PNC Bank 2007 Annual Report Download - page 78

Download and view the complete annual report

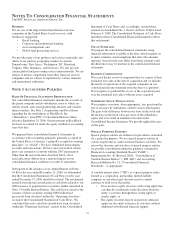

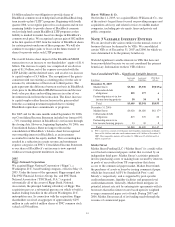

Please find page 78 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Certain loans are accounted for at fair value in accordance

with SFAS 155, “Accounting for Certain Hybrid Financial

Instruments – an amendment of FASB Statements No. 133

and 140,” with changes in the fair value reported in trading

revenue. The fair value of these loans was $149 million, or

less than .5% of the total loan portfolio, at December 31,

2007.

In addition to originating loans, we also acquire loans through

portfolio purchases or business acquisitions. For certain

acquired loans that have experienced a deterioration of credit

quality prior to our acquisition, we follow the guidance

contained in AICPA Statement of Position 03-3, “Accounting

for Certain Loans or Debt Securities Acquired in a Transfer”

(‘SOP 03-3’). Under SOP 03-3, the excess of the cash flows

expected to be collected over the purchase price of the loan at

acquisition is accreted into interest income over the remaining

life of the loan. Any valuation allowance for these loans

reflect only those losses incurred after acquisition. The

carrying value of loans accounted for under SOP 03-3 at

December 31, 2007 was $43 million, or less than .5% of the

total loan portfolio, and related to our October 26, 2007

acquisition of Yardville National Bancorp (“Yardville”).

We also provide financing for various types of equipment,

aircraft, energy and power systems, and rolling stock through

a variety of lease arrangements. Direct financing leases are

carried at the aggregate of lease payments plus estimated

residual value of the leased property, less unearned income.

Leveraged leases, a form of financing lease, are carried net of

nonrecourse debt. We recognize income over the term of the

lease using the interest method. Lease residual values are

reviewed for other-than-temporary impairment on a quarterly

basis. Gains or losses on the sale of leased assets are included

in other noninterest income while valuation adjustments on

lease residuals are included in other noninterest expense.

L

OAN

S

ALES

,S

ECURITIZATIONS

A

ND

R

ETAINED

I

NTERESTS

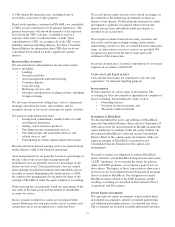

We recognize the sale of loans or other financial assets when

the transferred assets are legally isolated from our creditors

and the appropriate accounting criteria are met. We also sell

mortgage and other loans through secondary market

securitizations. In certain cases, we may retain a portion or all

of the securities issued, interest-only strips, one or more

subordinated tranches, servicing rights and, in some cases,

cash reserve accounts, all of which are considered retained

interests in the transferred assets.

When loans are redesignated from held for investment to held

for sale, specific reserves and allocated pooled reserves

included in the allowance for loan and lease losses are

charged-off and reduce the basis of the loans. Gains or losses

recognized on the sale of the loans depend on the allocation of

carrying value between the loans sold and the retained

interests, based on their relative fair market values at the date

of sale. We generally estimate fair value based on the present

value of future expected cash flows using assumptions as to

discount rates, interest rates, prepayment speeds, credit losses

and servicing costs, if applicable. Gains or losses on loan sales

transactions are reported in noninterest income.

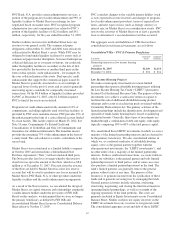

Our loan sales and securitizations are generally structured

without recourse to us and with no restrictions on the retained

interests with the exception of Federal National Mortgage

Association (“Fannie Mae”) loan sales.

In connection with our acquisition of ARCS Commercial

Mortgage Co., L.P. (“ARCS”) in July 2007, we also originate,

sell and service mortgage loans under the Fannie Mae

Delegated Underwriting and Servicing (“DUS”) program.

Under the provisions of the DUS program, PNC participates in

a loss-sharing arrangement with Fannie Mae. Refer to Note 24

Commitments and Guarantees for more information about our

obligations related to sales of loans under the DUS program.

When we are obligated for loss-sharing or recourse in a sale,

our policy is to record such liabilities at fair value upon

closing of the transaction based on the guidance contained in

FIN 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees

of Indebtedness of Others,” or as a contingent liability

recognized at inception of the guarantee under SFAS No. 5,

“Accounting for Contingencies.”

As of January 1, 2006, we adopted SFAS 156, “Accounting

for Servicing of Financial Assets – an amendment of FASB

Statement No. 140.” SFAS 156 was issued in March 2006 and

requires all newly recognized servicing rights and obligations

to be initially measured at fair value. For subsequent

measurement of the asset or obligation, the standard permits

the election of either the amortization method or the fair value

measurement method by class of recognized servicing rights

and obligations. For servicing rights and obligations related to

commercial loans and commercial mortgages, we have elected

the amortization method. This method requires the

amortization of the servicing assets or liabilities in proportion

to and over the periods of estimated net servicing income or

net servicing loss. For servicing rights or obligations related to

residential mortgage loans, we have elected the fair value

method, with changes in the value of the right or obligation

reflected in noninterest income.

Each quarter, we analyze our servicing assets carried at

amortized cost for impairment by categorizing the pools of

assets underlying the servicing rights into various stratum. If

the carrying amount of a specific asset category exceeds its

fair value, a valuation allowance is recorded and reduces

noninterest income.

In securitization transactions, we classify securities retained as

debt securities available for sale or other assets, depending on

the form of the retained interest. Retained interests that are

subject to prepayment risk are reviewed on a quarterly basis

73