PNC Bank 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

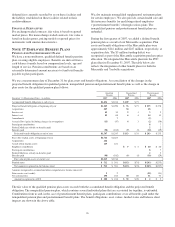

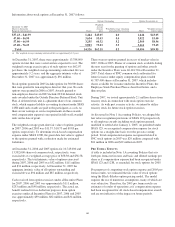

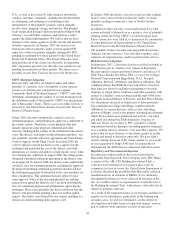

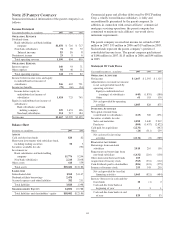

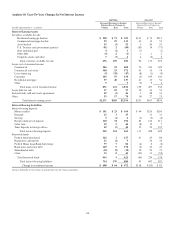

The following table sets forth regulatory capital ratios for

PNC and its only significant bank subsidiary, PNC Bank, N.A.

Regulatory Capital

December 31

Dollars in millions

Amount Ratios

2007 2006 2007 2006

Risk-based capital

Tier 1

PNC $7,815 $8,924 6.8% 10.4%

PNC Bank, N.A. 7,851 6,159 7.6 8.0

Total

PNC 11,803 11,559 10.3 13.5

PNC Bank, N.A. 10,616 8,541 10.2 11.1

Leverage

PNC NM NM 6.2 9.3

PNC Bank, N.A. NM NM 6.8 7.2

NM—Not meaningful.

The principal source of parent company cash flow is the

dividends it receives from PNC Bank, N.A., which may be

impacted by the following:

• Capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

Also, there are statutory and regulatory limitations on the

ability of national banks to pay dividends or make other

capital distributions. The amount available for dividend

payments to the parent company by PNC Bank, N.A. without

prior regulatory approval was approximately $655 million at

December 31, 2007.

Under federal law, bank subsidiaries generally may not extend

credit to the parent company or its non-bank subsidiaries on

terms and under circumstances that are not substantially the

same as comparable extensions of credit to nonaffiliates. No

extension of credit may be made to the parent company or a

non-bank subsidiary which is in excess of 10% of the capital

stock and surplus of such bank subsidiary or in excess of 20%

of the capital and surplus of such bank subsidiary as to

aggregate extensions of credit to the parent company and its

non-bank subsidiaries. Such extensions of credit, with limited

exceptions, must be fully collateralized by certain specified

assets. In certain circumstances, federal regulatory authorities

may impose more restrictive limitations.

Federal Reserve Board regulations require depository

institutions to maintain cash reserves with the Federal Reserve

Bank (“FRB”). At December 31, 2007, the balance

outstanding at the FRB was $74 million.

N

OTE

23 L

EGAL

P

ROCEEDINGS

Adelphia

Some of our subsidiaries are defendants (or have potential

contractual contribution obligations to other defendants) in

several pending lawsuits brought during late 2002 and 2003

arising out of the bankruptcy of Adelphia Communications

Corporation and its subsidiaries.

One of the lawsuits was brought on Adelphia’s behalf by the

unsecured creditors’ committee and equity committee in

Adelphia’s consolidated bankruptcy proceeding and was

removed to the United States District Court for the Southern

District of New York by order dated February 9, 2006.

Pursuant to Adelphia’s plan of reorganization, this lawsuit will

be prosecuted by a contingent value vehicle, known as the

Adelphia Recovery Trust. In October 2007, the Adelphia

Recovery Trust filed an amended complaint in this lawsuit,

adding defendants and making additional allegations.

The other lawsuits, one of which is a putative consolidated

class action, were brought by holders of debt and equity

securities of Adelphia and have been consolidated for pretrial

purposes in the above district court. The bank defendants,

including the PNC defendants, have entered into a settlement

of the consolidated class action. This settlement was approved

by the district court in November 2006. In December 2006, a

group of class members appealed orders related to the

settlement to the United States Court of Appeals for the

Second Circuit. The amount for which we would be

responsible under this settlement is insignificant.

The non-settled lawsuits arise out of lending and investment

banking activities engaged in by PNC subsidiaries together

with other financial services companies. In the aggregate,

hundreds of other financial services companies and numerous

other companies and individuals have been named as

defendants in one or more of these lawsuits. Collectively, with

respect to some or all of the defendants, the lawsuits allege

federal law claims (including violations of federal securities

and banking laws), violations of common law duties, aiding

and abetting such violations, voidable preference payments,

and fraudulent transfers, among other matters. The lawsuits

seek monetary damages (including in some cases punitive or

treble damages), interest, attorneys’ fees and other expenses,

and a return of the alleged voidable preference and fraudulent

transfer payments, among other remedies.

We believe that we have defenses to the claims against us in

these lawsuits, as well as potential claims against third parties,

and intend to defend the remaining lawsuits vigorously. These

lawsuits involve complex issues of law and fact, presenting

complicated relationships among the many financial and other

participants in the events giving rise to these lawsuits, and

have not progressed to the point where we can predict the

outcome of the non-settled lawsuits. It is not possible to

determine what the likely aggregate recoveries on the part of

the plaintiffs in these remaining matters might be or the

portion of any such recoveries for which we would ultimately

be responsible, but the final consequences to PNC could be

material.

Data Treasury

In March 2006, a first amended complaint was filed in the

United States District Court for the Eastern District of Texas

by Data Treasury Corporation against PNC and PNC Bank,

108