PNC Bank 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for impairment. If the fair value of the retained interests is

below its carrying amount and the decline is determined to be

other-than-temporary, then the decline is reflected in

noninterest income.

L

OANS

A

ND

C

OMMITMENTS

H

ELD

F

OR

S

ALE

We designate loans and related loan commitments as held for

sale when we have a positive intent to sell them. We transfer

loans and commitments to the loans held for sale category at

the lower of cost or fair market value. At the time of transfer,

related write-downs on the loans and commitments are

recorded as charge-offs or as a reduction in the liability for

unfunded commitments. We establish a new cost basis upon

transfer and recognize any subsequent lower of cost or market

adjustment as a valuation allowance with charges included in

noninterest income. Gains or losses on the actual sale of these

loans and commitments are included in noninterest income

when realized.

We apply the lower of cost or fair market value analysis on

pools of commercial mortgage loans and commitments on a

net aggregate basis. For other loans held for sale and

commitments, we do this analysis on an individual loan and

commitment basis.

Interest income with respect to loans held for sale classified as

performing is accrued based on the principal amount

outstanding.

In certain circumstances, loans and commitments designated

as held for sale may be later transferred back to the loan

portfolio based on a change in strategy to retain the credit

relationship with those customers. We transfer these loans and

commitments to the portfolio at the lower of cost or fair

market value.

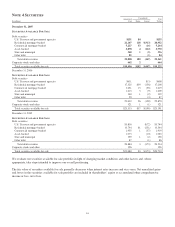

N

ONPERFORMING

A

SSETS

Nonperforming assets include:

• Nonaccrual loans,

• Troubled debt restructurings, and

• Foreclosed assets.

Measurement of delinquency and past due status are based on

the contractual terms of each loan.

Other than consumer loans, we generally classify loans as

nonaccrual when we determine that the collection of interest

or principal is doubtful or when a default of interest or

principal has existed for 90 days or more and the loans are not

well-secured or in the process of collection. When the accrual

of interest is discontinued, any accrued but uncollected

interest previously included in income is reversed. We charge

off these loans based on the facts and circumstances of the

individual loan.

Consumer loans well-secured by residential real estate,

including home equity installment loans and lines of credit,

are classified as nonaccrual at 12 months past due. These

loans are considered well secured if the fair market value of

the property, less 15% to cover potential foreclosure expenses,

is greater than or equal to the principal balance including any

superior liens. A fair market value assessment of the property

is initiated when the loan becomes 80 to 90 days past due. The

procedures for foreclosure of these loans is consistent with our

general foreclosure process discussed below. The

classification of consumer loans well-secured by residential

real estate as nonaccrual loans at 12 months past due is

consistent with Federal Financial Institutions Examination

Council (“FFIEC”) guidelines for consumer loans. We charge

off these loans based on the facts and circumstances of the

individual loan.

Consumer loans in the process of collection but not well-

secured are classified as nonaccrual at 120 days past due if

they are home equity installment loans and at 180 days past

due if they are home equity lines of credit. These loans are

recorded at the lower of cost or market value, less liquidation

costs and the unsecured portion of these loans is generally

charged off in accordance with FFIEC guidelines for

consumer loans. At this time, the remaining portion of the

loan is also placed on nonaccrual.

A loan is categorized as a troubled debt restructuring if a

significant concession is granted due to deterioration in the

financial condition of the borrower.

Nonperforming loans are generally not returned to performing

status until the obligation is brought current and the borrower

has performed in accordance with the contractual terms for a

reasonable period of time and collection of the contractual

principal and interest is no longer doubtful. Nonaccrual

commercial and commercial real estate loans and troubled

debt restructurings are designated as impaired loans. We

recognize interest collected on these loans on the cost

recovery method.

Foreclosed assets are comprised of any asset seized or

property acquired through a foreclosure proceeding or

acceptance of a deed-in-lieu of foreclosure. Depending on

various state statutes, legal proceedings are initiated on or

about the 65th day of delinquency. If no other remedies arise

from the legal proceedings, the final outcome will result in the

sheriff’s sale of the property. When PNC acquires the deed,

the transfer of loans to other real estate owned (“OREO”) will

be completed. These assets are recorded on the date acquired

at the lower of the related loan balance or market value of the

collateral less estimated disposition costs. We estimate market

values primarily based on appraisals, when available, or

quoted market prices on liquid assets. Subsequently,

foreclosed assets are valued at the lower of the amount

recorded at acquisition date or the current market value less

estimated disposition costs. Valuation adjustments on these

assets and gains or losses realized from disposition of such

property are reflected in noninterest expense.

74