PNC Bank 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

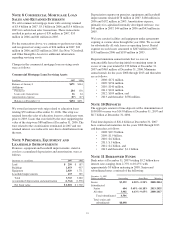

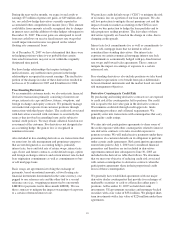

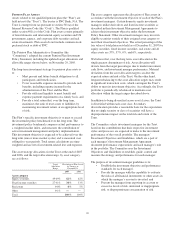

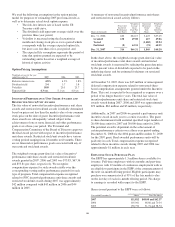

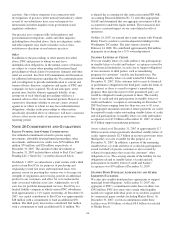

The weighted-average assumptions used (as of the beginning

of each year) to determine net periodic costs were as follows:

Net Periodic Cost Determination

Year ended December 31 2007 2006 2005

Discount rate

Qualified pension 5.70% 5.50% 5.25%

Nonqualified pension 5.60 5.40 5.25

Postretirement benefits 5.80 5.60 5.25

Rate of compensation increase (average) 4.00 4.00 4.00

Assumed health care cost trend rate

Initial trend 10.00 10.00 10.00

Ultimate trend 5.00 5.00 5.00

Year ultimate reached 2012 2011 2010

Expected long-term return on plan assets 8.25 8.25 8.50

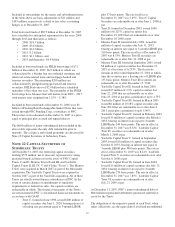

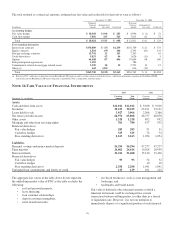

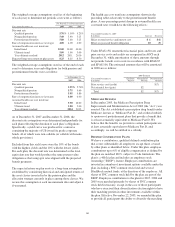

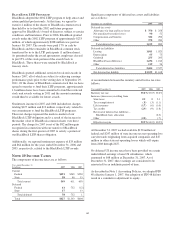

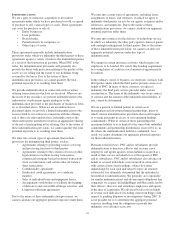

The weighted-average assumptions used (as of the end of each

year) to determine year-end obligations for both pension and

postretirement benefits were as follows:

At December 31

2007 2006

Discount rate

Qualified pension 5.95% 5.70%

Nonqualified pension 5.75 5.60

Postretirement benefits 5.95 5.80

Rate of compensation increase (average) 4.00 4.00

Assumed health care cost trend rate

Initial trend 9.50 10.00

Ultimate trend 5.00 5.00

Year ultimate reached 2014 2012

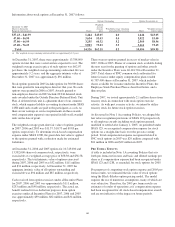

As of December 31, 2007 and December 31, 2006, the

discount rate assumptions were determined independently for

each plan reflecting the duration of each plan’s obligations.

Specifically, a yield curve was produced for a universe

containing the majority of US-issued Aa grade corporate

bonds, all of which were non-callable (or callable with make-

whole provisions).

Excluded from this yield curve were the 10% of the bonds

with the highest yields and the 10% with the lowest yields.

For each plan, the discount rate was determined as the level

equivalent rate that would produce the same present value

obligation as that using spot rates aligned with the projected

benefit payments.

The expected return on plan assets is a long-term assumption

established by considering historical and anticipated returns of

the asset classes invested in by the pension plan and the

allocation strategy currently in place among those classes. We

review this assumption at each measurement date and adjust it

if warranted.

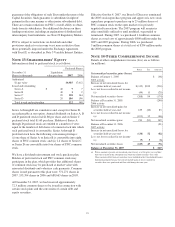

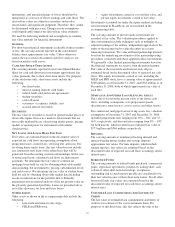

The health care cost trend rate assumptions shown in the

preceding tables relate only to the postretirement benefit

plans. A one-percentage-point change in assumed health care

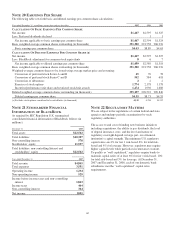

cost trend rates would have the following effects:

Year ended December 31, 2007

In millions Increase Decrease

Effect on total service and interest cost $ 1 $(1)

Effect on year-end benefit obligation 10 (9)

