PNC Bank 2007 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

HORT

-T

ERM

B

ORROWINGS

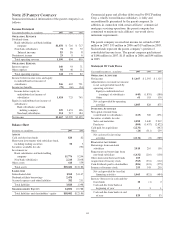

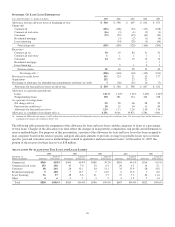

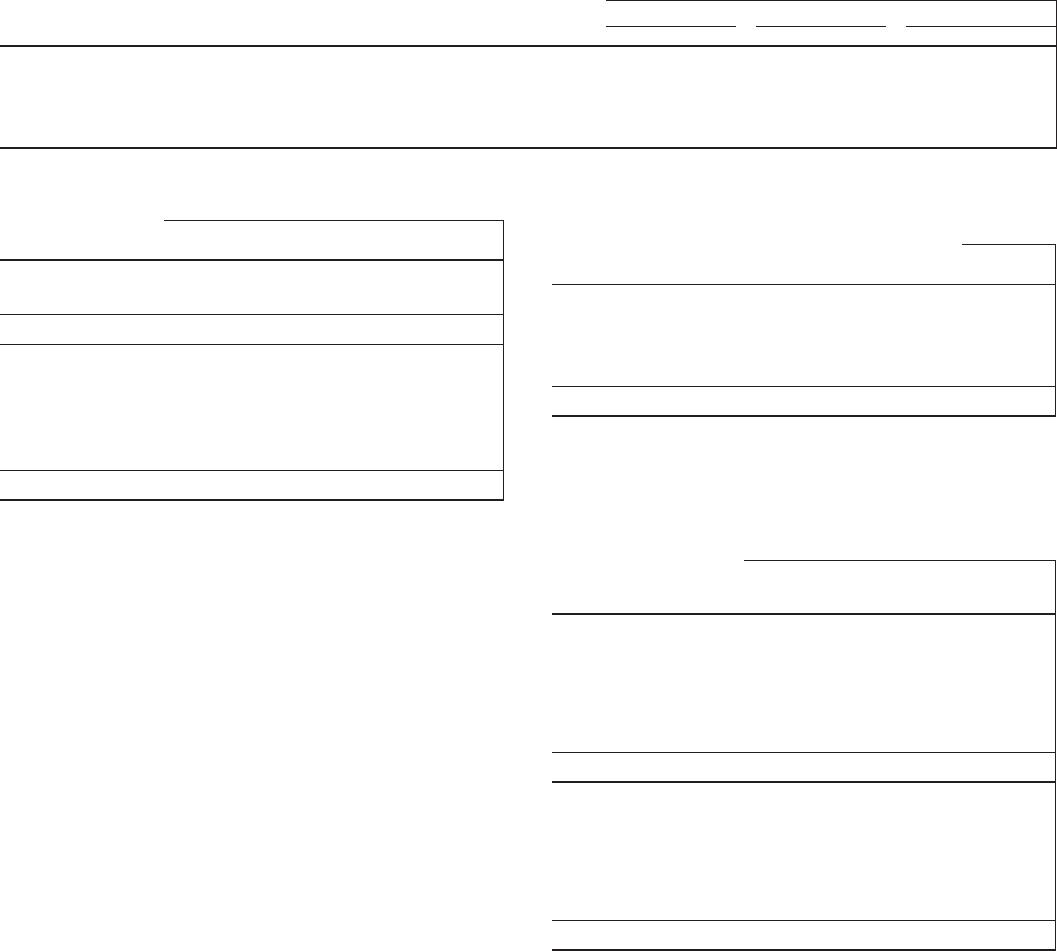

Federal funds purchased include overnight borrowings and term federal funds, which are payable at maturity.

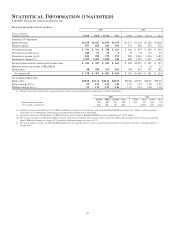

2007 2006 2005

Dollars in millions Amount Rate Amount Rate Amount Rate

Federal funds purchased

Year-end balance $7,037 3.17% $2,711 5.24% $4,128 4.07%

Average during year 5,533 5.13 3,081 5.10 2,098 3.38

Maximum month-end balance during year 8,798 4,226 4,128

S

ELECTED

L

OAN

M

ATURITIES AND

I

NTEREST

S

ENSITIVITY

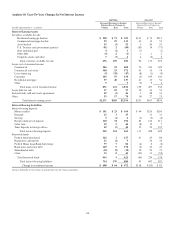

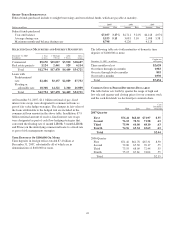

December 31, 2007

In millions

1 Year

or Less

1 Through

5 Years

After

5 Years

Gross

Loans

Commercial $9,670 $15,017 $3,920 $28,607

Real estate projects 3,124 2,461 529 6,114

Total $12,794 $17,478 $4,449 $34,721

Loans with

Predetermined

rate $2,486 $3,157 $2,089 $7,732

Floating or

adjustable rate 10,308 14,321 2,360 26,989

Total $12,794 $17,478 $4,449 $34,721

At December 31, 2007, $1.1 billion notional of pay-fixed

interest rate swaps were designated to commercial loans as

part of fair value hedge strategies. The changes in fair value of

the loans attributable to the hedged risk are included in the

commercial loan amount in the above table. In addition, $7.9

billion notional amount of receive-fixed interest rate swaps

were designated as part of cash flow hedging strategies that

converted the floating rate (1 month LIBOR, 3 month LIBOR

and Prime) on the underlying commercial loans to a fixed rate

as part of risk management strategies.

T

IME

D

EPOSITS

O

F

$100,000 O

R

M

ORE

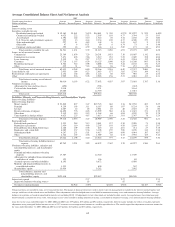

Time deposits in foreign offices totaled $7.4 billion at

December 31, 2007, substantially all of which are in

denominations of $100,000 or more.

The following table sets forth maturities of domestic time

deposits of $100,000 or more:

December 31, 2007 – in millions

Certificates

of Deposit

Three months or less $2,628

Over three through six months 1,983

Over six through twelve months 893

Over twelve months 1,930

Total $7,434

C

OMMON

S

TOCK

P

RICES

/D

IVIDENDS

D

ECLARED

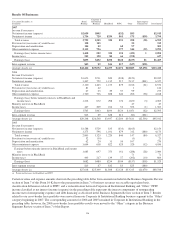

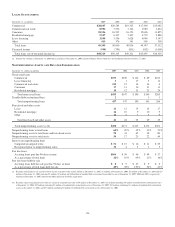

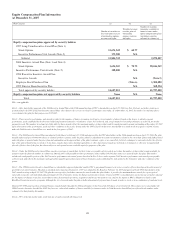

The table below sets forth by quarter the range of high and

low sale and quarter-end closing prices for our common stock

and the cash dividends we declared per common share.

High Low Close

Cash

Dividends

Declared

2007 Quarter

First $76.41 $68.60 $71.97 $.55

Second 76.15 70.31 71.58 .63

Third 75.99 64.00 68.10 .63

Fourth 74.56 63.54 65.65 .63

Total $2.44

2006 Quarter

First $71.42 $61.78 $67.31 $.50

Second 72.00 65.30 70.17 .55

Third 73.55 68.09 72.44 .55

Fourth 75.15 67.61 74.04 .55

Total $2.15

122