PNC Bank 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

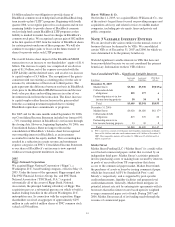

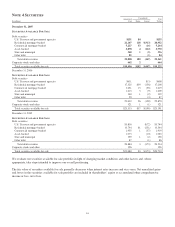

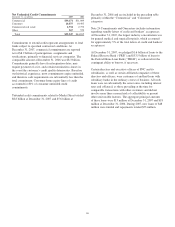

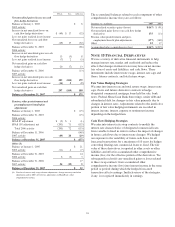

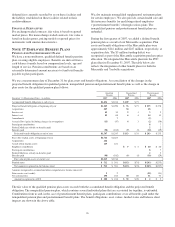

Net Unfunded Credit Commitments

December 31 - in millions 2007 2006

Commercial $39,171 $31,009

Consumer 10,875 10,495

Commercial real estate 2,734 2,752

Other 567 579

Total $53,347 $44,835

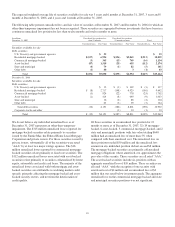

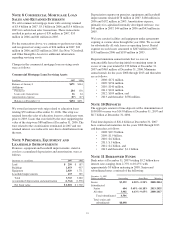

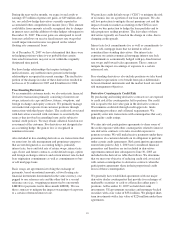

Commitments to extend credit represent arrangements to lend

funds subject to specified contractual conditions. At

December 31, 2007, commercial commitments are reported

net of $8.9 billion of participations, assignments and

syndications, primarily to financial services companies. The

comparable amount at December 31, 2006 was $8.3 billion.

Commitments generally have fixed expiration dates, may

require payment of a fee, and contain termination clauses in

the event the customer’s credit quality deteriorates. Based on

our historical experience, most commitments expire unfunded,

and therefore cash requirements are substantially less than the

total commitment. Consumer home equity lines of credit

accounted for 80% of consumer unfunded credit

commitments.

Unfunded credit commitments related to Market Street totaled

$8.8 billion at December 31, 2007 and $5.6 billion at

December 31, 2006 and are included in the preceding table

primarily within the “Commercial” and “Consumer”

categories.

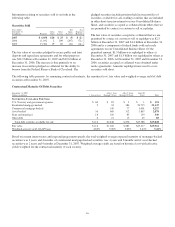

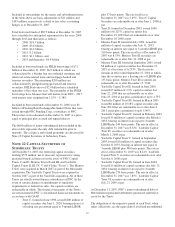

Note 24 Commitments and Guarantees includes information

regarding standby letters of credit and bankers’ acceptances.

At December 31, 2007, the largest industry concentration was

for general medical and surgical hospitals, which accounted

for approximately 5% of the total letters of credit and bankers’

acceptances.

At December 31, 2007, we pledged $1.6 billion of loans to the

Federal Reserve Bank (“FRB”) and $33.5 billion of loans to

the Federal Home Loan Bank (“FHLB”) as collateral for the

contingent ability to borrow, if necessary.

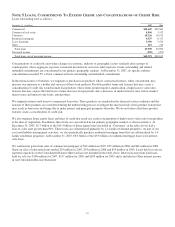

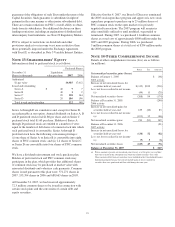

Certain directors and executive officers of PNC and its

subsidiaries, as well as certain affiliated companies of these

directors and officers, were customers of and had loans with

subsidiary banks in the ordinary course of business. All such

loans were on substantially the same terms, including interest

rates and collateral, as those prevailing at the time for

comparable transactions with other customers and did not

involve more than a normal risk of collectibility or present

other unfavorable features. The aggregate principal amounts

of these loans were $13 million at December 31, 2007 and $18

million at December 31, 2006. During 2007, new loans of $48

million were funded and repayments totaled $53 million.

88