PNC Bank 2007 Annual Report Download - page 102

Download and view the complete annual report

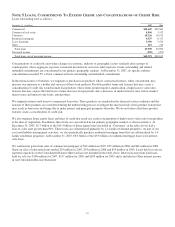

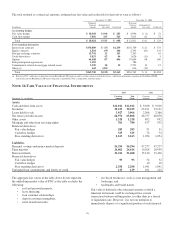

Please find page 102 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.instruments, and unrealized gains or losses should not be

interpreted as a forecast of future earnings and cash flows. The

derived fair values are subjective in nature and involve

uncertainties and significant judgment. Therefore, they cannot

be determined with precision. Changes in our assumptions

could significantly impact the derived fair value estimates.

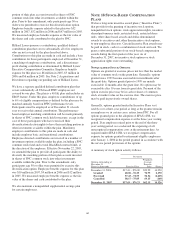

We used the following methods and assumptions to estimate

fair value amounts for financial instruments.

G

ENERAL

For short-term financial instruments realizable in three months

or less, the carrying amount reported in the consolidated

balance sheet approximates fair value. Unless otherwise

stated, the rates used in discounted cash flow analyses are

based on market yield curves.

C

ASH

A

ND

S

HORT

-T

ERM

A

SSETS

The carrying amounts reported in our Consolidated Balance

Sheet for cash and short-term investments approximate fair

values primarily due to their short-term nature. For purposes

of this disclosure only, short-term assets include the

following:

• due from banks,

• interest-earning deposits with banks,

• federal funds sold and resale agreements,

• trading securities,

• cash collateral,

• customers’ acceptance liability, and

• accrued interest receivable.

S

ECURITIES

The fair value of securities is based on quoted market prices or

observable inputs from active markets. Investments that are

not readily marketable are valued using dealer quotes, pricing

models or quoted prices for instruments with similar

characteristics.

N

ET

L

OANS

A

ND

L

OANS

H

ELD

F

OR

S

ALE

Fair values are estimated based on the discounted value of

expected net cash flows incorporating assumptions about

prepayment rates, credit losses, servicing fees and costs. For

revolving home equity loans, this fair value does not include

any amount for new loans or the related fees that will be

generated from the existing customer relationships. In the case

of nonaccrual loans, scheduled cash flows exclude interest

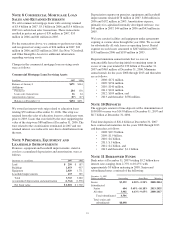

payments. We determine the fair value of commercial

mortgage loans held for sale by obtaining observable market

data including, but not limited to, pricing, subordination levels

and yield curves. We determine the fair value of student loans

held for sale by obtaining observable market data including

recent securitizations for the portfolio that is Federally

guaranteed and an external analysis of the net present value on

the privately guaranteed portfolio. Loans are presented above

net of the allowance for loan and lease losses.

O

THER

A

SSETS

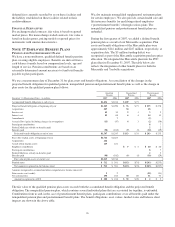

Other assets as shown in the accompanying table include the

following:

• noncertificated interest-only strips,

• FHLB and FRB stock,

• equity investments carried at cost and fair value, and

• private equity investments carried at fair value.

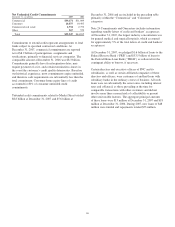

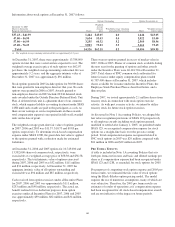

Investments accounted for under the equity method, including

our investment in BlackRock, are not included in the

accompanying table.

The carrying amounts of private equity investments are

recorded at fair value. The valuation procedures applied to

direct investments include techniques such as multiples of

adjusted earnings of the entities, independent appraisals of the

entity or the pricing used to value the entity in a recent

financing transaction. We value affiliated partnership interests

based on the underlying investments of the partnership using

procedures consistent with those applied to direct investments.

We generally value limited partnership investments based on

the financial statements we receive from the general partner.

Fair value of the noncertificated interest-only strips is

estimated based on the discounted value of expected net cash

flows. The equity investments carried at cost, including the

FHLB and FRB stock, have a carrying value of approximately

$766 million as of December 31, 2007, and $365 million as of

December 31, 2006, both of which approximate fair value at

each date.

M

ORTGAGE

A

ND

O

THER

L

OAN

S

ERVICING

A

SSETS

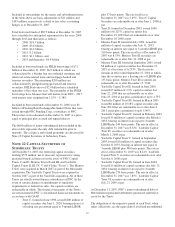

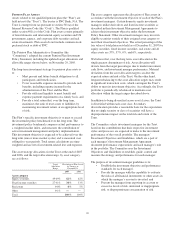

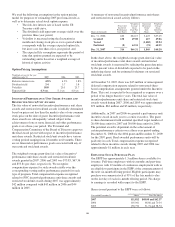

Fair value is based on the present value of the future cash

flows, including assumptions as to prepayment speeds,

discount rates, interest rates, cost to service and other factors.

For commercial mortgage loan servicing assets, key valuation

assumptions at December 31, 2007 and December 31, 2006

included prepayment rates ranging from 10% – 16% and 7% –

16%, respectively, and discount rates ranging from 8% – 10%

for both periods, which resulted in an estimated fair value of

$773 million and $546 million, respectively.

D

EPOSITS

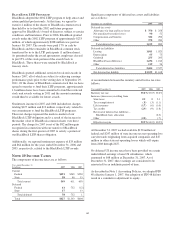

The carrying amounts of noninterest-bearing demand and

interest-bearing money market and savings deposits

approximate fair values. For time deposits, which include

foreign deposits, fair values are estimated based on the

discounted value of expected net cash flows assuming current

interest rates.

B

ORROWED

F

UNDS

The carrying amounts of federal funds purchased, commercial

paper, repurchase agreements, proprietary trading short, cash

collateral, other short-term borrowings, acceptances

outstanding and accrued interest payable are considered to be

their fair value because of their short-term nature. For all other

borrowed funds, fair values are estimated based on the

discounted value of expected net cash flows assuming current

interest rates.

U

NFUNDED

L

OAN

C

OMMITMENTS

A

ND

L

ETTERS

O

F

C

REDIT

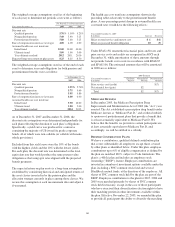

The fair value of unfunded loan commitments and letters of

credit is our estimate of the cost to terminate them. For

purposes of this disclosure, this fair value is the sum of the

97