PNC Bank 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

6A

SSET

Q

UALITY

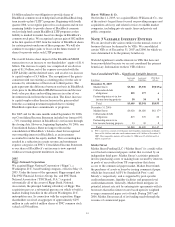

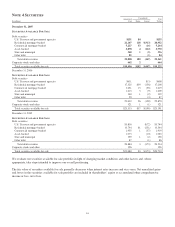

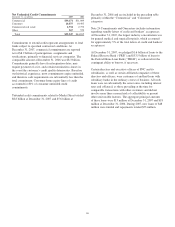

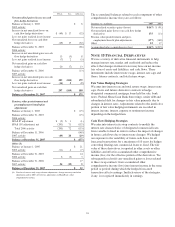

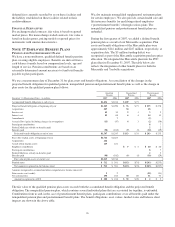

The following table sets forth nonperforming assets and related information:

December 31 - dollars in millions 2007 2006

Nonaccrual loans

Commercial $193 $109

Commercial real estate 212 12

Consumer 17 13

Residential mortgage 10 12

Lease financing 31

Total nonaccrual loans 435 147

Restructured loans 2

Total nonperforming loans 437 147

Foreclosed and other assets

Lease financing 11 12

Residential mortgage 16 10

Other 14 2

Total foreclosed and other assets 41 24

Total nonperforming assets (a) (b) $478 $171

Nonperforming loans to total loans .64% .29%

Nonperforming assets to total loans and foreclosed assets .70 .34

Nonperforming assets to total assets .34 .17

Interest on nonperforming loans

Computed on original terms $51 $15

Recognized prior to nonperforming status 32 4

Past due loans

Accruing loans past due 90 days or more $106 $50

As a percentage of total loans .16% .10%

(a) Excludes equity management assets that are carried at estimated fair value of $4 million at December 31, 2007 and $11 million (including $4 million of troubled debt restructured

assets) at December 31, 2006.

(b) Excludes loans held for sale carried at lower of cost or market value related to the Mercantile and Yardville acquisitions of $25 million at December 31, 2007.

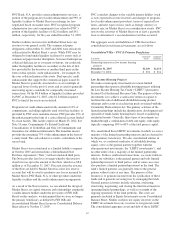

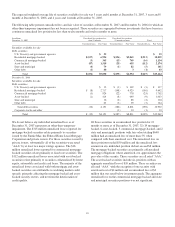

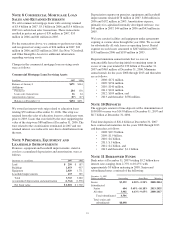

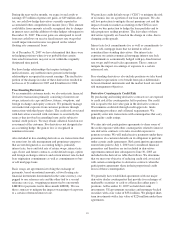

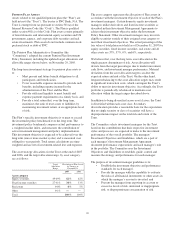

Changes in the allowance for loan and lease losses were as

follows:

In millions 2007 2006 2005

January 1 $ 560 $ 596 $ 607

Charge-offs (245) (180) (129)

Recoveries (a) 45 40 99

Net charge-offs (a) (200) (140) (30)

Provision for credit losses 315 124 21

Acquired allowance (b) 152 23

Net change in allowance for unfunded

loan commitments and letters of credit 3(20) (25)

December 31 $ 830 $ 560 $ 596

(a) Amount for 2005 included the impact of a $53 million loan recovery.

(b) Mercantile and Yardville in 2007 and Riggs in 2005.

Changes in the allowance for unfunded loan commitments and

letters of credit were as follows:

In millions 2007 2006 2005

Allowance at January 1 $120 $100 $ 75

Acquired allowance- Mercantile 17

Net change in allowance for unfunded loan

commitments and letters of credit (3) 20 25

December 31 $134 $120 $100

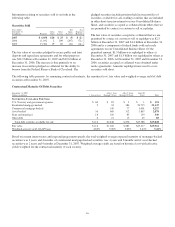

All nonperforming loans at December 31, 2007 and 2006 are

considered impaired, Under SFAS 114, which excludes leases

and smaller homogeneous type loans (i.e., consumer-related

loans), impaired loans amounted to $407 million at

December 31, 2007 and $121 million at December 31, 2006

and had a corresponding specific allowance for loan and lease

losses of $124 million and $32 million, respectively. The

average balance of SFAS 114 impaired loans was $200

million in 2007, $147 million 2006 and $106 million in 2005.

We did not recognize any interest income on loans while they

were impaired in 2007, 2006 or 2005.

89