PNC Bank 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

our primary geographic markets, with certain products and

services provided nationally.

Corporate & Institutional Banking is focused on becoming a

premier provider of financial services in each of the markets it

serves. Its value proposition to its customers is driven by

providing a broad range of competitive and high quality

products and services by a team fully committed to delivering

the comprehensive resources of PNC to help each client

succeed. Corporate & Institutional Banking’s primary goals

are to achieve market share growth and enhanced returns by

means of expansion and retention of customer relationships

and prudent risk and expense management.

B

LACK

R

OCK

BlackRock, Inc. (“BlackRock”) is one of the largest publicly

traded investment management firms in the United States with

$1.357 trillion of assets under management at December 31,

2007. BlackRock manages assets on behalf of institutional and

individual investors worldwide through a variety of fixed

income, cash management, equity and balanced and

alternative investment separate accounts and funds. In

addition, BlackRock provides risk management, investment

system outsourcing and financial advisory services globally to

institutional investors.

At December 31, 2007, our ownership interest in BlackRock

was approximately 33.5%. Our investment in BlackRock is a

strategic asset of PNC and a key component of our diversified

earnings stream. The ability of BlackRock to grow assets

under management is the key driver of increases in its

revenue, earnings and, ultimately, shareholder value.

BlackRock’s strategies for growth in assets under

management include a focus on achieving client investment

performance objectives in a manner consistent with their risk

preferences and delivering excellent client service. The

business dedicates significant resources to attracting and

retaining talented professionals and to the ongoing

enhancement of its investment technology and operating

capabilities to deliver on its strategy.

PFPC

PFPC is a leading full service provider of processing,

technology and business solutions for the global investment

industry. Securities services include custody, securities

lending, and accounting and administration for funds

registered under the 1940 Act and alternative investments.

Investor services include transfer agency, managed accounts,

subaccounting, and distribution. We serviced $2.5 trillion in

total fund assets and 72 million shareholder accounts as of

December 31, 2007 both domestically and internationally.

PFPC’s international and domestic capabilities were expanded

during 2007. We received approval for a banking license in

Ireland and a branch in Luxembourg, which will allow PFPC

to provide depositary services in Europe’s leading domicile

for traditional investment funds and the second largest

worldwide domicile after the United States. The opening of a

sales office in London supported this initiative. The

acquisition of Albridge and Coates Analytics in December

2007 will enhance our business model and product offerings

with the delivery of information services to asset managers,

financial advisors, and the distribution channel to help them

better service their respective target markets.

PFPC focuses technological resources on driving efficiency

through streamlining operations and developing flexible

systems architecture and client-focused servicing solutions.

SUBSIDIARIES

Our corporate legal structure at December 31,

2007 consisted of three subsidiary banks, including their

subsidiaries, and approximately 67 active non-bank

subsidiaries. PNC Bank, N.A., headquartered in Pittsburgh,

Pennsylvania, is our principal bank subsidiary. At

December 31, 2007, PNC Bank, N.A. had total consolidated

assets representing approximately 90% of our consolidated

assets. Our other bank subsidiaries are PNC Bank, Delaware

and Yardville National Bank. Our non-bank PFPC subsidiary

has obtained a banking license in Ireland and a branch in

Luxembourg, which allow PFPC to provide depositary

services as part of its business. For additional information on

our subsidiaries, you may review Exhibit 21 to this Report.

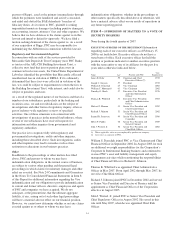

STATISTICAL DISCLOSURE BY BANK HOLDING COMPANIES

The following statistical information is included on the

indicated pages of this Report and is incorporated herein by

reference:

Form 10-K page

Average Consolidated Balance Sheet And Net

Interest Analysis 119

Analysis Of Year-To-Year Changes In Net Interest

Income 118

Book Values Of Securities 26 and 84-86

Maturities And Weighted-Average Yield Of

Securities 86

Loan Types 25, 87 and 120

Selected Loan Maturities And Interest Sensitivity 122

Nonaccrual, Past Due And Restructured Loans And

Other Nonperforming Assets 47-48, 74, 89 and 120

Potential Problem Loans And Loans Held For Sale 27 and 47-48

Summary Of Loan Loss Experience 48-49 and 121

Assignment Of Allowance For Loan And Lease

Losses 48-49 and 121

Average Amount And Average Rate Paid On

Deposits 119

Time Deposits Of $100,000 Or More 91 and 122

Selected Consolidated Financial Data 17-18

SUPERVISION AND REGULATION

O

VERVIEW

PNC is a bank holding company registered under the Bank

Holding Company Act of 1956 as amended (“BHC Act”) and

a financial holding company under the Gramm-Leach-Bliley

Act (“GLB Act”).

We are subject to numerous governmental regulations, some of

which are highlighted below. You should also read Note 22

Regulatory Matters in the Notes To Consolidated Financial

Statements in Item 8 of this Report, included here by reference,

4