PNC Bank 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

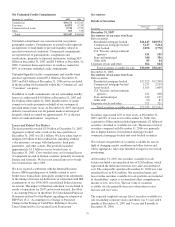

Market Street

Market Street Funding LLC (“Market Street”) is a multi-seller

asset-backed commercial paper conduit that is owned by an

independent third party. Market Street’s activities primarily

involve purchasing assets or making loans secured by interests

in pools of receivables from US corporations that desire

access to the commercial paper market. Market Street funds

the purchases of assets or loans by issuing commercial paper

which has been rated A1/P1 by Standard & Poor’s and

Moody’s, respectively, and is supported by pool-specific

credit enhancements, liquidity facilities and program-level

credit enhancement. Generally, Market Street mitigates its

potential interest rate risk by entering into agreements with its

borrowers that reflect interest rates based upon its weighted

average commercial paper cost of funds. During 2007 and

2006, Market Street met all of its funding needs through the

issuance of commercial paper.

At December 31, 2007 Market Street commercial paper

outstanding was $5.1 billion compared with $3.9 billion for

the prior year-end. The weighted average maturity of the

commercial paper was 32 days at December 31, 2007

compared with 23 days at December 31, 2006.

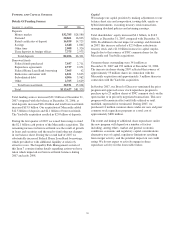

In the ordinary course of business during 2007, PNC Capital

Markets, acting as a placement agent for Market Street, held a

maximum daily position in Market Street commercial paper of

$113 million with an average of $27 million and a year-end

position of less than $1 million. This compares with a

maximum daily position of $105 million with an average of

$12 million during 2006. PNC Capital Markets did not own

any Market Street commercial paper at December 31, 2006.

PNC made no other purchases of Market Street commercial

paper during 2007 or 2006.

PNC Bank, N.A. provides certain administrative services, a

portion of the program-level credit enhancement and 99% of

liquidity facilities to Market Street in exchange for fees

negotiated based on market rates. PNC recognized program

administrator fees and commitments fees related to PNC’s

portion of the liquidity facilities of $12.6 million and $4.1

million, respectively, for the year ended December 31, 2007.

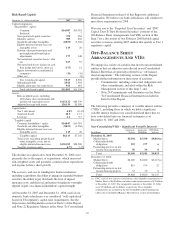

PNC views its credit exposure for the Market Street

transactions as limited. Neither creditors nor investors in

Market Street have any recourse to our general credit. The

commercial paper obligations at December 31, 2007 and 2006

were effectively collateralized by Market Street’s assets.

While PNC may be obligated to fund under liquidity facilities

for events such as commercial paper market disruptions,

borrower bankruptcies, collateral deficiencies or covenant

violations, our credit risk under the liquidity facilities is

secondary to the risk of first loss provided by the borrower or

another third party in the form of deal-specific credit

enhancement – for example, by the over collateralization of

the assets. Deal-specific credit enhancement that supports the

commercial paper issued by Market Street is generally

structured to cover a multiple of expected losses for the pool

of assets and is sized to generally meet rating agency

standards for comparably structured transactions. Of the $8.8

billion of liquidity facilities provided by PNC at December 31,

2007, only $2.8 billion required PNC to fund if the assets are

in default.

Program-level credit enhancement in the amount of 10% of

commitments, excluding explicitly rated AAA/Aaa facilities, is

provided by PNC and Ambac, a monoline insurer. PNC provides

25% of the enhancement in the form of a cash collateral account

funded by a loan facility. This facility expires on March 23, 2012.

See Note 5 Loans, Commitments To Extend Credit and

Concentrations of Credit Risk and Note 24 Commitments and

Guarantees included in Item 8 of this Report for additional

information. The monoline insurer provides the remaining 75%

of the enhancement in the form of a surety bond. The cash

collateral account is subordinate to the surety bond.

Market Street was restructured as a limited liability company

in October 2005 and entered into a Subordinated Note

Purchase Agreement (“Note”) with an unrelated third party.

The Note provides first loss coverage whereby the investor

absorbs losses up to the amount of the Note, which was $8.6

million as of December 31, 2007. Proceeds from the issuance

of the Note are held by Market Street in a first loss reserve

account that will be used to reimburse any losses incurred by

Market Street, PNC Bank, N.A. or other providers under the

liquidity facilities and the credit enhancement arrangements.

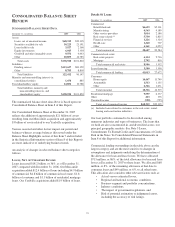

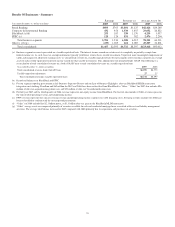

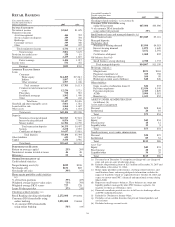

Assets of Market Street Funding LLC

In millions Outstanding Commitments

Weighted

Average

Remaining

Maturity In

Years

December 31, 2007 (a)

Trade receivables $1,375 $2,865 2.63

Automobile financing 1,387 1,565 4.06

Collateralized loan

obligations 519 1,257 2.54

Credit cards 769 775 .26

Residential mortgage 37 720 .90

Other 1,031 1,224 1.89

Cash and

miscellaneous receivables 186

Total $5,304 $8,406 2.41

December 31, 2006 (a)

Trade receivables $1,165 $2,429 2.14

Automobile financing 335 560 2.64

Collateralized loan

obligations 129 146 5.92

Credit cards 814 819 .29

Residential mortgage 501 618 .38

Other 914 1,084 2.21

Cash and miscellaneous

receivables 162

Total $4,020 $5,656 1.84

(a) Market Street did not recognize an asset impairment charge or experience

a rating downgrade on its assets during 2007 or 2006.

30