

We consolidated those LIHTC investments in which we own a

majority of the limited partnership interests and are deemed to

be primary beneficiary. We also consolidated entities in which

we, as a national syndicator of affordable housing equity, serve

as the general partner, and no other entity owns a majority of

the limited partnership interests (together with the investments

described above, the “LIHTC investments”). In these

syndication transactions, we create funds in which our

subsidiary is the general partner and sells limited partnership

interests to third parties, and in some cases may also purchase a

limited partnership interest in the fund. The fund’s limited

partners can generally remove the general partner without cause

at any time. The purpose of this business is to generate income

from the syndication of these funds and to generate servicing

fees by managing the funds. General partner activities include

selecting, evaluating, structuring, negotiating, and closing the

fund investments in operating limited partnerships, as well as

oversight of the ongoing operations of the fund portfolio. The

assets are primarily included in Equity Investments on our

Consolidated Balance Sheet. Neither creditors nor equity

investors in the LIHTC investments have any recourse to our

general credit. The consolidated aggregate assets and debt of

these LIHTC investments are provided in the Consolidated

VIEs – PNC Is Primary Beneficiary table and reflected in the

“Other” business segment.

We have a significant variable interest in certain other limited

partnerships that sponsor affordable housing projects. We do not

own a majority of the limited partnership interests in these

entities and are not the primary beneficiary. We use the equity

method to account for our investment in these entities.

31