PNC Bank 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

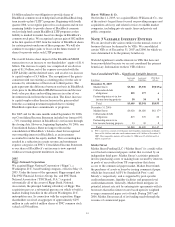

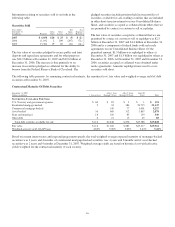

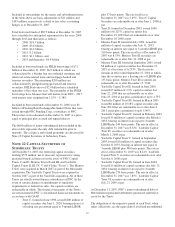

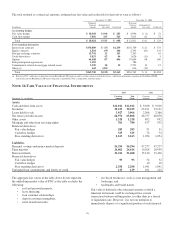

Information relating to securities sold is set forth in the

following table.

Securities Sold

Year ended

December 31

In millions Proceeds

Gross

Gains

Gross

Losses

Net

Gains

(Losses)

Tax

Expense

(Benefit)

2007 $ 6,056 $20 $ 25 $ (5) $ (2)

2006 11,102 2 209 (207) (72)

2005 13,304 19 60 (41) (14)

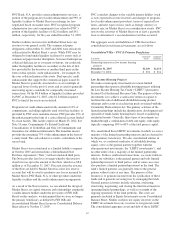

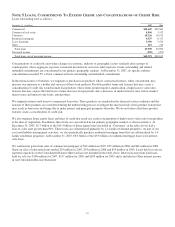

The fair value of securities pledged to secure public and trust

deposits and repurchase agreements and for other purposes

was $24.2 billion at December 31, 2007 and $10.6 billion at

December 31, 2006. The increase is due primarily to an

increase in securities pledged as collateral for the ability to

borrow from the Federal Reserve Bank of Cleveland. The

pledged securities include positions held in our portfolio of

securities available for sale, trading securities that are included

in other short-term investments on our Consolidated Balance

Sheet, and securities accepted as collateral from others that we

are permitted by contract or custom to sell or repledge.

The fair value of securities accepted as collateral that we are

permitted by contract or custom to sell or repledge was $2.3

billion at December 31, 2007 and $1.4 billion at December 31,

2006 and is a component of federal funds sold and resale

agreements on our Consolidated Balance Sheet. Of the

permitted amount, $1.5 billion was repledged to others at

December 31, 2007 and $1.3 billion was repledged to others at

December 31, 2006. At December 31, 2007 and December 31,

2006, securities accepted as collateral were obtained under

resale agreements. Amounts repledged were used to cover

securities sold short.

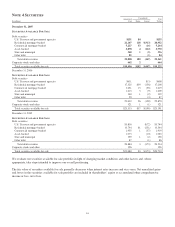

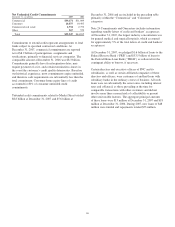

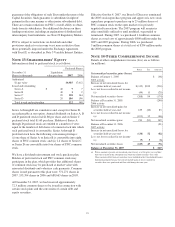

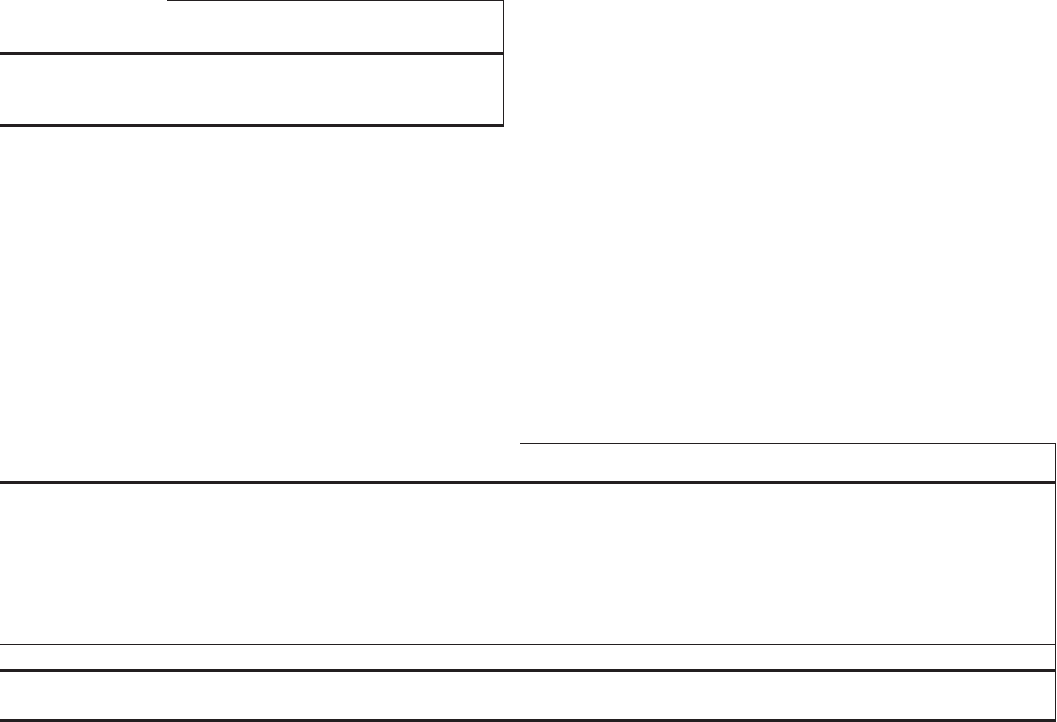

The following table presents, by remaining contractual maturity, the amortized cost, fair value and weighted-average yield of debt

securities at December 31, 2007.

Contractual Maturity Of Debt Securities

December 31, 2007

Dollars in millions 1 Year or Less

After 1 Year

through 5 Years

After 5 Years

through 10 Years

After 10

Years Total

S

ECURITIES

A

VAILABLE

F

OR

S

ALE

U.S. Treasury and government agencies $ 60 $ 85 $ 5 $ 1 $ 151

Residential mortgage-backed 2 24 386 20,735 21,147

Commercial mortgage-backed 149 77 5,001 5,227

Asset-backed 30 669 312 1,867 2,878

State and municipal 18 100 83 139 340

Other debt 6 21 13 45 85

Total debt securities available for sale $ 116 $1,048 $ 876 $27,788 $29,828

Fair value $ 116 $1,045 $ 883 $27,517 $29,561

Weighted-average yield, GAAP basis 4.66% 5.06% 5.02% 5.43% 5.41%

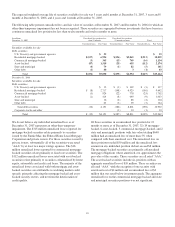

Based on current interest rates and expected prepayment speeds, the total weighted-average expected maturity of mortgage-backed

securities was 3 years and 4 months, of commercial mortgage-backed securities was 4 years and 8 months and of asset-backed

securities was 2 years and 9 months at December 31, 2007. Weighted-average yields are based on historical cost with effective

yields weighted for the contractual maturity of each security.

86