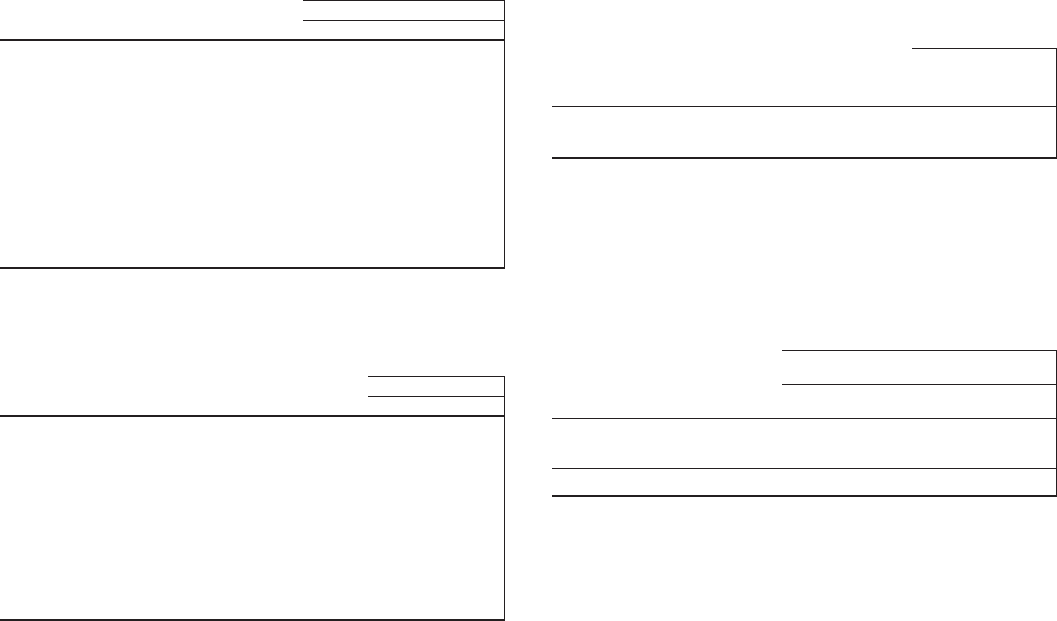

Under SFAS 158, unamortized actuarial gains and losses and

prior service costs and credits are recognized in AOCI each

December 31, while amortization of these amounts through

net periodic benefit cost occurs in accordance with SFAS 87

and SFAS 106. The estimated amounts that will be amortized

in 2008 are as follows:

2008 Estimate

Year ended December 31

In millions

Qualified

Pension

Nonqualified

Pension

Postretirement

Benefits

Prior service cost (credit) $(7)

Net actuarial loss (gain) $2

Total $2 $(7)

M

EDICARE

R

EFORM

In December 2003, the Medicare Prescription Drug

Improvement and Modernization Act of 2003 (the “Act”) was

enacted. The Act established a prescription drug benefit under

Medicare, known as “Medicare Part D,” and a federal subsidy

to sponsors of postretirement plans that provide a benefit that

is at least actuarially equivalent to Medicare Part D. We

believe that the benefits we provide to certain participants are

at least actuarially equivalent to Medicare Part D, and,

accordingly, we will be entitled to a subsidy.

D

EFINED

C

ONTRIBUTION

P

LANS

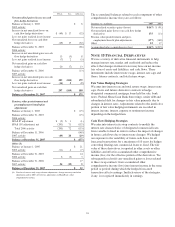

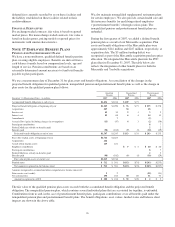

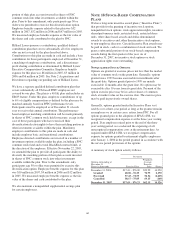

We have a contributory, qualified defined contribution plan

that covers substantially all employees except those covered

by other plans as identified below. Under this plan, employee

contributions up to 6% of eligible compensation as defined by

the plan are matched 100%, subject to Code limitations. The

plan is a 401(k) plan and includes an employee stock

ownership (“ESOP”) feature. Employee contributions are

invested in a number of investment options available under the

plan, including a PNC common stock fund and several

BlackRock mutual funds, at the direction of the employee. All

shares of PNC common stock held by the plan are part of the

ESOP. Employee contributions to the plan for 2007, 2006 and

2005 were matched primarily by shares of PNC common

stock held in treasury, except in the case of those participants

who have exercised their diversification election rights to have

their matching portion in other investments available within

the plan. Effective November 22, 2005, we amended the plan

to provide all participants the ability to diversify the matching

101