PNC Bank 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

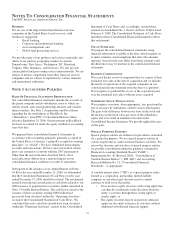

Transaction deposits - The sum of money market and interest-

bearing demand deposits and demand and other noninterest-

bearing deposits.

Value-at-risk (“VaR”) - A statistically-based measure of risk

which describes the amount of potential loss which may be

incurred due to severe and adverse market movements. The

measure is of the maximum loss which should not be

exceeded on 99 out of 100 days.

Yield curve - A graph showing the relationship between the

yields on financial instruments or market indices of the same

credit quality with different maturities. For example, a

“normal” or “positive” yield curve exists when long-term

bonds have higher yields than short-term bonds. A “flat” yield

curve exists when yields are the same for short-term and long-

term bonds. A “steep” yield curve exists when yields on long-

term bonds are significantly higher than on short-term bonds.

An “inverted” or “negative” yield curve exists when short-

term bonds have higher yields than long-term bonds.

C

AUTIONARY

S

TATEMENT

R

EGARDING

F

ORWARD

-L

OOKING

I

NFORMATION

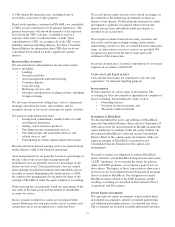

We make statements in this Report, and we may from time to

time make other statements, regarding our outlook or

expectations for earnings, revenues, expenses and/or other

matters regarding or affecting PNC that are forward-looking

statements within the meaning of the Private Securities

Litigation Reform Act. Forward-looking statements are

typically identified by words such as “believe,” “expect,”

“anticipate,” “intend,” “outlook,” “estimate,” “forecast,”

“will,” “ project” and other similar words and expressions.

Forward-looking statements are subject to numerous

assumptions, risks and uncertainties, which change over time.

Forward-looking statements speak only as of the date they are

made. We do not assume any duty and do not undertake to

update our forward-looking statements. Actual results or future

events could differ, possibly materially, from those that we

anticipated in our forward-looking statements, and future results

could differ materially from our historical performance.

Our forward-looking statements are subject to the following

principal risks and uncertainties. We provide greater detail

regarding some of these factors elsewhere in this Report,

including in the Risk Factors and Risk Management sections.

Our forward-looking statements may also be subject to other

risks and uncertainties, including those discussed elsewhere in

this Report or in our other filings with the SEC.

• Our businesses and financial results are affected by business

and economic conditions, both generally and specifically in

the principal markets in which we operate. In particular, our

businesses and financial results may be impacted by:

– Changes in interest rates and valuations in the debt,

equity and other financial markets.

– Disruptions in the liquidity and other functioning of

financial markets, including such disruptions in the

markets for real estate and other assets commonly

securing financial products.

– Actions by the Federal Reserve and other

government agencies, including those that impact

money supply and market interest rates.

– Changes in our customers’, suppliers’ and other

counterparties’ performance in general and their

creditworthiness in particular.

– Changes in customer preferences and behavior,

whether as a result of changing business and

economic conditions or other factors.

• A continuation of recent turbulence in significant

portions of the global financial markets could impact our

performance, both directly by affecting our revenues and

the value of our assets and liabilities and indirectly by

affecting the economy generally.

• Given current economic and financial market conditions,

our forward-looking financial statements are subject to

the risk that these conditions will be substantially

different than we are currently expecting. These

statements are based on our current expectations that

interest rates will remain low through most of 2008 and

that economic conditions, although showing slower

growth than in recent years, will avoid a recession.

• Our operating results are affected by our liability to

provide shares of BlackRock common stock to help fund

certain BlackRock long-term incentive plan (“LTIP”)

programs, as our LTIP liability is adjusted quarterly

(“marked-to-market”) based on changes in BlackRock’s

common stock price and the number of remaining

committed shares, and we recognize gain or loss on such

shares at such times as shares are transferred for payouts

under the LTIP programs.

• Legal and regulatory developments could have an impact

on our ability to operate our businesses or our financial

condition or results of operations or our competitive

position or reputation. Reputational impacts, in turn,

could affect matters such as business generation and

retention, our ability to attract and retain management,

liquidity, and funding. These legal and regulatory

developments could include: (a) the unfavorable

resolution of legal proceedings or regulatory and other

governmental inquiries; (b) increased litigation risk from

recent regulatory and other governmental developments;

(c) the results of the regulatory examination process, our

failure to satisfy the requirements of agreements with

governmental agencies, and regulators’ future use of

supervisory and enforcement tools; (d) legislative and

63