PNC Bank 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

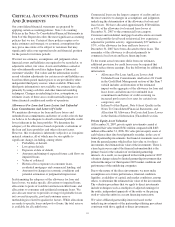

C

ORPORATE

&I

NSTITUTIONAL

B

ANKING

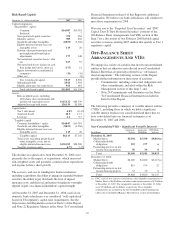

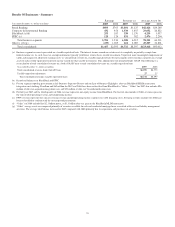

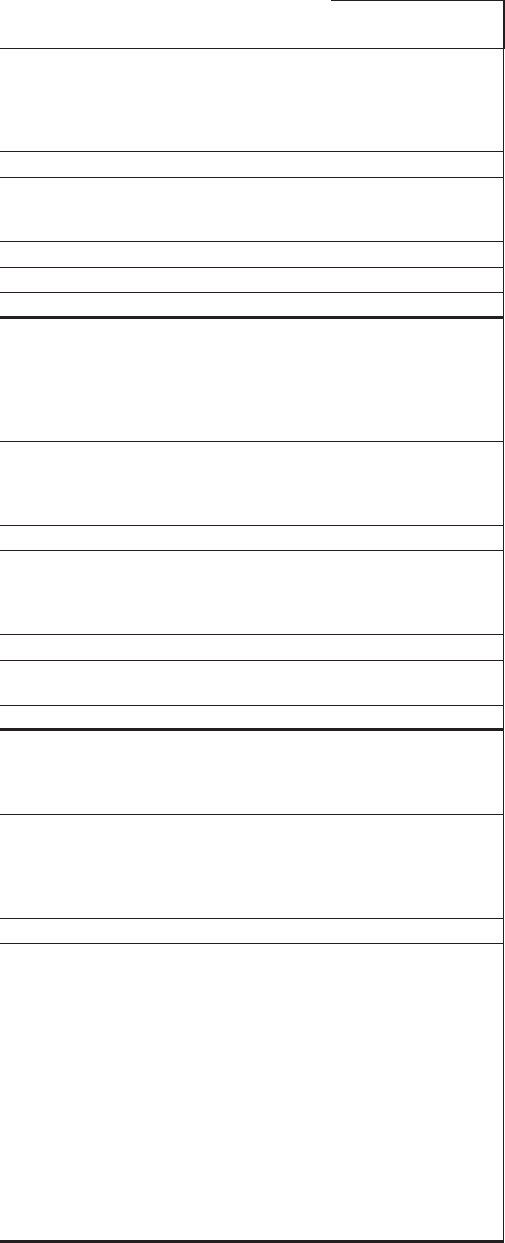

Year ended December 31

Taxable-equivalent basis

Dollars in millions except as noted 2007 2006

I

NCOME

S

TATEMENT

Net interest income $818 $703

Noninterest income

Corporate service fees 564 526

Other 156 226

Noninterest income 720 752

Total revenue 1,538 1,455

Provision for credit losses 125 42

Noninterest expense 818 746

Pretax earnings 595 667

Income taxes 163 213

Earnings $432 $454

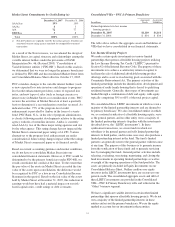

A

VERAGE

B

ALANCE

S

HEET

Loans

Corporate (a) $9,519 $8,633

Commercial real estate 3,590 2,876

Commercial – real estate related 3,580 2,433

Asset-based lending 4,634 4,467

Total loans 21,323 18,409

Goodwill and other intangible assets 1,919 1,352

Loans held for sale 1,319 893

Other assets 4,491 4,168

Total assets $29,052 $24,822

Deposits

Noninterest-bearing demand $7,301 $6,771

Money market 4,784 2,654

Other 1,325 907

Total deposits 13,410 10,332

Other liabilities 3,347 2,863

Capital 2,152 1,838

Total funds $18,909 $15,033

P

ERFORMANCE

R

ATIOS

Return on average capital 20% 25%

Noninterest income to total revenue 47 52

Efficiency 53 51

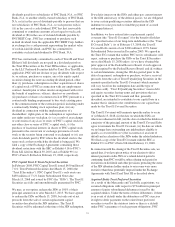

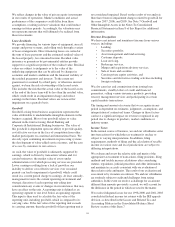

C

OMMERCIAL

M

ORTGAGE

S

ERVICING

P

ORTFOLIO

(in billions)

Beginning of period $200 $136

Acquisitions/additions 88 102

Repayments/transfers (45) (38)

End of period $243 $200

O

THER

I

NFORMATION

Consolidated revenue from (b):

Treasury management $476 $418

Capital markets $290 $283

Midland Loan Services $220 $184

Total loans (c) $23,861 $18,957

Nonperforming assets (c) (d) $243 $63

Net charge-offs $70 $54

Full-time employees (c) 2,290 1,936

Net gains on commercial mortgage loan sales $39 $55

Commercial mortgage loans held for sale (c) $2,100 $871

Valuation adjustment on commercial

mortgage loans held for sale $(26)

Net carrying amount of commercial mortgage

servicing rights (c) $694 $471

(a) Includes lease financing.

(b) Represents consolidated PNC amounts.

(c) Presented as of period end.

(d) Includes nonperforming loans of $222 million at December 31, 2007 and $50

million at December 31, 2006.

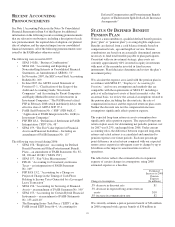

Corporate & Institutional Banking earned $432 million in

2007 compared with $454 million in 2006. While total

