PNC Bank 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.would be subject during the period of such default or deferral to

restrictions on dividends and other provisions protecting the

status of the debenture holders similar to or in some ways more

restrictive than those potentially imposed under the Exchange

Agreements with Trust II and Trust III, as described above.

B

USINESS

S

EGMENTS

R

EVIEW

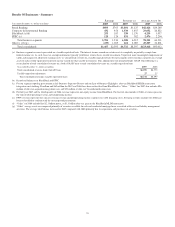

We have four major businesses engaged in providing banking,

asset management and global fund processing products and

services. Business segment results, including inter-segment

revenues, and a description of each business are included in

Note 26 Segment Reporting included in the Notes To

Consolidated Financial Statements under Item 8 of this Report.

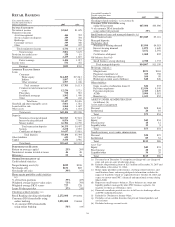

Certain revenue and expense amounts included in this

Business Segments Review differ from the amounts shown in

Note 26 due to the presentation in this Business Segments

Review of business revenue on a taxable-equivalent basis, the

inclusion of BlackRock/MLIM transaction integration costs in

the “Other” category, and income statement classification

differences related to PFPC. Also, the presentation of

BlackRock results for the 2006 period have been modified in

this Business Segments Review as described on page 41 to

conform with our current period presentation.

Results of individual businesses are presented based on our

management accounting practices and our management

structure. There is no comprehensive, authoritative body of

guidance for management accounting equivalent to GAAP;

therefore, the financial results of individual businesses are not

necessarily comparable with similar information for any other

company. We refine our methodologies from time to time as

our management accounting practices are enhanced and our

businesses and management structure change. Financial

results are presented, to the extent practicable, as if each

business, with the exception of our BlackRock segment,

operated on a stand-alone basis. As permitted under GAAP,

we have aggregated the business results for certain operating

segments for financial reporting purposes.

Assets receive a funding charge and liabilities and capital

receive a funding credit based on a transfer pricing

methodology that incorporates product maturities, duration

and other factors. Capital is intended to cover unexpected

losses and is assigned to the banking and processing

businesses using our risk-based economic capital model. We

have assigned capital equal to 6% of funds to Retail Banking

to reflect the capital required for well-capitalized domestic

banks and to approximate market comparables for this

business. The capital assigned for PFPC reflects its legal

entity shareholders' equity.

BlackRock business segment results for the nine months

ended September 30, 2006 reflected our majority ownership in

BlackRock during that period. Subsequent to the

September 29, 2006 BlackRock/MLIM transaction closing,

our ownership interest was reduced to approximately 34%.

Since that date, our investment in BlackRock has been

accounted for under the equity method but continues to be a

separate reportable business segment of PNC. We describe our

presentation method for the BlackRock segment for this

Business Segments Review and our Line of Business

Highlights on page 41.

We have allocated the allowances for loan and lease losses

and unfunded loan commitments and letters of credit based on

our assessment of risk inherent in the loan portfolios. Our

allocation of the costs incurred by operations and other

support areas not directly aligned with the businesses is

primarily based on the use of services.

Total business segment financial results differ from total

consolidated results. The impact of these differences is

reflected in the “Other” category. “Other” for purposes of this

Item 7 Financial Review includes residual activities that do

not meet the criteria for disclosure as a separate reportable

business, such as gains or losses related to BlackRock

transactions including LTIP share distributions and

obligations, BlackRock/MLIM transaction and acquisition

integration costs, asset and liability management activities, net

securities gains or losses, certain trading activities and equity

management activities, differences between business segment

performance reporting and financial statement reporting

(GAAP), intercompany eliminations, and most corporate

overhead.

Employee data as reported by each business segment in the

tables that follow reflect staff directly employed by the

respective businesses and excludes corporate and shared

services employees. Prior period employee statistics generally

are not restated for organizational changes.

34