PNC Bank 2007 Annual Report Download - page 43

Download and view the complete annual report

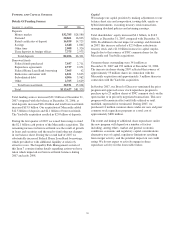

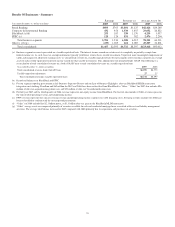

Please find page 43 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Full-time employees at December 31, 2007 totaled 12,036, an

increase of 2,487 over the prior year. The acquisitions added

approximately 2,300 full-time Retail Banking employees.

Part-time employees have increased by 480 since

December 31, 2006. The increase in part-time employees is a

result of acquisitions and various customer service

enhancement and efficiency initiatives. These initiatives

include utilizing more part-time customer-facing employees

rather than full-time employees during peak business hours.

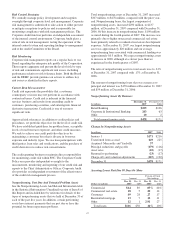

Growing core checking deposits as a lower-cost funding

source and as the cornerstone product to build customer

relationships is the primary objective of our deposit strategy.

Furthermore, core checking accounts are critical to our

strategy of expanding our payments business. Average total

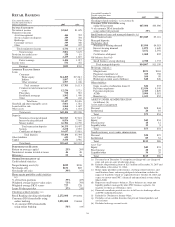

deposits increased $9.1 billion, or 20%, compared with 2006.

• Certificates of deposits increased $2.8 billion and money

market deposits increased $2.0 billion. These increases

were primarily attributable to acquisitions. The deposit

strategy of Retail Banking is to remain disciplined on

pricing, target specific markets for growth, and focus on

the retention and growth of balances for relationship

customers.

• Average demand deposit growth of $3.6 billion, or 23%,

was almost solely due to acquisitions as the core growth

was impacted by customers shifting funds into higher

yielding deposits in the first part of 2007, small business

sweep checking products, and investment products.

• Small business and consumer-related checking

relationships retention remained strong and stable.

Consumer-related checking relationship retention has

benefited from improved penetration rates of debit cards,

online banking and online bill payment.

Currently, we are focused on a relationship-based lending

strategy that targets specific customer sectors (homeowners,

small businesses and auto dealerships) while seeking to

maintain a moderate risk profile in the loan portfolio.

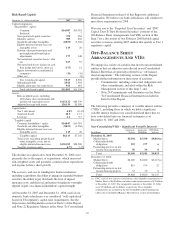

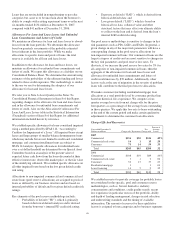

• Average commercial and commercial real estate loans

grew $6.8 billion, or 119%, compared with 2006. The

increase is attributable to acquisitions and organic loan

growth on the strength of increased small business loan

demand from existing customers and the acquisition of

new relationships through our sales efforts. At

December 31, 2007, commercial and commercial real

estate loans totaled $14.4 billion. This portfolio included

$3.6 billion of commercial real estate loans, the majority

of which were added with the Mercantile acquisition.

• Average home equity loans grew $396 million, or 3%,

compared with 2006 primarily due to acquisitions.

Consumer loan demand has slowed as a result of the

current rate and economic environment. Our home equity

loan portfolio is relationship based, with 93% of the

portfolio attributable to borrowers in our primary

geographic footprint. We monitor this portfolio closely

and the charge-offs and delinquencies that we have

experienced are within our expectations given current

market conditions.

• Average indirect loans grew $845 million, or 80%,

compared with 2006. The increase is attributable to

acquisitions and growth in our core portfolio that has

benefited from increased sales and marketing efforts.

• Average residential mortgage loans increased $552

million, or 38%, primarily due to the addition of loans

from the acquisitions. In general, the only meaningful

growth in our mortgage portfolio is a result of

acquisitions.

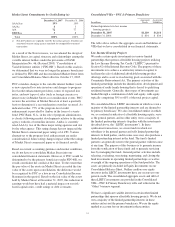

Assets under management of $73 billion at December 31,

2007 increased $19 billion compared with the balance at

December 31, 2006. The increase was primarily attributable to

the Mercantile acquisition and core organic business growth,

partially offset by other declines such as the divestiture of a

Mercantile asset management subsidiary during the fourth

quarter. The remaining portfolio growth was a result of

positive client net asset flows. Client net asset flows are the

result of investment additions from new and existing clients

offset by ordinary course distributions from trust and

investment management accounts and account closures.

Nondiscretionary assets under administration of $113 billion

at December 31, 2007 increased $27 billion compared with the

balance at December 31, 2006, primarily due to the impact of

Mercantile.

See Note 2 Acquisitions and Divestitures in the Notes To

Consolidated Financial Statements in Item 8 of this Report

regarding our planned sale of Hilliard Lyons during the first

half of 2008.

38