PNC Bank 2007 Annual Report Download - page 56

Download and view the complete annual report

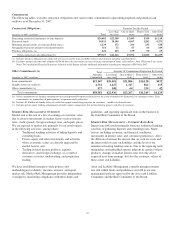

Please find page 56 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PNC Bank, N.A. established a program in December 2004 to

offer up to $3.0 billion of its commercial paper. As of

December 31, 2007, there were no issuances outstanding

under this program.

As of December 31, 2007, there were $5.0 billion of PNC

Bank, N.A. short- and long-term debt issuances with

maturities of less than one year.

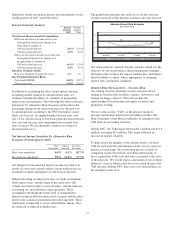

Parent Company Liquidity

Our parent company’s routine funding needs consist primarily

of dividends to PNC shareholders, share repurchases, debt

service, the funding of non-bank affiliates, and acquisitions.

Parent company liquidity guidelines are designed to help

ensure that sufficient liquidity is available to meet these

requirements over the succeeding 12-month period. In

managing parent company liquidity we consider funding

sources, such as expected dividends to be received from PNC

Bank, N.A. and potential debt issuance, and discretionary

funding uses, the most significant of which is the external

dividend to be paid on PNC’s stock.

The principal source of parent company cash flow is the

dividends it receives from PNC Bank, N.A., which may be

impacted by the following:

• Capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

Also, there are statutory and regulatory limitations on the

ability of national banks to pay dividends or make other

capital distributions or to extend credit to the parent company

or its non-bank subsidiaries. We provide additional

information on these limitations in Note 22 Regulatory

Matters in the Notes To Consolidated Financial Statements

included in Item 8 of this Report and include such information

here by reference. Dividends may also be impacted by the

bank’s capital needs and by contractual restrictions. We

provide additional information on certain contractual

restrictions under the “Perpetual Trust Securities.” “PNC

Capital Trust E Trust Preferred Securities,” and “Acquired

Entity Trust Preferred Securities” sections of the Off-Balance

Sheet Arrangements and VIEs section of this Item 7. The

amount available for dividend payments to the parent

company by PNC Bank, N.A. without prior regulatory

approval was approximately $655 million at December 31,

2007.

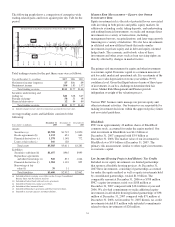

In addition to dividends from PNC Bank, N.A., other sources of

parent company liquidity include cash and short-term investments,

as well as dividends and loan repayments from other subsidiaries

and dividends or distributions from equity investments. As of

December 31, 2007, the parent company had approximately $118

million in funds available from its cash and short-term

investments. During 2007, $1.0 billion of parent company senior

debt was redeemed by the holders, all during the fourth quarter.

We can also generate liquidity for the parent company and

PNC’s non-bank subsidiaries through the issuance of

securities in public or private markets.

• In February 2007, we issued $775 million of floating

rate senior notes due January 2012. Interest will be

reset quarterly to 3-month LIBOR plus 14 basis

points and interest will be paid quarterly.

• Also in February 2007, we issued $500 million of

floating rate senior notes due January 2014. Interest

will be reset quarterly to 3-month LIBOR plus 20

basis points and will be paid quarterly.

• In February 2007, we issued $600 million of

subordinated notes due February 2017. These notes

pay interest semiannually at a fixed rate of 5.625%.

• In June 2007, we issued $500 million of Senior Notes

that mature on June 12, 2009. Interest will be reset

monthly to 1-month LIBOR plus 2 basis points.

These notes are not redeemable by us or the holders

prior to maturity.

• In September 2007, we issued $250 million of senior

notes that mature on September 28, 2012. These

notes pay interest semiannually at a fixed rate of

5.50%.

None of the 2007 issuances described above are redeemable

by us or the holders prior to maturity.

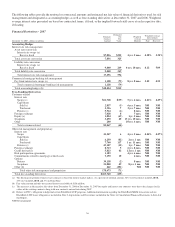

In February 2008, PNC Capital Trust E was formed and issued

$450 million of Capital Securities. Proceeds from the issuance

were used to purchase $450 million of junior subordinated

notes issued by PNC that mature on March 15, 2068 and are

redeemable on or after March 15, 2013 at par. These notes pay

interest quarterly at a fixed rate of 7.75%.

We used the February 2007 issuances described above to fund

a substantial portion of the cash portion of our Mercantile

acquisition.

In the first half of 2007, we elected to redeem all of the

underlying Capital Securities related to the following trusts,

totaling $516 million:

• UNB Capital Trust I ($16 million),

• Riggs Capital Trust II ($200 million), and

• PNC Institutional Capital Trust B ($300 million).

In July 2006, PNC Funding Corp established a program to

offer up to $3.0 billion of commercial paper to provide the

parent company with additional liquidity. As of December 31,

2007, $458 million of commercial paper was outstanding

under this program.

As of December 31, 2007, there were $1.4 billion of parent

company contractual obligations, including commercial paper,

with maturities of less than one year.

We have effective shelf registration statements which enable

us to issue additional debt and equity securities, including

certain hybrid capital instruments.

51