PNC Bank 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

N

ET

I

NTEREST

I

NCOME

-O

VERVIEW

Changes in net interest income and margin result from the

interaction of the volume and composition of interest-earning

assets and related yields, interest-bearing liabilities and related

rates paid, and noninterest-bearing sources of funding.

See Statistical Information – Analysis of Year-To-Year

Changes In Net Interest Income and Average Consolidated

Balance Sheet and Net Interest Analysis in Item 8 of this

Report for additional information.

N

ET

I

NTEREST

I

NCOME

- GAAP R

ECONCILIATION

The interest income earned on certain assets is completely or

partially exempt from federal income tax. As such, these

tax-exempt instruments typically yield lower returns than a

taxable investment. To provide more meaningful comparisons

of yields and margins for all interest-earning assets, we also

provide net interest income on a taxable-equivalent basis by

increasing the interest income earned on tax-exempt assets to

make it fully equivalent to interest income earned on other

taxable investments. This adjustment is not permitted under

GAAP in the Consolidated Income Statement.

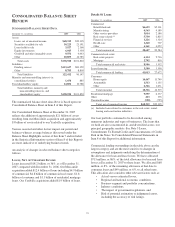

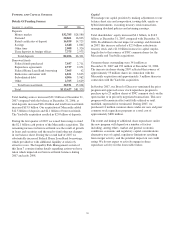

A reconciliation of net interest income as reported in the

Consolidated Income Statement (GAAP basis) to net interest

income on a taxable-equivalent basis follows (in millions):

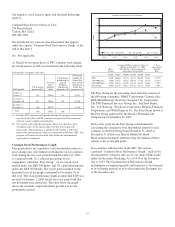

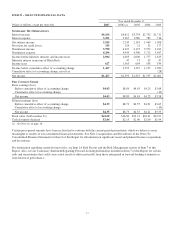

For the year ended December 31,

2007 2006 2005

Net interest income, GAAP basis $2,915 $2,245 $2,154

Taxable-equivalent adjustment 27 25 33

Net interest income, taxable-

equivalent basis $2,942 $2,270 $2,187

Taxable-equivalent net interest income increased $672

million, or 30%, in 2007 compared with 2006. This increase

was consistent with the $20.3 billion, or 26%, increase in

average interest-earning assets during 2007 compared with

2006. The reasons driving the higher interest-earning assets in

2007 are further discussed in the Balance Sheet Highlights

portion of the Executive Summary section of this Item 7.

We expect net interest income to be higher in 2008 compared

with 2007, assuming our current expectations for interest rates

and economic conditions. Our forward-looking statements are

based on our current expectations that interest rates will

remain low through most of 2008 and that economic

conditions, although showing slower growth than in recent

years, will avoid a recession.

N

ET

I

NTEREST

M

ARGIN

The net interest margin was 3.00% for 2007 and 2.92% for

2006. The following factors impacted the comparison:

• The Mercantile acquisition.

• The yield on interest-earning assets increased 35

basis points. The yield on loans, the single largest

component, increased 31 basis points.

• These factors were partially offset by an increase in

the rate paid on interest-bearing liabilities of 25 basis

points. The rate paid on interest-bearing deposits, the

single largest component, increased 22 basis points.

• The impact of noninterest-bearing sources of funding

decreased 2 basis points in 2007 compared with the

prior year.

Comparing yields and rates paid to the broader market, the

average federal funds rate was 5.03% during 2007 compared

with 4.96% for 2006.

We believe that net interest margins for our industry will

continue to be impacted by competition for high quality loans

and deposits and customer migration from lower to higher rate

deposit or other products. We expect our net interest margin to

improve slightly in 2008 compared with 2007, assuming our

current expectations for interest rates and economic conditions.

P

ROVISION

F

OR

C

REDIT

L

OSSES

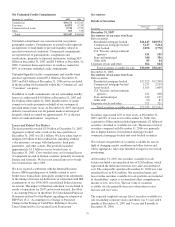

The provision for credit losses totaled $315 million for 2007

and $124 million for 2006. Of the total 2007 provision, $188

million was recorded in the fourth quarter, including

approximately $45 million related to our Yardville acquisition.

The higher provision in 2007 was also impacted by an increase

in our real estate portfolio, including residential real estate

development exposure, and growth in total credit exposure.

Total residential real estate development outstandings were

approximately $2.1 billion at December 31, 2007.

We do not expect to sustain asset quality at its current level.

Given our projections for loan growth and continued credit

deterioration, we expect nonperforming assets and the

provision for credit losses will be higher in 2008 compared

with 2007. Also, we expect that the level of provision for

credit losses in the first quarter of 2008 will be modestly lower

than the amount reported for the fourth quarter of 2007.

The Credit Risk Management portion of the Risk Management

section of this Item 7 includes additional information

regarding factors impacting the provision for credit losses.

N

ONINTEREST

I

NCOME

Summary

Noninterest income was $3.790 billion for 2007 and $6.327

billion for 2006. Noninterest income for 2007 included the

impact of $83 million gain recognized in connection with our

transfer of BlackRock shares to satisfy a portion of PNC’s

LTIP obligation and a $210 million net loss representing the

mark-to-market adjustment on our LTIP obligation.

22