PNC Bank 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

5L

OANS

,C

OMMITMENTS

T

O

E

XTEND

C

REDIT AND

C

ONCENTRATIONS OF

C

REDIT

R

ISK

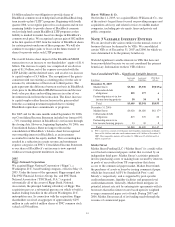

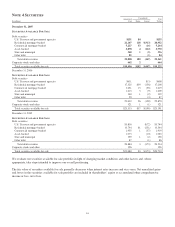

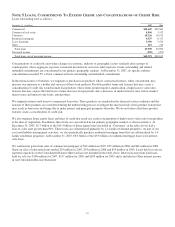

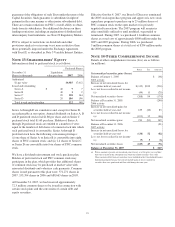

Loans outstanding were as follows:

December 31 - in millions 2007 2006

Commercial $28,607 $20,584

Commercial real estate 8,906 3,532

Consumer 18,326 16,515

Residential mortgage 9,557 6,337

Lease financing 3,500 3,556

Other 413 376

Total loans 69,309 50,900

Unearned income (990) (795)

Total loans, net of unearned income $68,319 $50,105

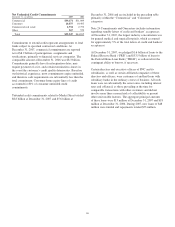

Concentrations of credit risk exist when changes in economic, industry or geographic factors similarly affect groups of

counterparties whose aggregate exposure is material in relation to our total credit exposure. Loans outstanding and related

unfunded commitments are concentrated in our primary geographic markets. At December 31, 2007, no specific industry

concentration exceeded 5% of total commercial loans outstanding and unfunded commitments.

In the normal course of business, we originate or purchase loan products whose contractual features, when concentrated, may

increase our exposure as a holder and servicer of those loan products. Possible product terms and features that may create a

concentration of credit risk would include loan products whose terms permit negative amortization, a high loan-to-value ratio,

features that may expose the borrower to future increases in repayments above increases in market interest rates, below-market

interest rates and interest-only loans, among others.

We originate interest-only loans to commercial borrowers. These products are standard in the financial services industry and the

features of these products are considered during the underwriting process to mitigate the increased risk of this product feature that

may result in borrowers not being able to make interest and principal payments when due. We do not believe that these product

features create a concentration of credit risk.

We also originate home equity loans and lines of credit that result in a credit concentration of high loan-to-value ratio loan products

at the time of origination. In addition, these loans are concentrated in our primary geographic markets as discussed above. At

December 31, 2007, $2.7 billion of the $14.4 billion of home equity loans (included in “Consumer” in the table above) had a

loan-to-value ratio greater than 90%. These loans are collateralized primarily by 1-4 family residential properties. As part of our

asset and liability management activities, we also periodically purchase residential mortgage loans that are collateralized by 1-4

family residential properties. At December 31, 2007, $3.0 billion of the $9.6 billion of residential mortgage loans were interest-

only loans.

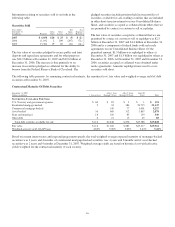

We realized net gains from sales of commercial mortgages of $39 million in 2007, $55 million in 2006 and $61 million in 2005.

Gains on sales of education loans totaled $24 million in 2007, $33 million in 2006 and $19 million in 2005. Loans held for sale are

reported separately on the Consolidated Balance Sheet and are not included in the table above. Interest income from total loans

held for sale was $184 million for 2007, $157 million for 2006 and $104 million for 2005 and is included in Other interest income

in our Consolidated Income Statement.

87