PNC Bank 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other noninterest income increased $29 million, to $344

million, in 2007 compared with 2006. Other noninterest

income for 2007 included the negative impact in the fourth

quarter of a $26 million valuation adjustment for commercial

mortgage loans held for sale. In early 2008, spreads have been

widening and there has been limited activity in the CMBS

securitization market. We value our commercial mortgage

loans held for sale based on securitization prices. Therefore, if

these conditions continue, additional losses will be incurred

that will be significantly higher than the losses incurred during

the fourth quarter of 2007. However, we do not expect the

impact to be significant to our capital position. Currently,

these valuation losses are unrealized (non-cash) and all of the

loans in this portfolio are performing.

Other noninterest income for 2006 included a $48 million loss

incurred in the third quarter in connection with the rebalancing

of our residential mortgage portfolio.

Other noninterest income typically fluctuates from period to

period depending on the nature and magnitude of transactions

completed and market price fluctuations.

P

RODUCT

R

EVENUE

In addition to credit products to commercial customers,

Corporate & Institutional Banking offers other services,

including treasury management and capital markets-related

products and services, commercial loan servicing and insurance

products that are marketed by several businesses across PNC.

Treasury management revenue, which includes fees as well as

net interest income from customer deposit balances, increased

14% to $476 million for 2007 compared with $418 million for

2006. The higher revenue reflected continued expansion and

client utilization of commercial payment card services, strong

revenue growth in investment products and in various

electronic payment and information services.

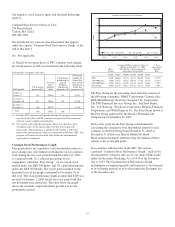

Revenue from capital markets-related products and services

totaled $290 million for 2007 compared with $283 million in

2006. This increase was driven primarily by merger and

acquisition advisory and related services.

Midland Loan Services offers servicing, real estate advisory

and technology solutions for the commercial real estate

finance industry. Midland’s revenue, which includes servicing

fees and net interest income from servicing portfolio deposit

balances, totaled $220 million for 2007 and $184 million for

2006, an increase of 20%. The revenue growth was primarily

driven by growth in the commercial mortgage servicing

portfolio and related services.

As a component of our advisory services to clients, we

provide a select set of insurance products to fulfill specific

customer financial needs. Primary insurance offerings include

annuities, life, credit life, health, and disability. Revenue from

these products increased 4% to $74 million for 2007 compared

with $71 million for 2006.

PNC, through subsidiary company Alpine Indemnity Limited,

participates as a direct writer for its general liability,

automobile liability, workers’ compensation, property and

terrorism insurance programs. In the normal course of

business, Alpine Indemnity Limited maintains insurance

reserves for reported claims and for claims incurred but not

reported based on actuarial assessments. We believe these

reserves were adequate at December 31, 2007.

N

ONINTEREST

E

XPENSE

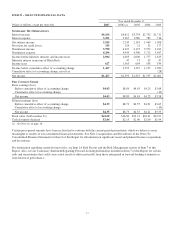

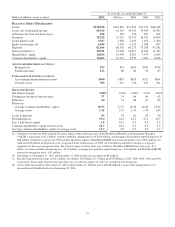

Total noninterest expense was $4.296 billion for 2007, a

decrease of $147 million compared with $4.443 billion for

2006.

Item 6 of this Report includes our efficiency ratios for 2007

and 2006, along with information regarding certain significant

items impacting noninterest income and expense in 2006.

Noninterest expense for 2007 included the following:

• Acquisition integration costs of $102 million, and

• A charge of $82 million for an indemnification

obligation related to certain Visa litigation.

Noninterest expense for 2006 included the following:

• The first nine months of 2006 included $765 million

of expenses related to BlackRock, which was still

consolidated during that time, and

• BlackRock/MLIM transaction integration costs

totaling $91 million.

Apart from the impact of these items, noninterest expense

increased $525 million, or 15%, in 2007 compared with 2006.

These increases were largely a result of the acquisition of

Mercantile. Investments in growth initiatives were mitigated

by disciplined expense management.

We expect to incur pretax integration costs of approximately

$70 million in 2008 primarily related to our planned

acquisition of Sterling and additional costs related to the

Yardville and Albridge acquisitions.

E

FFECTIVE

T

AX

R

ATE

Our effective tax rate was 29.9% for 2007 and 34% for 2006.

The lower effective tax rate in 2007 compared with the prior

year reflected the impact of the following matters:

• An increase in income taxes related to the gain from,

and a $57 million cumulative adjustment to increase

deferred income taxes in connection with, the

BlackRock/MLIM transaction in 2006, and

• Lower pretax income for the fourth quarter of 2007

had the impact of reducing the effective tax rate for

the full year.

Our effective tax rate is sensitive to levels of pretax income as

certain income tax credits and items not subject to income tax

remain relatively constant. Based upon current projections, we

believe that the effective tax rate will be approximately 31%

in 2008, before considering the impact of the pending sale of

Hilliard Lyons.

24