revenue increased more than noninterest expense, earnings

declined due to an increase in the provision for credit losses.

Market-related declines in CMBS securitization activities and

non-customer-related trading revenue resulted in a year- over-

year reduction in noninterest income. Treasury management,

commercial mortgage servicing, and capital markets revenues

led by merger and acquisition advisory services showed

growth over 2006.

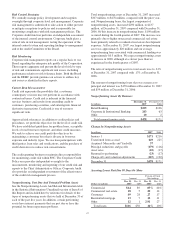

Highlights during 2007 for Corporate & Institutional Banking

included:

• Total revenue increased $83 million, or 6%, to $1.5

billion for 2007 compared with 2006. The increase was

driven by higher taxable-equivalent net interest income

related to increases in loans and noninterest-bearing

deposits. Corporate service fees were higher due to

increased sales of treasury management products and

services, commercial mortgage servicing, and fees

generated by Harris Williams. Partially offsetting these

increases were declines in other noninterest income from

commercial mortgage loan sale gains and related

economic hedging activities and lower non-customer-

related trading revenue resulting from recent volatility in

the financial markets. Other noninterest income also

reflected a $26 million negative valuation adjustment on

our commercial mortgage loans held for sale in the fourth

quarter of 2007.

• In early 2008, spreads have been widening and there has

been limited activity in the CMBS securitization market.

We value our commercial mortgage loans held for sale

based on securitization prices. Therefore, if these

conditions continue, additional losses will be incurred

that will be significantly higher than the losses incurred

during the fourth quarter of 2007. Currently, these

valuation losses are unrealized (non-cash) and all of the

loans in this portfolio are performing.

• On July 2, 2007, PNC acquired ARCS, a leading

originator and servicer of agency multifamily permanent

financing products, which added a commercial mortgage

servicing portfolio of $13 billion.

• Commercial mortgage servicing-related revenue, which

includes fees and net interest income, totaled $233

million for 2007 compared with $184 million for 2006.

The 27% increase was primarily driven by growth in the

commercial mortgage servicing portfolio. The total

servicing portfolio increased to $243 billion at

December 31, 2007. The related increase in deposits

drove the increase in the net interest income portion of

this revenue.

39